The Indian equity market has recently experienced significant volatility, leaving investors anxious about their investments. Benchmark indices like the Nifty 50 and S&P BSE Sensex have dropped by 10-11% from their record highs in September 2024.

The mid-cap and small-cap segments have been hit the hardest, facing severe selling pressure. This decline is due to global and domestic factors, including global trade tensions, inflation concerns, and fears of an economic slowdown. High valuations in these segments have also contributed to the sell-off.

As of February 14, 2025, the BSE Small Cap Index and BSE Mid Cap Index have fallen by 18.3% and 17.9%, respectively. This sharp decline has left many retail investors questioning whether they should stay invested in mutual funds, particularly those exposed to mid-cap and small-cap categories.

Foreign investors have become more risk-averse due to rising US bond yields and concerns over a global economic slowdown, leading to significant outflows from Indian equities. Additionally, geopolitical tensions and fluctuating crude oil prices have added to market volatility. Domestically, worries about corporate earnings growth and stretched valuations in mid and small-caps have further impacted investor sentiment.

In this article, we explore the reasons behind the market‘s volatility, its impact on mutual fund investments, and the best strategies to navigate this turbulent phase. Bottom of Form

Understanding the Recent Market Volatility

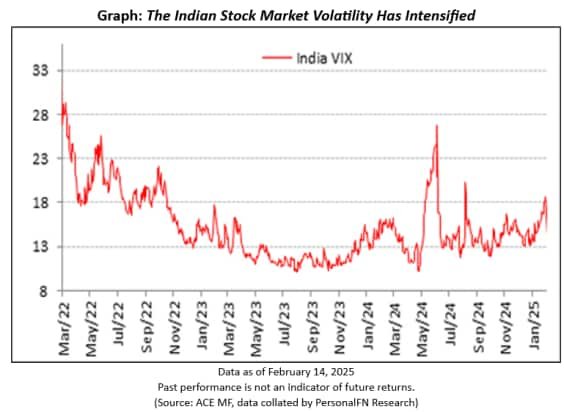

Amid this market chaos, the India VIX, which measures market volatility also known as the fear gauge, has surged to its highest levels in recent months, reflecting the prevailing fear and uncertainty among investors.

A high VIX generally indicates increased market fluctuations and jittery investor sentiment, adding to the anxiety of those heavily invested in equities. The sudden and steep corrections have not only impacted direct equity investors but also those who have invested in equity mutual funds, especially mid-cap and small-cap funds.

Market turbulence, as reflected in the India VIX, could stem from various factors including economic policy changes, global financial crises, geopolitical events, and shifts in investor behaviour. For instance, the spike in 2022 could be associated with global inflationary pressures, the Russia-Ukraine conflict, and its impact on commodity prices. Similarly, any volatility observed in 2024 could be linked to events such as election outcomes, changes in monetary policy, or international trade tensions.

Understanding these potential drivers is crucial for investors and policymakers to anticipate and manage risks associated with market fluctuations. The VIX, therefore, serves as a valuable tool for gauging market sentiment and predicting potential future volatility.

On February 01, 2025, coinciding with the Union Budget announcement, the India VIX closed at 14.10, marking its lowest level since January 03, 2025 and registering a significant single-day decline. However, the respite was short-lived. By February 10, 2025, the India VIX had risen to 14.45, reflecting a 5.55% increase from its previous close.

This uptick indicates a resurgence of market apprehension, possibly due to emerging concerns over global economic conditions, domestic policy changes, or corporate earnings reports. The oscillation of the India VIX during this period underscores the market’s sensitivity to both domestic events, such as fiscal policy announcements, and international economic developments.

For investors, the current behaviour of the India VIX serves as a barometer for market sentiment. With increased market volatility, investors should exercise caution and conversely, a declining VIX may indicate a more stable market environment.

The Factors Behind Market Volatility

Global Economic Uncertainty

One of the key contributors to market volatility is global economic uncertainty. Rising interest rates in the US have impacted global liquidity and led to capital outflows from emerging markets, including India. Additionally, geopolitical tensions, fluctuating crude oil prices, and fears of a global economic slowdown have added to investor concerns, resulting in erratic market movements.

Domestic Economic Factors

Domestically, high valuations in the Indian stock market, especially in the mid and small-cap segments, have triggered profit-booking, leading to sharp corrections. Concerns over corporate earnings growth, inflationary pressures, and changes in government policies have also contributed to market instability. These factors have affected investor sentiment, making the market more volatile.

Sentiment and Speculation

Investor sentiment plays a significant role in market volatility. Negative news flows, uncertainty about economic policies, and fear of potential losses may lead to panic selling, amplifying market swings. On the other hand, speculative buying during market rallies may also contribute to increased volatility.

Liquidity and Market Dynamics

Liquidity crunches and changes in institutional investment flows, such as foreign portfolio investor (FPI) sell-offs, may lead to rapid price fluctuations. When liquidity dries up, markets tend to react more sharply to news events, causing increased volatility. This is particularly evident in the current market scenario, where large-scale sell-offs have impacted stock prices.

What Should Mutual Fund Investors Do Amidst Market Volatility?

During periods of market turbulence, existing mutual fund investors often face the dilemma of whether to stay invested or exit to avoid potential losses. The key to navigating such uncertain times lies in adopting a strategic and well-thought-out approach.

Stay Invested and Avoid Panic Selling

One of the most common mistakes investors make during market downturns is panic selling. Reacting impulsively to short-term volatility may lead to significant financial losses and disrupt long-term wealth creation. It is important to remember that market corrections are a natural part of the investment cycle, and history shows that markets eventually recover.

Investors should avoid making emotional exit decisions and stay invested if their financial goals are long-term. By remaining patient and disciplined, they could benefit from potential rebounds when market conditions stabilize. The key is to maintain a long-term perspective and avoid getting swayed by short-term fluctuations.

Focus on Asset Allocation

Asset Allocation is a critical strategy for managing risk and minimizing the impact of market volatility. It involves spreading investments across different asset classes, such as equity, debt, gold, and real estate, to achieve a balanced portfolio. A well-diversified asset allocation helps reduce the risk of significant losses, as different asset classes react differently to market movements.

For instance, while equity investments may experience high volatility, debt instruments provide stability and act as a cushion against market downturns. By maintaining a diversified portfolio, investors could manage risk more effectively and safeguard their investments during uncertain times.

Portfolio Rebalancing

Market volatility may cause the asset allocation of a portfolio to deviate from the intended mix. For example, during a market correction, the equity component of a portfolio may decline, leading to an underweight equity allocation. In such cases, portfolio rebalancing becomes essential.

Portfolio rebalancing involves realigning investments to the original target allocation. This may require selling overperforming assets and buying underperforming ones. By doing so, investors could maintain the desired risk-return profile and stay on track with their investment objectives. Rebalancing also helps investors take advantage of market fluctuations by buying low and selling high.

Maintain Investment Discipline

Discipline is a key factor in successful investing, especially during volatile market conditions. Investors should continue their Systematic Investment Plans (SIPs) and avoid the temptation to time the market. This strategy helps reduce the average cost of investment over time, enhancing long-term returns. Maintaining investment discipline and avoiding impulsive actions are crucial for achieving financial goals.

Regular Portfolio Review

In a volatile market scenario, it is crucial to assess the performance of mutual funds and make informed decisions about holding or switching funds. During the portfolio review, investors should evaluate the consistency of returns, expense ratios, and the fund manager’s track record.

If certain funds are underperforming or no longer align with the investor’s objectives, they may consider switching to better-performing options. However, it is important to avoid frequent churning, as it may lead to unnecessary costs and tax implications.

To conclude…

Market volatility is an inevitable part of investing, and reacting impulsively to short-term fluctuations often does more harm than good. For those already invested in mutual funds, especially in volatile categories, this is an opportunity to reassess their investment strategy rather than exit hastily. By staying invested and resisting panic-driven decisions, they could navigate uncertainty and potentially benefit from future market recoveries.

This article first appeared on PersonalFN.

Disclaimer: The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.