Fund managers of small-cap mutual funds have ventured further down the market capitalisation ladder over the last one year, opting to explore and capitalise on the potential of micro-cap stocks.

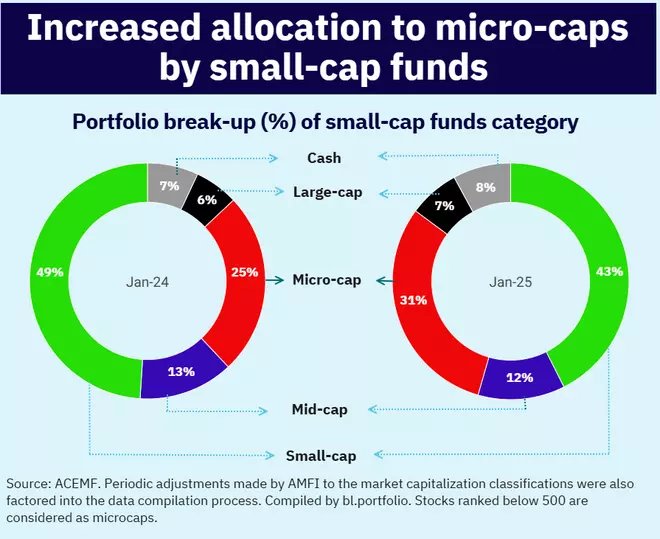

ACEMF data shows a significant rise in micro-cap stock allocation within small-cap fund portfolios, climbing to 31 per cent in January 2025 from 25 per cent in January 2024. Interestingly, the share of small-cap stocks declined during the same period, dropping from 49 per cent to 43 per cent.

Smallcap funds increased allocation to microcap stocks

No stricter norms

Despite the inherent risks associated with micro-cap stocks — such as heightened volatility, limited liquidity, and increased vulnerability to market downturns — small-cap fund managers have continued to seek opportunities in this under-researched segment to effectively deploy their steady and uninterrupted inflows.

According to AMFI, stocks ranked below 250 are categorised as small-cap, with no formal classification for micro-cap stocks. For this study, stocks ranked below 500 are considered as microcaps.

Small-cap funds are mandated to allocate at least 65 per cent of their investments to stocks ranked below the 250th position in terms of market capitalisation. There are no restrictions preventing these funds from delving further down the market-cap ladder, allowing them to explore opportunities in even smaller companies.

Expanding universe

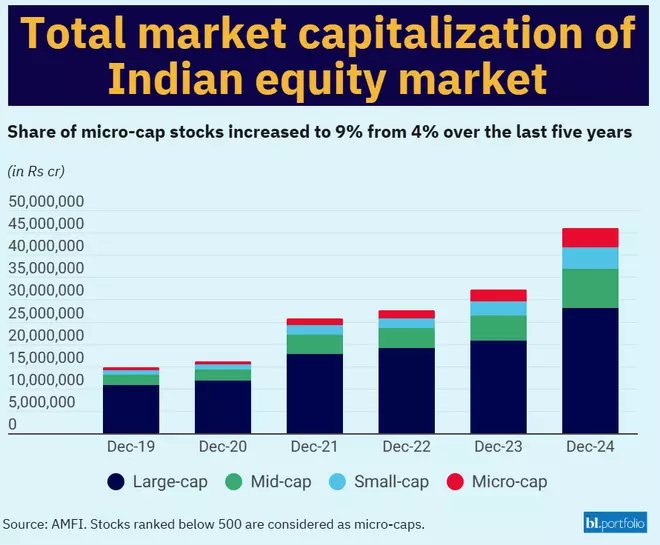

The microcap universe in India has witnessed substantial growth in recent years, driven by a confluence of factors, including enhanced liquidity and improved market infrastructure, which have lowered the barriers to investing in microcap companies. Notably, the post-COVID equity market rally catalysed significant gains in microcap stocks, amplifying their appeal among investors.

It is significant to highlight that, as per the AMFI’s classification, the market capitalisation of the 501st stock stood at ₹2,079 crore in December 2020. Propelled by the strong upward momentum in share prices across large-, mid-, and small-cap segments, the market capitalisation threshold for the 501st stock has now risen to ₹11,227 crore, as per the latest classification as of December 2024.

This extraordinary growth has unlocked new opportunities for small-cap fund managers to explore this segment, enabling both diversification and the potential for alpha generation. It has reflected in the total number of microcap stocks invested by smallcap funds that was increased significantly from 292 to 387 in the last one year.

However, it remains a high-risk segment due to lower liquidity, higher volatility, and potential governance issues. Retail investors need to conduct thorough due diligence to avoid pitfalls such as price manipulation or fraudulent practices.