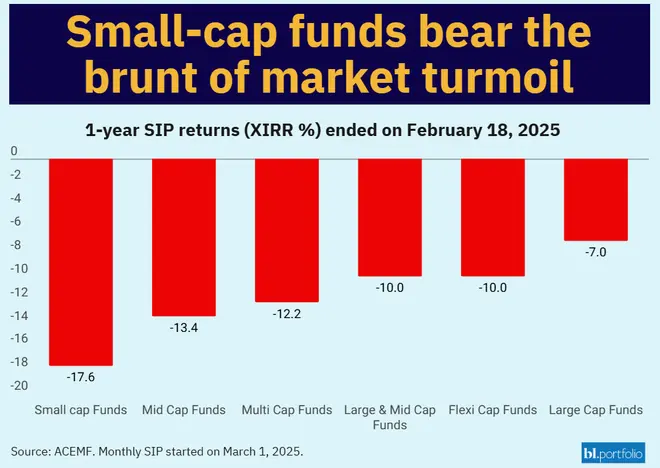

Amidst the ongoing market turbulence, small-cap mutual fund schemes have emerged as one of the most impacted equity fund categories, experiencing the sharpest declines in their Net Asset Values (NAVs). For instance, for the 1-year SIP ended on February 18, 2025, the small-cap funds category delivered an XIRR returns of -18 per cent while the large-cap, mid-cap and flexi-cap funds categories generated -7 per cent, -13 per cent, and -10 per cent respectively.

This volatility has unsettled many new investors in small-cap funds, leading some to consider discontinuing their SIPs—a move that could disrupt their financial planning and jeopardize their long-term goals.

Nevertheless, retail investors should approach small-cap fund investments with caution, ensuring they align with their risk tolerance. Below, we outline a strategic approach to investing in small-cap funds.

Small-cap funds are meant for investors with a high-risk profile who want to build wealth in the long run. They primarily invest in stocks of small-cap companies that are ranked below the top 250 companies in terms of market capitalization on the stock exchange. These companies are usually in the early or growth stages of their business cycle, offering higher growth potential but also carrying higher risk compared to large-cap or mid-cap companies.

Here are six crucial factors that retail investors should consider when investing in small-cap mutual funds.

Peaks or Troughs: Don’t stop your SIPs due to market fluctuations

Stopping SIPs in small-cap funds during market fluctuations can disrupt your long-term financial planning and prevent you from achieving your goals. By staying invested, you harness the power of rupee-cost averaging, compounding, and long-term growth potential while avoiding the pitfalls of market timing and emotional decision-making. Small-cap funds are inherently volatile, but with patience and discipline, they can deliver significant rewards over time.

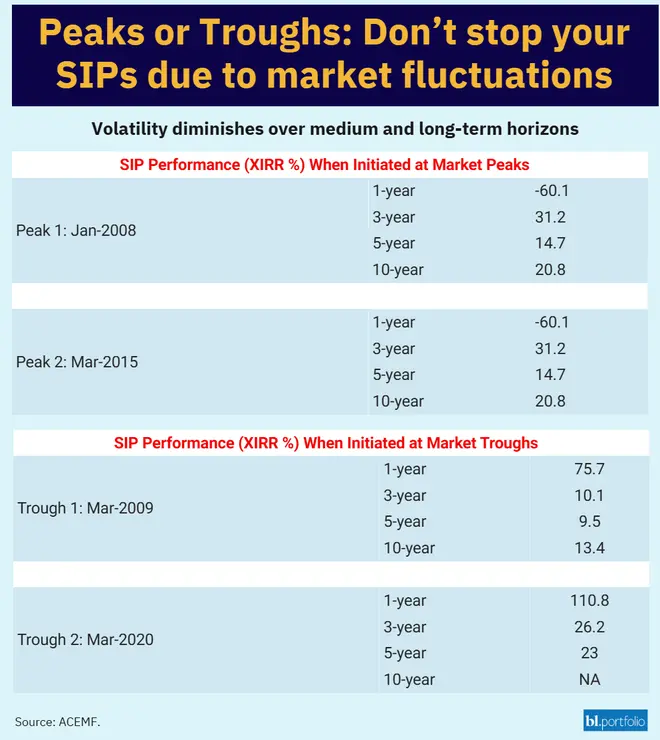

The accompanying tables highlight why short-term market noise should be ignored. Table-1 demonstrates that SIPs initiated during market peaks undergo significant short-term fluctuations, which diminish over medium and long-term horizons. Meanwhile, Table-2 reveals that SIPs started during market troughs ultimately deliver stronger returns, thanks to the benefits of rupee-cost averaging.

SIP performance of small-cap funds in market troughs and peaks

Smallcap funds are more volatile in short term

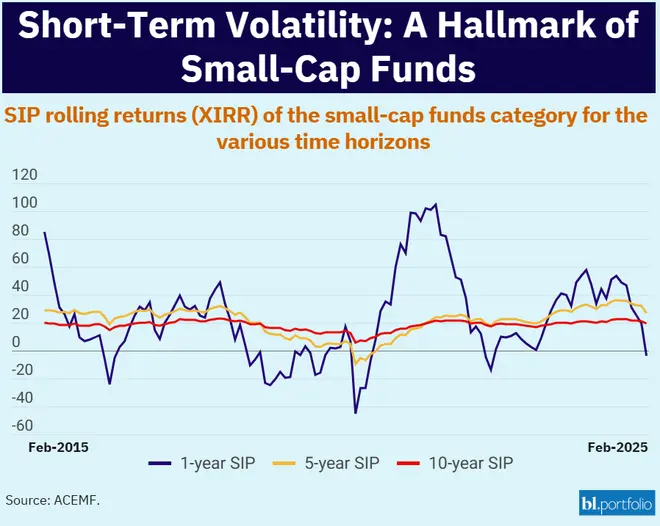

Small-cap funds are more volatile in the short term due to several inherent characteristics of small-cap companies and the nature of the market, such as lower market capitalisation, limited liquidity, earnings volatility and economic sensitivity. Also, Small-cap companies are often in the early or growth stages of their business cycle. They are more vulnerable to economic changes, industry disruptions, or company-specific risks, which can cause sharp fluctuations in their stock prices.

Smallcap funds are more volatile in short term

Smallcap funds deliver positive and better returns in long run

However, their long-term performance stabilises as companies grow, establish themselves, and generate consistent earnings. Additionally, compounding and rupee-cost averaging through SIPs helps mitigate short-term volatility, allowing investors to benefit from their high growth potential over time.

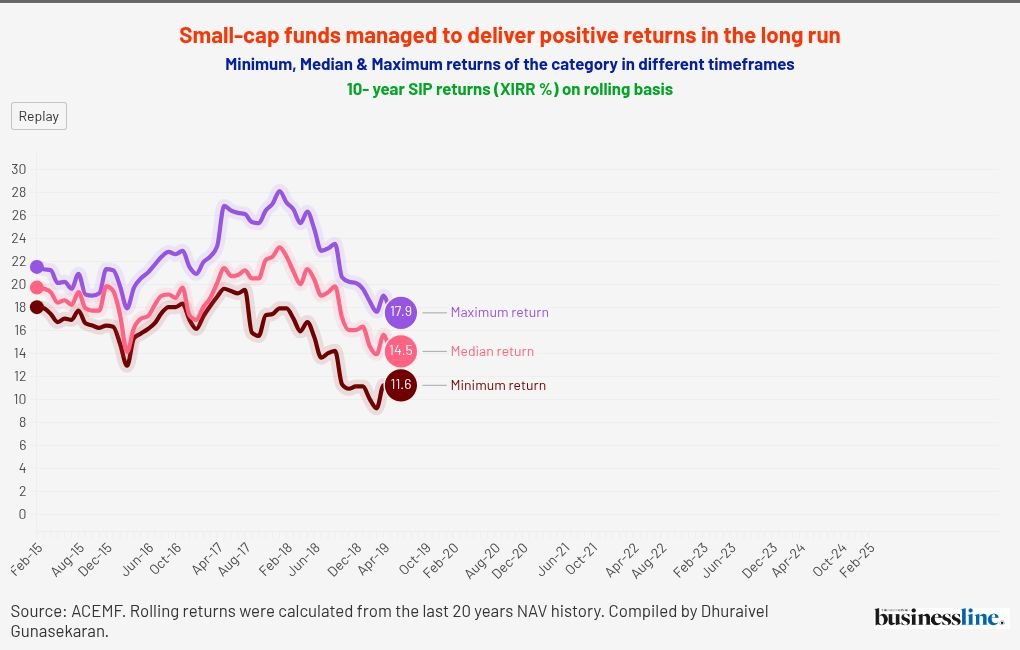

The accompanying chart showcases the minimum, median, and maximum returns achieved by the schemes in the small-cap category as per the 10-year SIP rolling returns that were calculated from the last 20 years NAV history. Notably, none of the funds in this category generated negative returns during these timeframes.

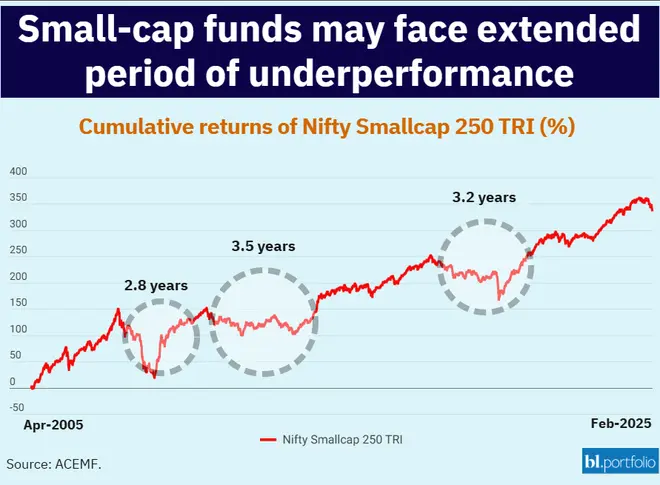

Small-caps may undergo prolonged underperformance

Small investors who want to invest in smallcap funds should have the fortitude to handle market volatility. It is highly probable that smallcap funds will produce zero or negative returns for a prolonged period of three to four years as shown in the accompanying chart.

Small-caps may undergo prolonged underperformance

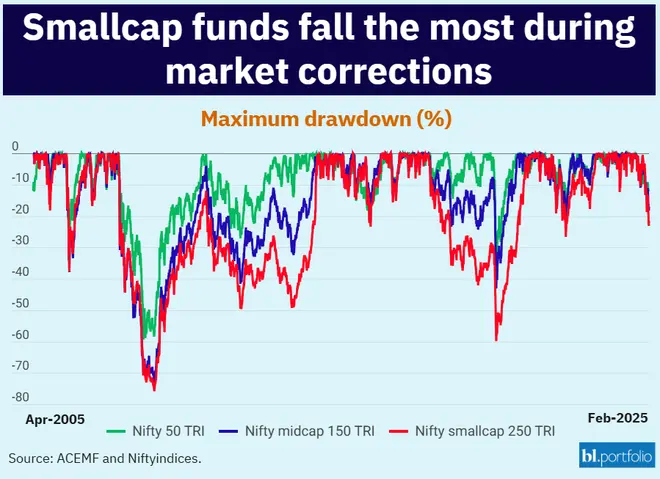

Small-cap funds are risky compared to mid- and large-cap funds

Despite higher growth potential, small-cap companies are more sensitive to market changes. The accompanying chart explains the Maximum drawdown, which measures the largest drop in the value of an index from its highest point to its lowest point over a specific period. It shows the worst loss an investor could have experienced if they had invested at the fund’s peak and sold at its lowest point.

Understanding and preparing for such fluctuations, whether during bullish or bearish market phases, is essential for small investors to make informed decisions when considering small-cap funds.

Small-cap funds are risky compared to mid- and large-cap funds

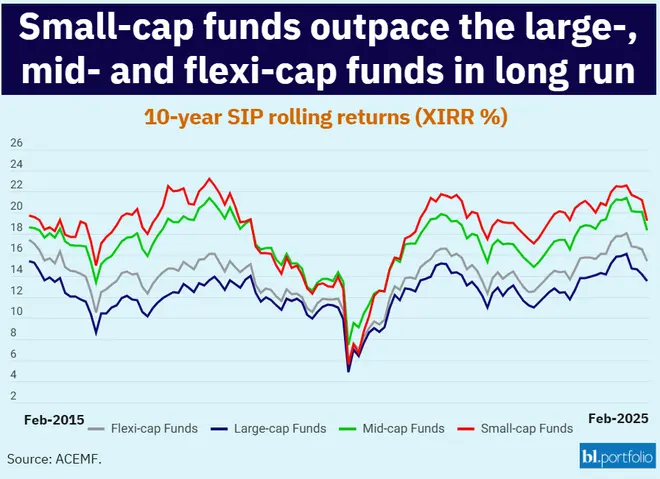

Small-cap funds outpace the mid-cap and large-cap counterparts in long run

Small-cap funds have been wealth creators and outpacing the mid-cap and large-cap counterparts over the long run. However, it is crucial for small investors to be cautious when investing in smallcap funds depending on their risk tolerance.

Smallcaps outperform mid and flexicap funds in long run

They are particularly suitable for investors with a long-term horizon and willingness to take on high market risk for wealth creation. However, it is essential to align your investment decision with your financial goals, risk tolerance, and time horizon. Keep in mind that asset allocation should be in place while making your investment decisions.

Allocating 10-15 per cent of your long-term portfolio to small-cap funds is generally sufficient. You can explore top-rated funds from the bl.portfolio Star Track MF Ratings for selection. However, it is essential to conduct periodic reviews, ideally once a year, to ensure your portfolio stays aligned with your financial goals and timelines.