The great decline

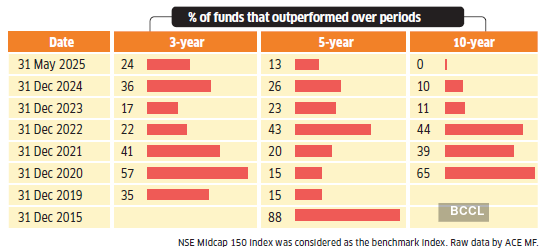

We examined the 3-year, 5-year, and 10-year returns of mid-cap funds, calculated as of each month-end from May 2015 to May 2025. For each of these time periods, we then looked at how many funds (in terms of percentages) outperformed their benchmark indices. To keep things simple, we considered the Nifty Midcap 150 – Total Returns Index (TRI), even though six of the 30 funds under consideration had the BSE 150 MidCap TRI as their benchmark index.

Between 2015 and 2016 month-ends, 88% of the schemes had outperformed their benchmark indices over 5-year periods, compared to 20% for 2024-2025 month-end measurements. The 3-year time periods exhibit a wider variance, regardless of the period under consideration. For instance, as of May 2019, only 10% of mid-cap funds outperformed their benchmark indices, compared to 52% as of July 2020, 13% as of September 2022, and 24% as of May 2025.

The 10-year returns reveal a more pronounced trend of actively managed midcap funds underperforming benchmark indices. Nearly 71%of mid-cap funds had outperformed as of May 2020, as opposed to 44% as of December 2022 and 10% as of February 2025. As of March 2025, April 2025 and May 2025, none of the mid-cap funds outperformed their benchmark funds. Note: Only the Nifty Midcap 150 TRI was considered as the benchmark index.

“It’s a silent boom that’s flying under the radar,” says Kunal Valia, Founder of StatLane, a Sebi registered research analyst, talking about how mid-cap fund managers are struggling to beat their benchmarks.

Is popularity a curse?

Mid-cap funds gained popularity due to the improving quality of the companies in their portfolios. According to an analysis by Mirae Asset Investment Managers (India), nine sectors (as represented by companies in the Nifty 100, Nifty Midcap 150 and Nifty Smallcap 250 indices) are present solely in companies that are part of the midcap space, including commercial vehicles, financial technology (fintech), and tractors. An additional 22 industries are present only in the mid-cap and smallcap space, as defined by the Association of Mutual Funds of India classification.

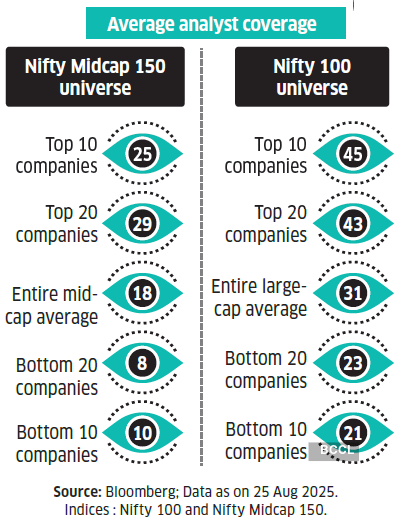

As mid-cap companies grew bigger and market depth increased, more analysts began to track them. Nearly 29 brokerages track the top companies in the Nifty 150 mid-cap space, according to Bloomberg. A comprehensive coverage of these companies, coupled with better disclosures, has also led to better price discovery, says Siddharth Srivastava, Head–ETF Product & Fund Manager, Mirae Asset Investment Managers. He adds that the flow of information has become more efficient.

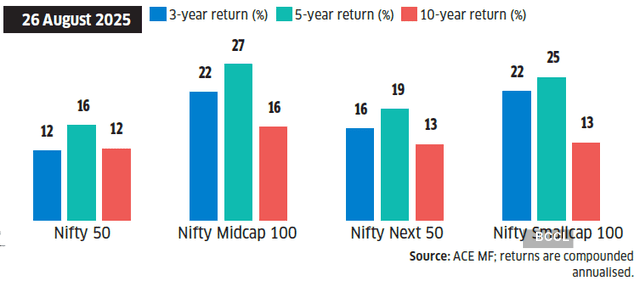

The Nifty Midcap 100 index averaged 27% annual returns across the calendar years 2020-2024, compared to 14% for the Nifty 50 index, which represents the 50 largest companies by market capitalisation. As of December 2024, the Nifty Midcap 100 index outperformed the large- and small-cap segments across 3-year, 5-year and 10-year time periods, according to ACE MF data.

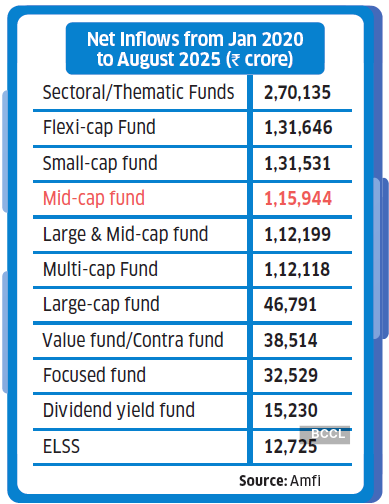

Naturally, investors came in by the droves. Between January 2020 and July 2025, mid-cap funds had received net inflows of Rs.1.16 trillion, according to Amfi. It was one of the hottest categories in the equity MF segment, next only to sector/thematic funds, flexi-cap funds and small-cap funds. Investors also started to buy shares of mid-cap companies directly. The average traded volume of the top 20 companies for the year ending July 2025 was Rs.10,546 crore, up from Rs.3,034 crore for the year ending July 2018. Even the bottom 10 companies in the index saw a surge in average trading volumes, from Re.30 crore as of end-July 2018 to Rs.309 crore as of end-July 2025, according to Mirae Asset India’s analysis.

Mid-cap funds struggle to outperform

An ET Wealth analysis of 25 actively managed mid-cap funds shows that fewer number of funds have outperformed benchmark indices than before.

Note: “Passive mid-cap indices simply track all names, including weaker businesses vulnerable to downturns.”

RAVI KUMAR DIRECTOR,

GAINING GROUND INVESTMENT SERVICES

“The Nifty Midcap 150 index has gained popularity among investors for its strong performance relative to large- and small-cap indices, making it an appealing choice for those starting their mid-cap investment journey,” says Valia.

Active vs passive mid-cap funds: Who wins?

The flipside of all this? When everything about these companies becomes common knowledge, fund managers lose their information edge. The bigger problem, experts say, is Sebi’s strict classification of what constitutes mid-cap stocks. In 2018, Sebi standardised the definition of large-, midand small-cap stocks. The top 100 stocks in terms of market capitalisation are defined as large-caps; those ranked from 101st to 250th are defined as mid-cap companies, and those ranked from 251st and below are classified small-cap stocks. This means that only 150 companies are classified as mid-caps.

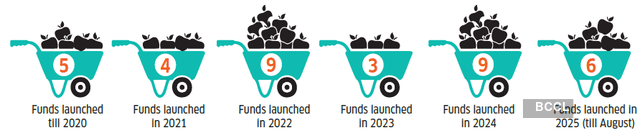

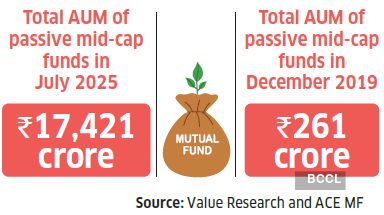

Growing popularity of passive mid-cap funds

The static definition means that the market capitalisation boundaries have also expanded exponentially. This means taking meaningful exposures becomes a problem. In December 2017, the smallest mid-cap stock’s market capitalisation was Rs.10,012 crore, and the largest was Rs.30,740 crore, as per the ETIG database. As of July 2025, the smallest mid-cap stock’s market capitalisation is Rs.34,395 crore, and the largest is Rs.1.02 lakh crore. “This, coupled with increasing corpus sizes of actively-managed mid-cap funds, has made it difficult for managers to take meaningful positions, due to liquidity risk,” says Valia.

Improved performance

…brought in a surge of investors

Srivastava notes that markets have also observed a narrowing gap between actively and passively managed mid-cap funds in recent times. His fund house, Mirae Asset India, launched a Nifty Midcap 150 Exchange Traded Fund (ETF) in March 2022, followed by a mid- and small-cap ETF (a factor-based fund that accounts for momentum and quality factors) in May 2024.

More eyes tracking mid-caps

Not everyone is convinced by the surge in passively managed mid-cap funds, though. Ravi Kumar TV, Director, Gaining Ground Investment Services, says that if you closely track sectors and keep tabs on their quarterly performance, you can still identify winners from a mid-cap index, rather than just buying the entire index. Kumar acknowledges that the gap between actively and passively managed mid-cap funds has narrowed over time, and now focuses on just four-five fund managers, whom he believes can still outperform the benchmark index. “With global uncertainties unleashed by US President Donald Trump’s tariffs, it’s going to be a stock picker’s market,” he says. Kumar also notes that the Indian government is attempting to promote consumption-driven growth. “I usually leave it to a good mid-cap fund manager to figure out the sectors and areas where this growth might trickle down to,” he says, asserting his faith in fund managers to build a mid-cap portfolio. “Passive mid-cap indices simply track all names, including weaker businesses vulnerable to downturns. Active managers can avoid balance-sheet risks, overleveraged companies, and structurally declining businesses, while tilting toward stronger franchises,” he adds.

The flip side to this could be if your fund manager deviates too much from the index, and the picks go wrong. “Active managers might deviate more from their benchmarks, and these deviations can lead to underperformance,” says Valia.

Deepak Chhabria, Chief Executive Officer and Director of Axiom Financial Services, a Bengaluru-based distributor of financial products, has begun closely monitoring the mid-cap index funds and ETFs, but says he is far from making the switch from active to passive funds. “My concern with passive funds is that there are no filters to them; they just have to mirror the entire index. We are not comfortable with all the stocks part of the index; active fund managers can pick and choose, instead,” says Chhabria.

Srikanth Bhagavat,Managing Director of Hexagon Capital Advisors, has only recently begun recommending a handful of passively managed mid-cap funds selectively, but prefers active ones on a larger scale. “There are unseen risks in buying an entire mid-cap index, such as liquidity and quality. But underperformance by a large section of actively managed mid-cap funds is there, and the choice of good fund managers in this segment is less,” says Bhagavat.

What should you do?

Both active and passive funds have their reasons to get your attention. While passive funds in the mid-cap segment are growing in size, many fund houses are also launching factor-based funds in this segment, which add one or two layers of filters to weed out the so-called undesirable stocks in the index. However, there are still good fund managers who can outperform the index in the long run, although the group is small. Of the 121 instances of 5-year time periods that we analysed, six funds outperformed the benchmark index more than 50% of the time, of which just two managed a score of 60% or more. Of the 61 instances of 10-year periods examined, eight funds outperformed the benchmark index at least 50% of the time, with six achieving an outperformance score of 60% or more.

If you are confused about finding a mid-cap fund that can consistently beat the benchmark index and justify its higher expense ratio, pick a multi-cap fund, says Dhirendra Kumar, Chief Executive Officer, Value Research. “A multi-cap fund will invest at least 25% of its corpus in mid-cap stocks. This is forced diversification into the segment, without you worrying about picking a good midcap fund manager in times when the gap between active and passive funds has narrowed down,” he says.