Property is usually considered a safe, long-term investment, but with the era of ultra-low interest rates well and truly over, is it still a good option?

Exclusive analysis provided to Money shows that in the past 15 years, property owners in certain parts of the country have reaped much bigger rewards than others – and these winners have changed a lot since 2010.

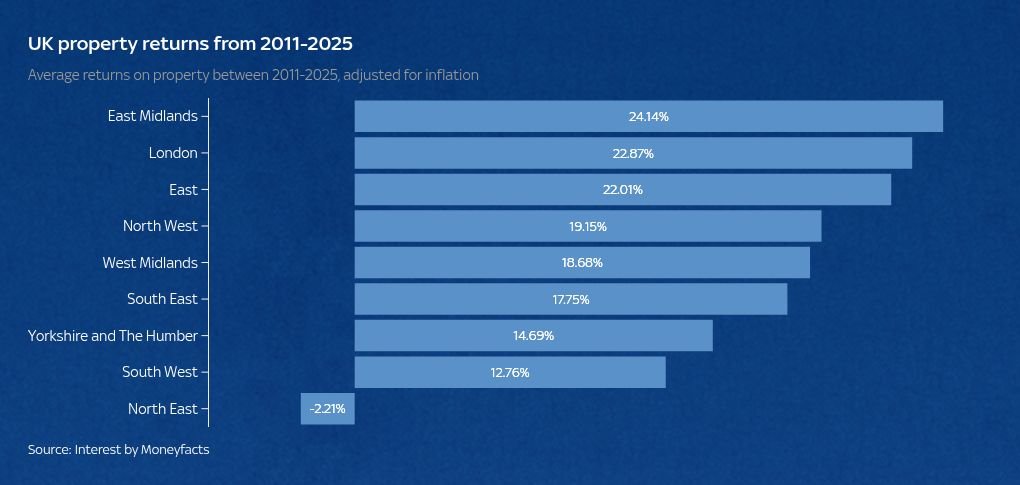

Overall, homeowners in the East Midlands have made the most money, with average returns of more than 24% from 2011 to 2025 when adjusted for inflation, according to analysis of HM Land Registry and inflation data by Interest from Moneyfacts.

Follow the latest consumer news here

London has been another big long-term winner, with returns of almost 23% during the same period.

Property owners in the North East have experienced the worst outcome, with an average loss of 2.21%.

But a breakdown of the past 15 years reveals a different picture – let’s take a closer look…

The 2010s were defined by low borrowing costs as the country tried to boost spending to recover from the 2008 financial crisis.

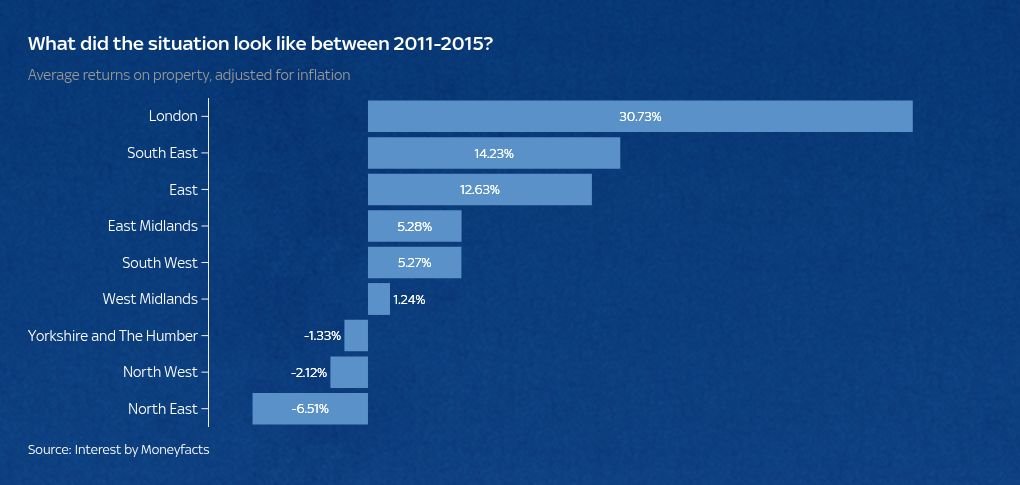

Between 2011 and 2015, the state of play – investment winners in the South and losers in the North – was fairly similar.

Property owners in London saw a huge return on their bricks and mortar investment, making an average of 30.73% when adjusted for inflation.

During the same period, homeowners in the North East lost money, at an average rate of 6.51%.

Those in the North West, and Yorkshire and the Humber, also failed to make money, with losses of 2.12% and 1.33%.

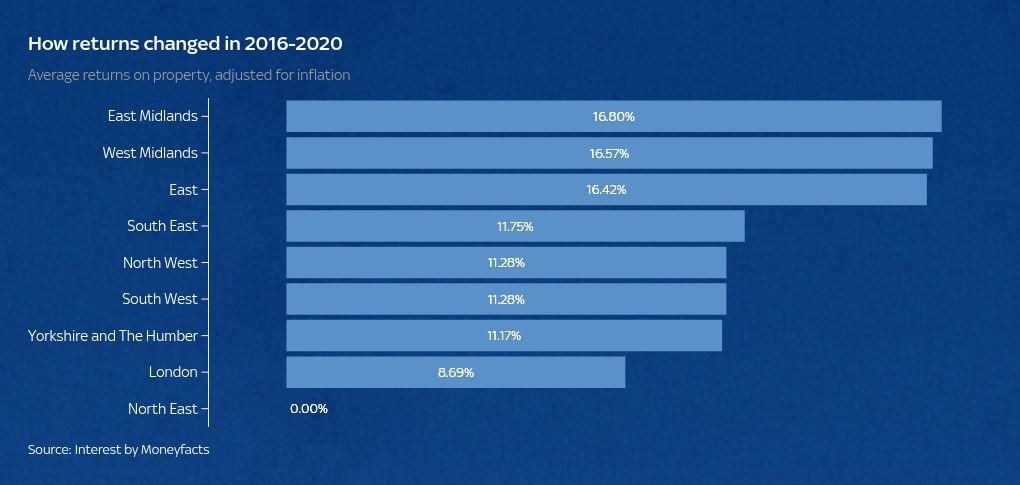

But as the second half of the decade rolled around, the picture started to change.

Salaries grew rapidly, mortgage rates sat well below 4% and the Bank of England’s interest rate hovered around 0.5%.

Buyers around the country were able to borrow more, and the property market continued to boom, but the areas seeing the greatest returns started to shift.

The previous winners in London saw their returns fall to just shy of 9%, losing the top spot to property owners in the East Midlands, who saw theirs grow to 16.8%.

In the North East, they broke even, and in the North West returns jumped to 11.2%.

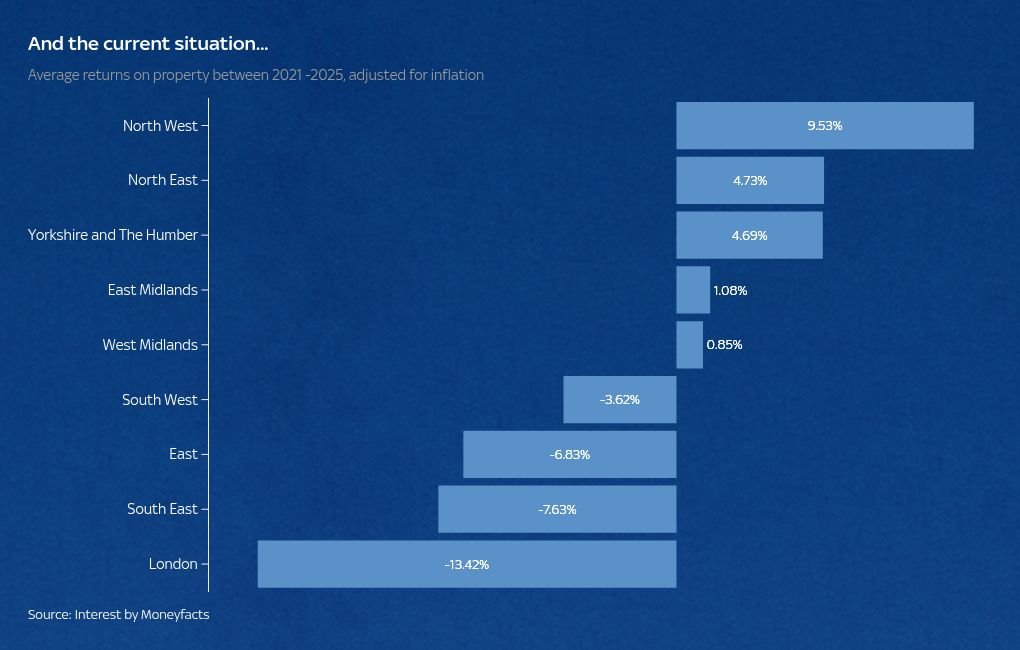

As the economy continued its recovery and interest rates climbed sharply as we entered the 2020s, property prices started to flatline, and returns dropped dramatically.

By 2021-2025, Londoners, who were seeing their price-to-income ratios most stretched, were losing money at an average rate of 13.42%.

It was similar in the East, South East and South West, which saw losses of 6.83%, 7.63% and 3.62%, respectively.

In the North East, where house prices were lower and affordability was stronger, returns continued to grow, hitting an average of 4.73%.

Property owners across the rest of the country continued to make money, but saw their returns drop.

Are we now seeing a property market correction?

Looking at the data, Adam French, head of news at Moneyfacts, said the policy of ultra-low interest rates helped to inflate house prices and reshape the property market in a way that made long-term affordability tougher for many.

The 2010s created an environment that allowed property prices to run ahead of inflation, entrenching a generational divide between those who bought early and those who were left chasing ever-rising deposits, he explained.

Read more from Money:

‘This was final straw with Asda…’

‘My husband died before getting state pension. Am I entitled to any of it?’

‘BA lost our luggage on dream US road trip’

“Our analysis reveals that areas which benefited most from those artificially cheap borrowing conditions, such as London and the South East, have felt the biggest real-terms reversals since rates have risen,” he added.

“When mortgage rates normalised and the Base Rate rose above 4%, the housing market lost the tailwind that had supported a decade of rapid price inflation.

“The good news is that, instead of a collapse, the correction we’re seeing now may simply be the market rebalancing after an unusually distorted time.”

What does all of this mean for you?

More affordable areas such as the North West, Wales and Northern Ireland have continued to deliver positive real returns even in a higher-rate environment.

French explained that these areas took longer to bounce back after the financial crash and were less inflated by the low-rate decade, and were proving more resilient as the market adjusts.

“Overall, this is likely to come as welcome news for many first-time buyers saving for a deposit, as house prices are now being shaped by income and affordability rather than cheap credit,” he said.

“For sellers, particularly in the South, it shows the need for more realistic pricing.

“However, a shift towards greater sustainability in the market may ultimately help prevent a more painful crash.”