Infrastructure has garnered significant attention in the last few years, both from Central/State planners and retail/institutional investors. In the current stage, while a few indicators may not be as supportive of continued momentum as they were a year earlier, there is still a long runway for growth and investors should continue their exposure to the segment. We track the mutual funds available in this sector and analyse their performance and portfolios.

Macro signs

Right at the top, the yearly public capital expenditure may likely consolidate at a higher plane and not report much growth from here. For one, the base has expanded significantly, and two, the hit on government revenues (direct and indirect taxes) will likely show in deficit numbers. This shift was evident this year itself when budgeted capital expenditure rose 11 per cent to ₹11 lakh crore compared to 27 per cent CAGR growth in the last five years. But as indicated, consolidation at ₹11 lakh crore even with degrowth is comparably better than the ₹3.4 lakh crore base of expenditure five years ago. The larger purse need not expand to sustain the listed companies’ order books.

Private capex has failed expectations so far in taking over the mantle. A revival in aggregate demand is likely as rural economy is turning around and will be aided by a strong monsoon. The urban economy has higher disposable income and lower interest rates supporting its revival from the recent slump. The upcoming festival season should be a strong indicator of any revival. But partially, the demand from exports and international markets in auto companies, infrastructure and consumer durables sectors are reporting a strong demand from West Asia, Africa and other regions which should supplement domestic demand to an extent.

Power capacity and power transmission has been in an expansionary mode. The power target of 777 GW by 2030 from 476 GW now includes a significant non-fossil fuel portion of 500 GW which is largely led by solar power. The generation and transmission capacity to be added has been on a strong trajectory. The power demand has also been high with power companies reporting a marginal slump in the recent quarter owing to early rains.

Transportation, real estate demand from housing and commercials including data centres, GCCs and office space are expected to sustain, despite being in an elongated upcycle. The strong GDP print, despite the commentary on inflation adjustments, should spur a higher pace of capacity building along with lowered cost of borrowing. The lower inflation print and the rate cut cycle globally are factors supporting another round of rate cuts in India as well.

Funds and performance

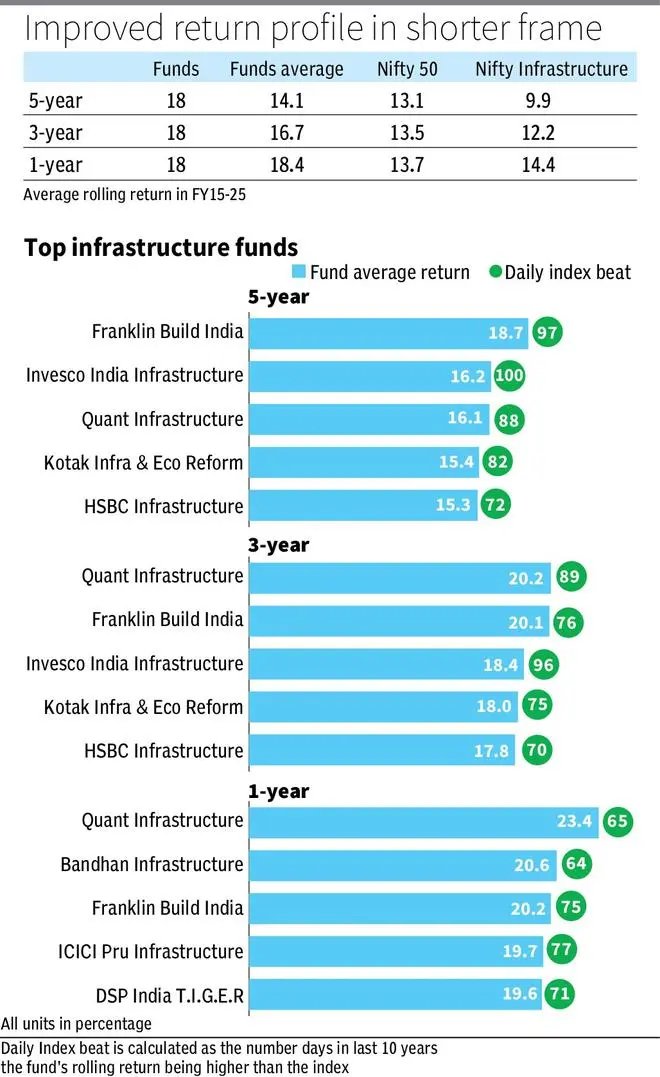

The sector definition allows for close to 350 companies ranging from banks to refineries and telecom operators as infrastructure companies. This comparatively large investment universe allows funds to strategise effectively, which shows in the consistent benchmark outperformance; 17 of the 18 funds have beaten the index (Nifty Infrastructure) on 5-year rolling returns in the last decade. Essentially, there are sectors where index investment will suffice; infrastructure is not such a sector. This has also allowed the funds to outperform Nifty 50 (5-year rolling return basis), which the index has failed to deliver as shown in the table. The index has bettered Nifty 50 only in shorter frames and the funds have a better return profile in the shorter frames, which may point to large investment universe aiding the sector to switch strategies effectively.

The funds with a longer operating history, and rated high in bl.portfolio Star Track Mutual Fund ratings, are ICICI Pru Infrastructure, Canara Robeco Infrastructure and BOI Manufacturing and Infra Fund. These funds’ holdings are led by L&T, Reliance and NTPC and in line with sector weights.

Amongst funds, Quant Infrastructure, Invesco Infrastructure and Franklin Build India have delivered strong growth across time frames. The top five funds are as shown in the chart. The three funds have also beaten the index on most of the days in the last decade, indicating a higher probability of beating the index across time frames, based on the past data.

Amongst the three funds, Invesco is holding a lower proportion of large-cap stocks (30 per cent) compared to the sector (47 per cent) or the other two, 56 per cent for Quant and 61 per cent for Franklin. Considering the macro-economic push with lower rates and higher investment spending, large-caps may be the first beneficiaries which should aid funds with a larger cap concentration.

Quant fund is overweight on Construction Projects (primarily L&T) which has joined power as the leading sector focus. Franklin is also overweight construction projects along with banks and Invesco is overweight on electrical and industrial sectors currently – July 2025.

Only Quant fund is invested in auto components as a top-10 sector which indicates the fund expects minimal tariff or US exposure impact in the segment. As mentioned, the sector portfolios are as varied as the sector. While Quant has trimmed banking sector, Franklin has the highest exposure currently. We recommend investors stick to any of the three top performing funds to gain exposure to India Infrastructure upcycle.

Published on September 6, 2025