-

Learn about 2025 mutual fund performance trends -

Understand which fund categories led and lagged in 2025 -

Discover industry changes and how to use AAII’s mutual fund guide

Last year continued three trends we saw in 2023 and 2024. First, most mutual fund categories realized gains in 2025.

Second, equity funds saw further outflows. Investors, on balance, withdrew dollars from both domestic and foreign mutual funds throughout 2025.

Third, bond funds continued to realize net inflows—meaning cumulative investor purchases were larger than their cumulative outflows. This was the case for every month in 2025 except April. The implementation of tariffs sent shivers through both the domestic bond and stock markets last spring.

One thing that did change was the type of mutual funds that outperformed. Equity precious metals funds shined with a 153.6% average return for 2025—the highest of any category covered in our guide. The foreign large value and diversified emerging markets categories were a distant second and third with still-impressive average returns of 38.5% and 31.3%, respectively.

The outperformance of foreign stocks in 2025 followed what has been an unusually long period of underperformance compared to their U.S. stocks. Whether last year’s relative outperformance is the start of a multiyear trend for foreign stocks or just a blip remains to be seen. Among the benefits of diversification is the higher chance of being allocated to the right asset class and category at the right time.

There was a small increase in the number of mutual funds issuing large capital gains distributions. CapGainsValet.com counted 308 mutual fund distributions exceeding 10% of their net asset value (NAV) as of early December 2025. This is above the 258 large distributions in 2024 but below the 11-year average of 350. Three years of positive returns for U.S. stocks left fund managers with fewer losses to offset against gains.

More Mutual Funds Expected to Offer ETF Share Classes

Last fall, the U.S. Securities and Exchange Commission (SEC) issued a notice stating its intent to grant Dimensional Fund Advisors (DFA) the ability to offer exchange-traded fund (ETF) share classes for its existing mutual funds. A large number of other mutual fund companies are asking for permission to do the same.

Currently, the mutual funds and ETFs offered by nearly all firms are completely separate funds. There is no intermingling between the two. Vanguard is the exception. Through a now-expired patent, several Vanguard funds give investors the option to buy either a mutual fund or an ETF share class of the same fund. The assets of both the mutual fund and ETF share classes are pooled together.

ETF shares receive preferential tax treatment and can be bought and sold throughout the day. ETF share classes, however, cannot be closed to new investment like mutual fund shares can.

Such conversions will be an option for those with taxable accounts or individual retirement accounts (IRAs) and Roth IRAs. DFA does not expect its conversion to be taxable to shareholders. If offered the chance to convert your mutual fund shares to an ETF share class, evaluate the choice carefully based on your preferences and needs.

The net impact of these new ETF share classes on the mutual fund industry remains to be seen. We continue to see a decrease in the overall number of mutual funds. Our database has over 20,800 mutual funds with year-end 2025 data. This is an approximate 13% decrease from the 24,000 funds in existence at the end of 2022.

This Year’s Guide

The Top Mutual Funds by Category table uses the data and tools available to members on AAII.com. They include our mutual fund grades and category averages.

Download the Excel spreadsheet for the Top Mutual Funds by Category.

The category averages provide a peer-based benchmark to compare a given fund against. They allow you to quickly see if a fund is more or less attractive than all other funds in a particular category.

The mutual fund grades range from A to F. The scale works just like it did when you were in school: A’s are good, while F’s are bad. Each of these grades is tied to a percentile rank based on how a specific fund compares to its category peers. A fund’s average annual return for a given period that ranks in the top quintile (best 20%) relative to that of its category peers will receive a grade of A. Lower grades are assigned for lower quintile rankings. So, a grade of C means that the fund’s return for the period was about average relative to that of its category peers (in the 41st to 60th percentile).

Members using the online version of this guide can access data on more than 20,800 mutual funds on AAII.com. This large universe includes the no-load funds widely available to most individual investors as well as institutional and special share class funds. The latter may only be available through workplace retirement plans [e.g., 401(k) plans] and/or through brokers and financial advisers. Go to www.aaii.com/guides/mfguide to access the expanded online version of the guide.

Our mutual fund data is updated monthly. Clicking on one of the groups in the Expanded Fund Listings section of the guide will allow you to view the funds in that group as well as customize the fund categories you want displayed. Once viewing the expanded listings, spreadsheets can be downloaded by clicking on the green Export to Excel button located just above the fund names.

AAII members reading either the PDF or print version of this guide will see key mutual fund data presented for each fund on a single page. Approximately 300 mutual funds from a wide range of asset classes, fund groups and categories are covered in the PDF and print versions.

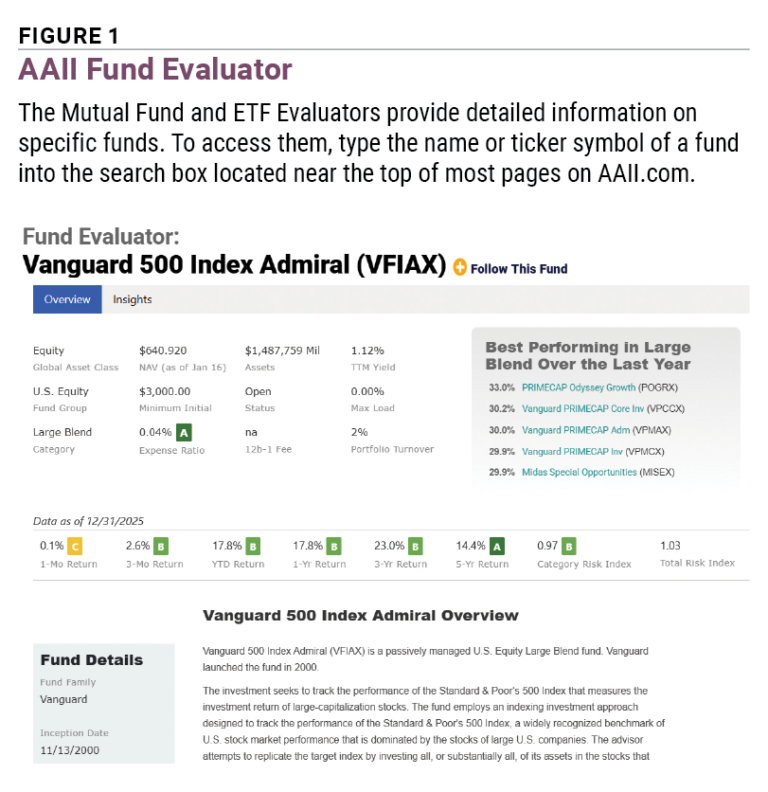

All AAII members have the ability to track the mutual funds they own in our newly rebuilt My Portfolio tool. Clicking on a fund’s name or ticker symbol (or typing either into the search box located at the top of most pages on AAII.com) will call up our Mutual Fund Evaluator (Figure 1). This page provides the valuable fund information and data that investors are most interested in. It’s a very helpful tool for conducting mutual fund research.

Which Mutual Funds Were Included?

The mutual funds that appear in the PDF/print guide were selected from the universe of open-end funds tracked through Nasdaq. The following are the various screens we used for the final selection of which funds to include in the PDF and print versions of this guide.

Categories

The starting point for determining which categories to include is the fund groups matching the AAII Asset Allocation Models. The stock and bond mutual funds comprising these groups are also the most frequently found in individual investors’ portfolios. We then expanded the list of fund categories to cover those of interest to a large number of investors or those that are commonly found in workplace retirement plans. This latter group includes sector funds, high-yield bond funds, allocation funds and target-date funds.

No digital asset funds met our criteria for inclusion. We suggest those interested in obtaining cryptocurrency exposure through a fund read our ETF guide, which is included in this issue.

Historical Record

Only those mutual funds with three full years of data are included in the Top Mutual Funds by Category table. This requirement ensures that there is a performance record of significant length and that all performance measures can be calculated. This requirement was loosened for the listings of the best- and worst-performing mutual funds.

Size

Funds must appear in the Nasdaq mutual fund listings. Funds are generally required to have at least $1 billion in assets. (Exceptions were made for certain categories.) A smaller size requirement is used for the top- and bottom-performing mutual fund listings. The online fund guide does not have any size requirement.

Loads

Only no-load mutual funds are included in the Top Mutual Funds by Category table. Funds charging a load are excluded because of the large number of no-load funds available to individual investors and the drag on returns a front-end or back-end fee can have. Share classes more likely to have 12b-1 fees are also excluded.

Expenses

Funds with significantly higher expense ratios than the average for their category are generally excluded.

Performance

For the most part, funds that significantly underperformed compared to the average performance of funds in their category are not included. Exceptions were made for funds of significant size.

Interest and Availability

Only those funds that are of general interest to mutual fund investors and available for investment by individual investors directly from the fund, without restrictions, are included in the PDF and print versions of this guide. If a fund family offers multiple no-load classes of its funds, the investor or retail class is presented.

Go to AAII.com for Information on More Funds

Performance figures for mutual funds that do not appear in the PDF/print version of this guide can be accessed at www.aaii.com/guides/mfguide, where data on over 20,800 mutual funds can be found. These include funds sold exclusively through advisers and those designated with special share classes, such as retirement.

Additional analysis can be conducted with our Compare Funds tool. You can use it to compare and contrast return, risk and turnover information for two or more funds. You can also track the funds you own or are most interested in with My Portfolio.

-

20,800+ funds -

More grades for performance, risk and expense -

Portfolio composition -

Additional risk figures -

Manager tenure -

Loads and 12b-1 fees -

Contact info

Plus,

-

Monthly data updates -

Check box to quickly compare funds -

Filter funds by category -

Sort by any data field -

Definitions of terms -

Downloadable Excel file

Also at AAII.com

Funds area at www.aaii.com/funds