Bollywood star Amitabh Bachchan is celebrating his 82nd birthday today. Here’s a look at the Bollywood star’s real estate portfolio.

₹194 crore investment into properties” title=”Amitabh Bachchan topped the list of film stars who prefer investing in residential and commercial real estate with a ₹194 crore investment into properties” />

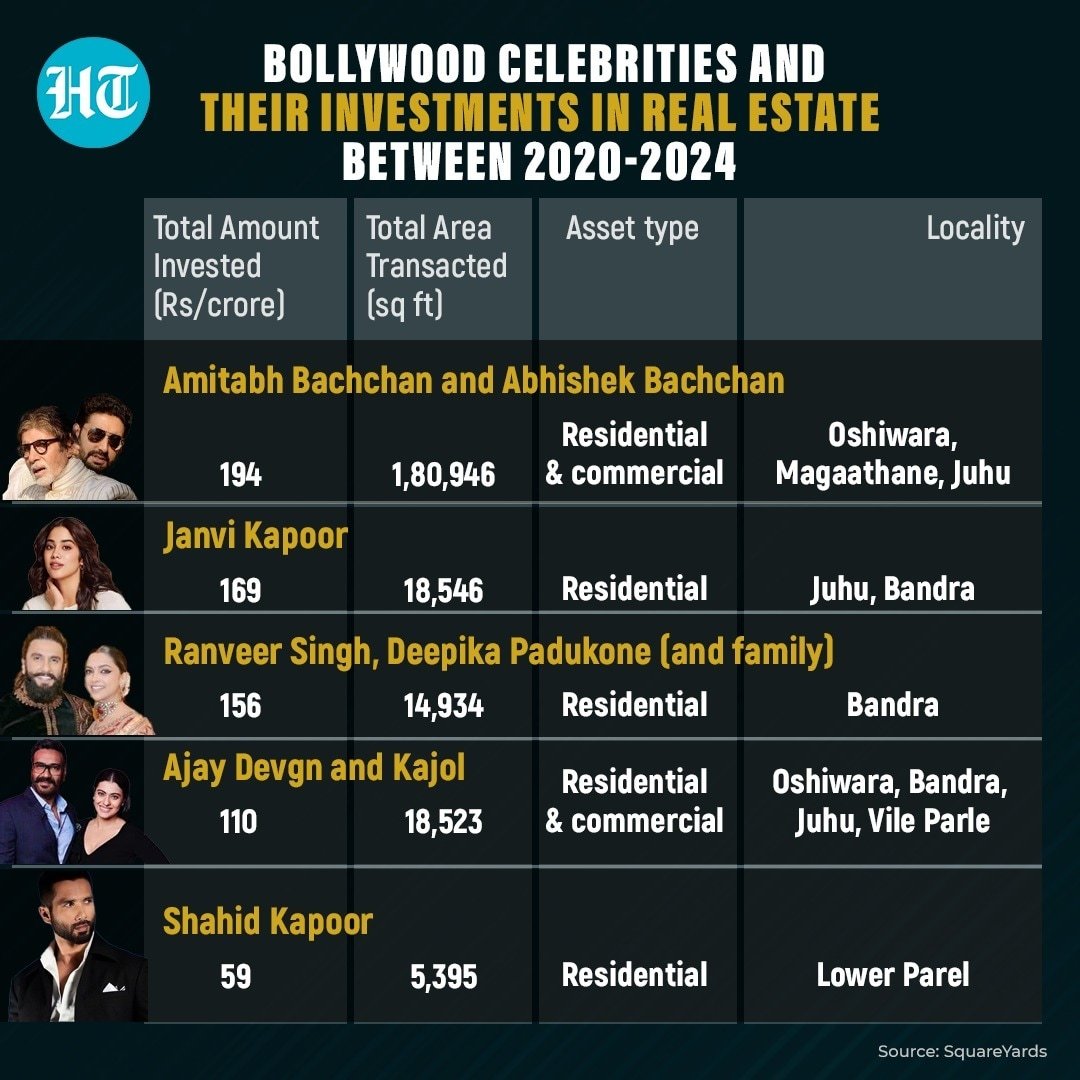

₹194 crore investment into properties” title=”Amitabh Bachchan topped the list of film stars who prefer investing in residential and commercial real estate with a ₹194 crore investment into properties” />Amitabh Bachchan topped the list of film stars who prefer investing in residential and commercial real estate with a ₹194 crore investment into properties. The Bachchan family has invested this amount in residential and commercial real estate assets in Mumbai spread across an area of 1.8 lakh sq ft over the last four years, according to data shared by SquareYards, a real estate consultancy firm.

Other actors who have invested in real estate include Jhanvi Kapoor who has invested ₹169 crore; Ranveer Singh, Deepika Padukone and family who has invested ₹156 crore in real estate; Ajay Devgn and Kajol who have invested ₹110 crore and Shahid Kapoor who has invested ₹59 crore, according to the data compiled by SquareYards.

While celebrities prefer to diversify their portfolios across asset classes, residential properties remain the clear favorite, making up 62% of all transactions. Commercial real estate is also gaining momentum, with celebrities eyeing multiple properties in key micro-markets for reliable rental returns, according to SquareYards.

Big B’s recent real estate investments

The Vettaiyan star has invested over ₹100 crore in properties over the last one year in the financial capital, Alibaug and the temple town of Ayodhya.

The Kalki 2898 AD star had purchased three more commercial properties spanning a carpet area of 8,429 square feet for nearly ₹60 crore in Mumbai’s Andheri West in June, property registration documents accessed by FloorTap.com had showed.

Also Read: Amitabh Bachchan buys three commercial properties in Mumbai for ₹60 crore

Big B had acquired four units spread over 8,396 square feet in the same building last year for nearly ₹29 crore. A stamp duty of ₹1.72 crore was paid on the purchase registered on September 1, 2023. The property deal included three office units in Signature Building on Veera Desai Road of Andheri West, Mumbai. It also included three car parks.

In November 2023, the actor had leased four office units in Lotus Signature building in Oshiwara that he purchased in September this year for ₹28.73 crore, to Warner Music Pvt Ltd for a monthly lease rent of ₹17.30 lakh.

The commercial units on the 21st floor of the 28-storey Lotus Signature office tower on Veera Desai Road in Andheri span across a carpet area of 10,180 sq ft and according to the deal, Warner Music will pay rent at ₹170 per sq ft for the first 36 months, and it will be escalated to ₹195.50 per sq ft in the final 24 months of the five-year agreement signed on November 30, according to the registration documents accessed by Propstack.com.

In September 2023, Bachchan had purchased four units in the Signature building measuring over 8,396 sq ft for ₹29 crore. Other Bollywood stars Sara Ali Khan, Kartik Aaryan and Manoj Bajpayee also own office units in the same building.

Also Read: Amitabh Bachchan purchases two apartments in Mumbai’s Borivali for ₹6.78 crore

Amitabh Bachchan had also purchased two apartments worth ₹6.78 crore in Oberoi Sky City project of Oberoi Realty in Borivali area of Mumbai on the same floor where his son Abhishek Bachchan had bought six apartments for ₹15.42 crore, according to documents accessed by Zapkey.com. Big B had registered six apartments measuring 4,894 sq ft of RERA carpet for ₹15.42 crore on May 28, 2024.

Big B had also purchased a plot in The Sarayu ‘, a plotted development project being constructed by The House of Abhinandan Lodha (HoABL), a Mumbai-based real estate developer, in Ayodhya near the Ram Temple last year.

In April this year, the Kaun Banega Crorepati host, had bought a 10,000 sq ft land parcel in Alibaug, near Mumbai, in Maharashtra, for ₹10 crore from The House of Abhinandan Lodha (HoABL).

Earlier, on May 28, 2024, his son Abhishek Bachchan had also registered six apartments in Oberoi Realty’s Oberoi Sky City project in Borivali west area of Mumbai. The six apartments totalling 4,894 sq ft of RERA carpet were bought for ₹15.42 crore.

Bollywood stars, high net worth individuals, investors, industrialists generally prefer investing in Grade A properties. Commercial office spaces are a favorite as they give better returns compared to residential projects, according to real estate consultants.

Most of them prefer to invest in established markets where capital appreciation is expected to be healthy and there is fixed income assured from rent. In terms of land investment, be it any investor, the focus is on capital appreciation, they said.