PhonePe Wealth today announced the launch of CRISP, a unique tool designed to help investors make more informed mutual fund investment decisions. The tool comes at a time when unique mutual fund investors in India have grown from 20 million as on December 31, 2019 to 53 million as on December 31, 2024 (Source: AMFI), but choosing the right funds still remains a significant challenge for most investors.

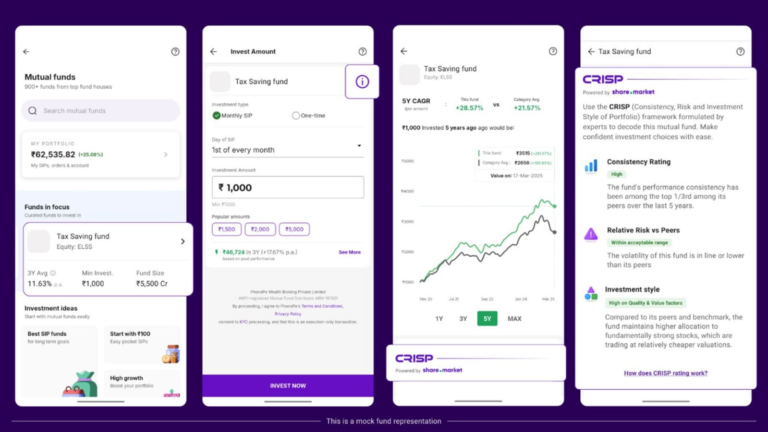

The CRISP (Consistency, Risk and Investment Style of the Portfolio) tool addresses this critical challenge by offering a holistic solution for investors to select appropriate funds beyond just looking at past returns. Retail investors, especially those investing via wealthtech platforms, have been largely relying on past point-to-point performance of funds to make their investment choices. This has often led to investors making wrong investment choices. CRISP simplifies investing decisions by converting performance, risk and portfolio data of mutual funds into actionable insights.

“The mutual fund industry is experiencing significant growth due to industry’s investor awareness initiatives and democratization of mutual fund investing by wealthtech platforms. At PhonePe Wealth, our focus is on supporting investors on our platform through innovative tools like CRISP. We are committed to developing research and technology-driven solutions that help investors embrace core investing principles and prudently navigate their wealth creation journey,” said Nilesh D Naik, Head of Investment Products, Share.Market (PhonePe Wealth).

The CRISP framework assesses funds based on the following parameters:

Consistency in Performance: CRISP assesses a fund’s performance consistency relative to its peer group based on rolling returns over a five-year period, assigning a score of “High,” “Medium,” or “Low.” This approach helps investors identify funds that have consistently outperformed, rather than those with sporadic or unpredictable performance.

Relative Risk vs. Peers: The tool demarcates risk for the fund compared to peers and categorizes it as “Within acceptable range” or “Too High”. This enables investors to spot risk outliers and avoid investing in funds that take extreme risks.

Investment Style or Factor Analysis: CRISP analyses a fund’s style exposure across factors like Value, Quality, and Momentum, over a five-year period, providing insights into the fund’s management style. This is presented in an easy-to-understand investment style classification of “High”, “Medium” and “Low” across the three factors. This becomes an extremely important input for investors while constructing their mutual fund portfolios, to ensure desired level of exposure across different styles or factors and to achieve diversification.

The tool is currently available on the PhonePe platform and will soon be integrated into their stock broking platform, Share.Market. This is in line with Share.Market’s mission to provide access to research and intelligence to its investors and trader community.

Disclaimer: This article has been produced on behalf of the brand by HT Brand Studio.

Want to get your story featured as above? click here!