Over the past year, Indian equity markets have witnessed heightened volatility, driven by global uncertainties, subdued corporate earnings, and concerns over tariffs. This turbulence is reflected in the India VIX (volatility index), which fluctuated between 9.9 and 22.8 between October 2024 and October 2025. The average VIX reading stood at 14.2, higher than the averages of 14 and 13.3 recorded in the preceding years, 2023-24 and 2022-23, respectively. These annual averages are calculated from 3 October of each year.

Analysts anticipate that market volatility will persist, driven by India’s relatively high valuations compared to more attractively priced global markets, which will keep foreign portfolio investment (FPI) flows unpredictable. However, earnings are projected to strengthen from 2026-27 onwards, which could improve valuations and renew interest among foreign investors.

Funds with low loss ratio

Given these near-term concerns, it is advisable to invest in funds that demonstrate greater stability in terms of downside risk or the frequency of negative returns. One way to identify such funds is by examining the loss (or the probability of loss of the returns) generated by a mutual fund. Schemes that maintain a loss below the average across different time periods are more resilient to downside risk.

This approach helps investors evaluate equity funds based on their risk tolerance. Those with a lower appetite for volatility within the equity space may find funds with consistently low loss more suitable for their portfolios.

A total of 113 equity diversified funds— with assets of over Rs.1,000 crore and a track record of at least five years—were evaluated to calculate the loss . For each of the three years (2022-23, 2023-24, and 2024-25), the schemes’ one-week rolling returns were analysed using daily data. The three-year periods spanned from October to September. Only actively managed, diversified equity funds were considered, while tax-saving, sectoral, and thematic schemes were excluded. The study analysed how frequently each fund generated negative returns over a oneyear period. To calculate the loss for a given year, the number of negative weekly rolling returns was divided by the total number of rolling weekly returns in that year.

Low on risk, high on consistency

For example, the HSBC Midcap Fund generated a negative weekly rolling return on 112 out of the total 249 rolling weekly returns in 2024-25 (October 2024 to September 2025). Therefore, its probability of loss works out to 0.45 (or 45%). This implies that if an investor had invested in the fund 100 different times during the year—each time for one week—they would have incurred a loss in 45 of those instances.

After calculating the loss for all 113 funds over three years, the average loss for the group was determined for each year. Funds with the likelihood of loss lower than the average in all three years were selected. A total of 14 funds made the cut.

Additionally, only those funds with high ratings—4-star or 5-star by Value Research—were further screened. Only seven such funds met all criteria.

Selected fund attributes

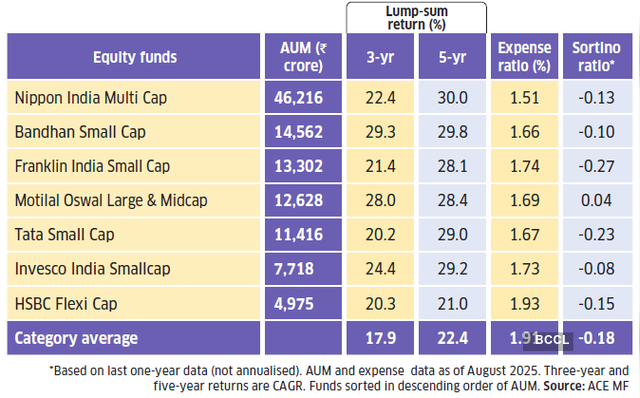

The aggregate AUM of the shortlisted seven funds rose 30.5% year-on-year between August 2024 and August 2025 to Rs.1.1 trillion. In comparison, the aggregate AUM of all equity diversified funds grew by 11.2% during the same period.

All these shortlisted funds significantly outperformed the category average of equity-diversified funds over three-year and five-year periods. Not only lump sum investments, but the selected funds also delivered returns in SIP mode higher than the category average of all equity-diversified funds over the last three and five years.

The selected funds also scored better in terms of the expense—the fees charged by the asset management company (AMC). Six out of the seven funds had expenses lower than the average for all equity-diversified funds (data as of August 2025), indicating lower investment costs.

Most of the selected funds have also performed well in terms of risk-adjusted returns. Five of the seven funds had Sharpe and Sortino ratios higher than the average for all equity diversified funds. Additionally, five funds generated positive alpha, which was also higher than the category average. These risk-adjusted returns are based on one-year data.

While the Sharpe ratio measures the excess return (over the risk-free rate) a fund generates relative to its total risk, the Sortino ratio measures excess return relative to the downside risk. On the other hand, alpha represents the excess return generated by a fund relative to its risk-adjusted expected return.

In terms of sector allocation, banking and finance, retail, capital goods, automobiles, and power emerged as the favoured sectors among the selected funds, based on the number of shares held in August 2025.