FRANKFURT, July 10 (Reuters) – Germany’s real estate industry, already in its third year of turmoil, faces more pain ahead as further companies go bust, the CEO of Germany’s largest landlord warned.

“We’re going to see an extreme number of bankruptcies over the next few months, maybe over the next few years. We’re already seeing them today,” Buch told journalists on Tuesday.

“It is going to be bitter.”

For years, low interest rates and a strong economy sustained a boom across the German property sector, which broadly contributes 730 billion euros ($789.64 billion) a year to the nation’s economy, or roughly a fifth of Germany’s output.

Buch built Vonovia through a series of multi-billion-euro takeovers, building up a debt mountain as the property crisis struck, forcing it to sell swathes of homes.

In its wake, Vonovia, which has roughly 550,000 apartments, slashed the value of its properties by almost 11 billion euros in 2023, taking the group to a 6.7-billion-euro loss, its worst ever.

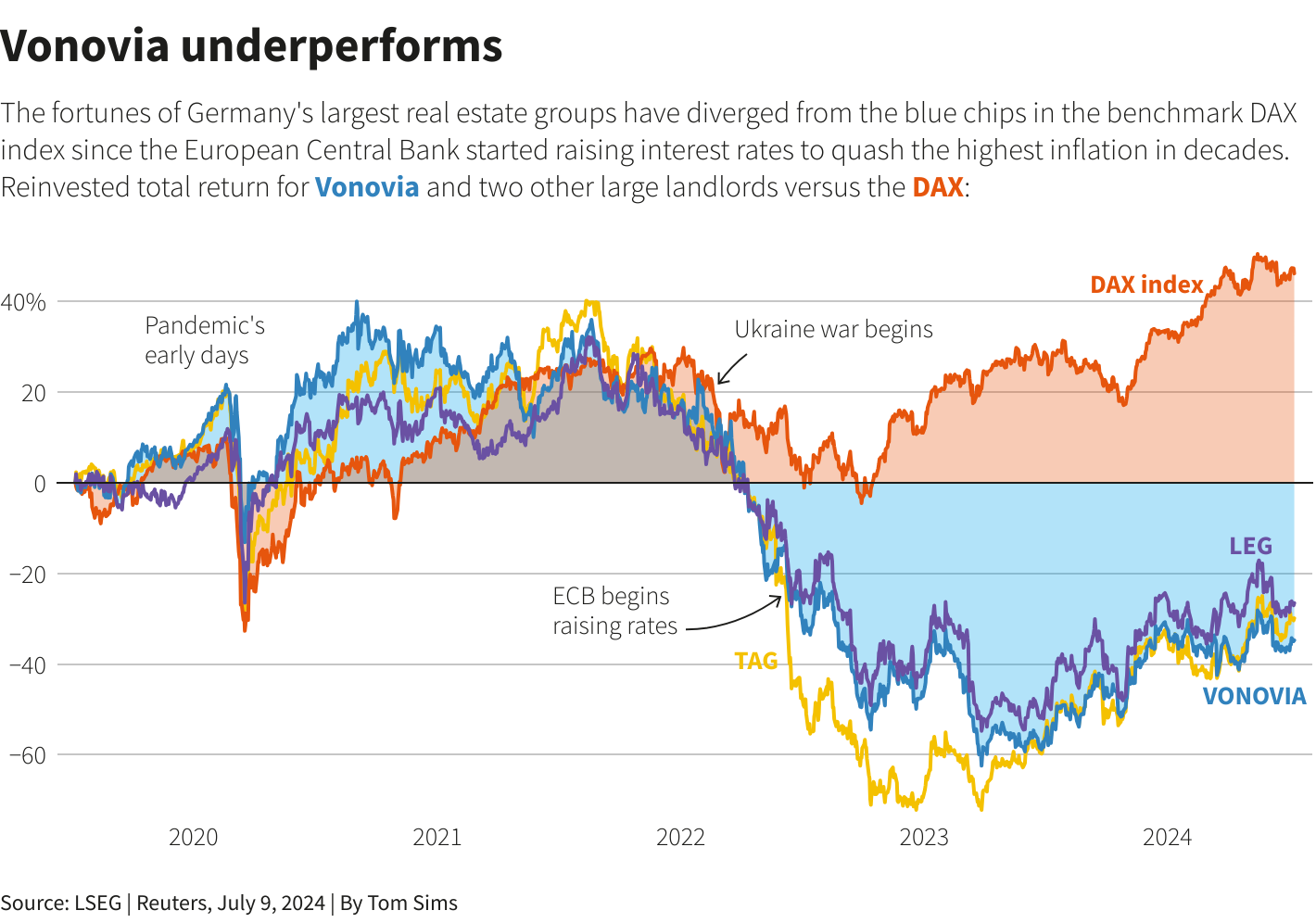

It has cut the value of its property by more than one fifth, stripping out rent increases, since 2022, when interest rates started to climb, knocking prices.

Buch said Vonovia was now finished with big writedowns, although said there could be further small adjustments.

ECB RATE CUT

A recent rate cut by the ECB has sparked hopes of a revival of the sector, but some executives are still cautious.

“Whether or not the ECB changes interest rates marginally will not reverse the trend for property,” said Matthias Danne, board member at Deka, one of Germany’s largest asset managers with 55 billion euros in property investments.

Elevated rates will keep financing expensive, and a rebound in building sales has been “slower coming than expected”, Danne told Reuters.

Germany is the largest real estate investment market on the European continent. The turnover of buildings through sales that often characterises a healthy market slowed to a halt and is only gradually picking up.

Jones Lang LaSalle, the global real estate consultant, this week disclosed that transaction volumes across Europe’s largest economy rose 10% during the first half of 2024 from last year’s low level.

Offices have been particularly hard hit, and the German bank LBBW said in a report on Wednesday that low turnover in transactions points to a risk that “distressed sales are on the back burner and could flood the market later”.

But weakness in commercial real estate in the United States, with offices still empty after the pandemic, and the struggles of major property developers in China have focused global attention on the sector.

The Apollo-owned property company Demire has revealed it is in talks with investors about restructuring 500 million euros in bonds. It has also said it has been struggling to agree with a bank on a loan. Demire and the bank, DZ HYP, declined to comment.

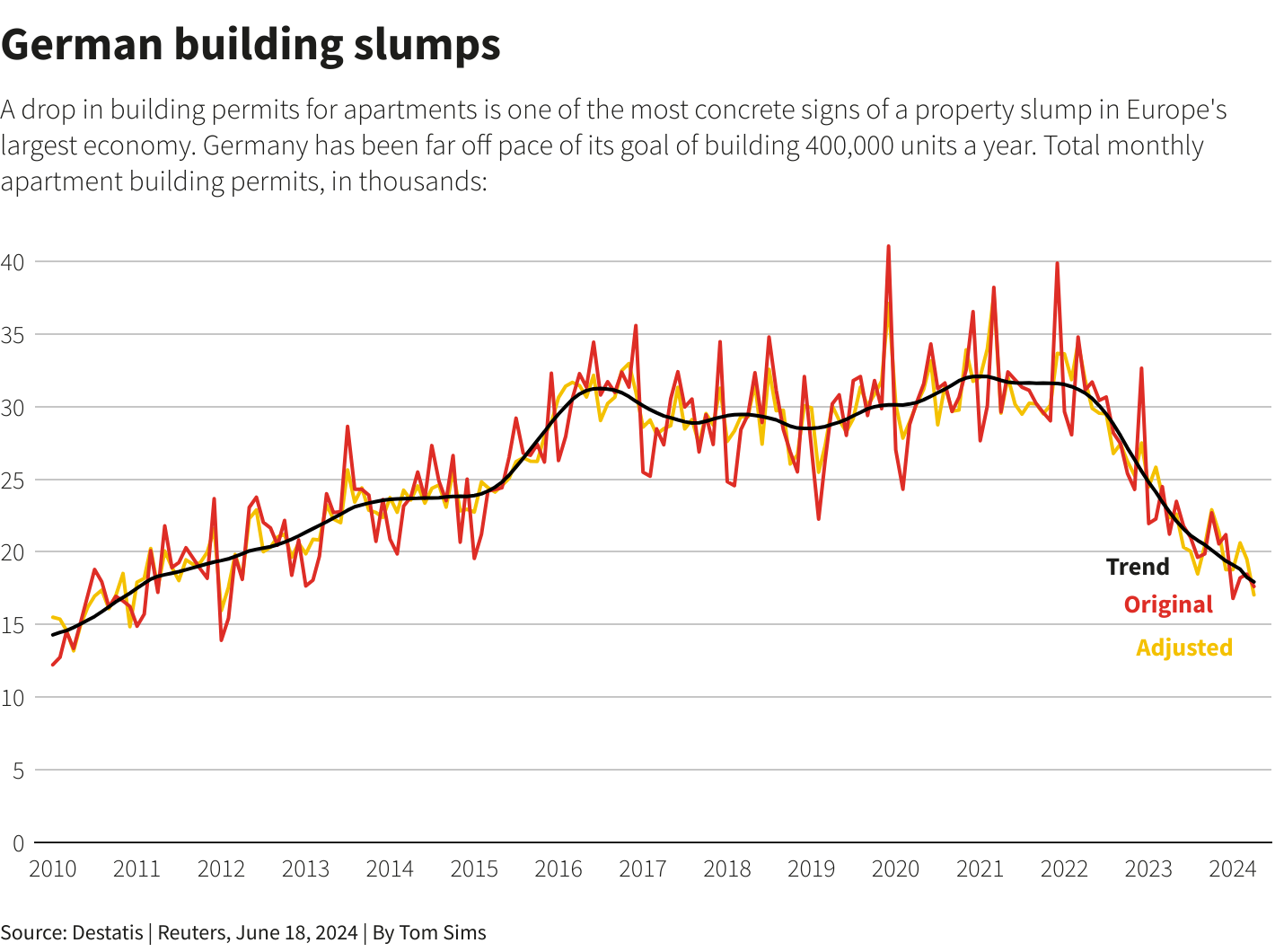

Rents have been climbing steeply as immigrants flock to Germany, foreigners seek work there and house building ground to a virtual halt, squeezing the supply of homes.

Vonovia targets mid- and low-income earners with affordable rents, and Buch said there was fierce competition for flats.

“The market for apartments is going to get worse,” he said.

($1 = 0.9245 euros)

Sign up here.

Additional reporting by Matthias Inverardi; editing by Rachel More and Mark Heinrich

Our Standards: The Thomson Reuters Trust Principles.