One of the relatively non-rigid categories to emerge after market regulator SEBI’s recategorisation norms came into effect is the flexicap segment.

Given that the mandate allows to choose any style and market cap split within the portfolio, it has been one of the most sought-after categories among equity mutual funds. Assets under management for the category stood at ₹5.34 lakh crore as of October 2025, the highest among all diversified equity fund segments.

Many older funds converted to the category, while a few others (even older houses) started fresh schemes 3-5 years ago.

Many of the new entrants to the mutual fund space, often from PMS or AIF backgrounds, too, are rolling out flexicap schemes first – Helios, Capitalmind and Wealth Company, for instance.

Over time, due to larger sizes of funds, many of the bigger and well-known flexicap funds have tended to become large-cap oriented, which was not the original idea behind starting the category

Now, a leading player in AIF space, Abakkus, founded by veteran fund manager Sunil Singhania, is launching its mutual fund operations with a flexicap fund. And the basic idea seems to be to create a more well-rounded flexicap portfolio with a more balanced representation to mid and small-caps.

Pitching anew

Now, as a background, Sunil Singhania was the fund manager of Reliance Growth, a scheme that made 100x returns in 22 years, before he moved out to start Abakkus in 2018. Abakkus manages ₹39,857 crore in assets spread across AIFs, PMS and advisory businesses.

Before getting into the framework envisaged for the flexicap fund, Abakkus has clearly indicated what it would not do.

It would not chase momentum picks, churn the portfolio needlessly, copy or mimic popular herd mentality portfolios or invest in companies with broken balance sheets.

The fund would follow a ‘MEETS’ framework – management quality, earnings (valuations and so on), events/trends, timing and structural (well positioned, consistent profitability and so forth).

Two data points are interesting and worth highlighting.

Data from AMFI and ACE MF (quoted in the presentation) show schemes accounting for almost 91 per cent of the category’s AUM have more than 60 per cent of their portfolio in large-caps.

For flexicap schemes of asset sizes ranging from ₹25,000 crore and stretching beyond ₹1 lakh crore, 65-95 per cent of the AUM is in large-caps, with the remaining spread across mid and small-caps.

With an increase in size, the number of stocks in the portfolio are increased and the tendency is to shift more to large-caps with many of these large-sized flexicap funds.

Abakkus Flexicap fund aims to have a more diversified portfolio with fewer stocks and suitable allocation across market caps.

As such, there is no track record for the fund house. Its AIFs are closed for subscription.

But there are returns data (not strictly comparable with mutual funds) available from two of its PMS strategies. Though the products are different and investment mandates vary, this may give some perspective on the asset manager’s performance record.

Abakkus All Cap Approach has delivered almost 25 per cent CAGR over the past five years (as of November 30, 2025), compared to benchmark BSE 500 TRI’s 20.8 per cent. This approach has 57.6 per cent in large-caps, 23.1 per cent in mid-caps and 16 per cent in small-caps.

The Abakkus Emerging Opportunities Approach has done even better, at 28.8 per cent CAGR in five years, and is dominated by mid and small-caps (collectively more than 85 per cent of the portfolio).

What should investors do?

One key question for investors to ask is are large-cap-led flexicap funds at a disadvantage in terms of long-term returns. Not necessarily.

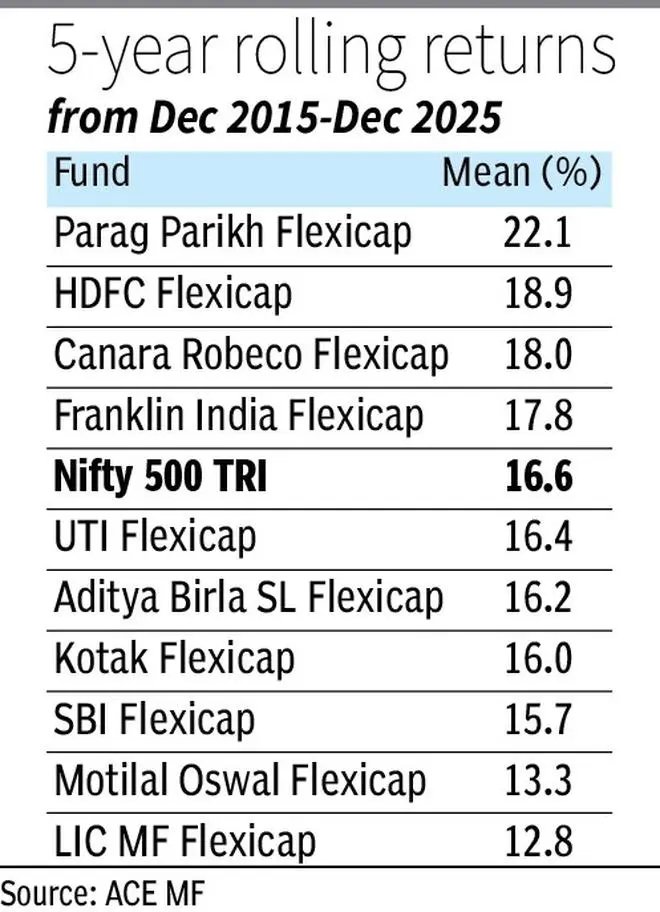

As the flexicap funds from Parag Parikh, HDFC and Franklin Templeton have shown over the past decade and those from ICICI Prudential, Nippon India and Invesco India have demonstrated in the last 3-4 years, it is possible to outperform indices such as Nifty 500 TRI consistently even with heavy large-cap proportions in their portfolios.

So, having greater representation in mid and small-caps in the portfolio is not always necessary for delivering broader market outperformance.

As flexicap funds must usually form the core parts of retail investment portfolios, 2-3 funds from the aforementioned list are enough for investors with a long-term perspective. Investors with an average risk appetite can stick to these funds.

Only those with a penchant for greater risk must look outside this list, more so in the case of a new fund.

Investors with a high risk appetite with hopes for Abakkus to replicate its PMS and AIF success in its new flexicap mutual fund – perhaps like Helios Flexicap has shown in the past two-odd years since its launch – can park small sums in the NFO for diversification.

Published on December 13, 2025