Property investors have been served up a cheat sheet of where to put their money in Adelaide’s housing market.

Finder’s latest Property Investment Index has named the cities riskiest and most opportune suburbs for homebuyers at a time when significant price growth and a severely undersupplied rental market boost returns.

The data found Wayville, Bowden and Tusmore are among the safest markets to invest in for house price growth, followed by Payneham, Unley Park, Hazelwood Park, Glenelg North, West Lakes, Two Wells and Plympton Park.

On the flip side, Elizabeth Grove, Elizabeth and Athol Park were flagged as areas to avoid for house hunters, along with Roseworthy, Christie Down, Seaford Rise, Seaford, Cowandilla, Evanston Park and One Tree Hill.

MORE NEWS

The bounding SA hotspots delivering high price growth and rental yields

30-year investment has seller laughing all the way to the bank

‘He smashed it in’: Buyers in shock after agent demolishes front door

The index modelled recent sales patterns, income changes, building approvals, buyer demand and more to reveal future growth stars, scoring each suburb out of 100.

Finder head of consumer research Graham Cooke said the data, which looked at close to 500 suburbs and towns across SA, found investors were beginning to take on more of the market from owner occupiers.

“In January 2021, investor loans made up 24 per cent of all home loans, but that figure has now grown to 37 per cent,” he said.

“So this whole project is designed to give investors an extra tool to help them with where to look in the market … a market that is constantly shifting and changing.”

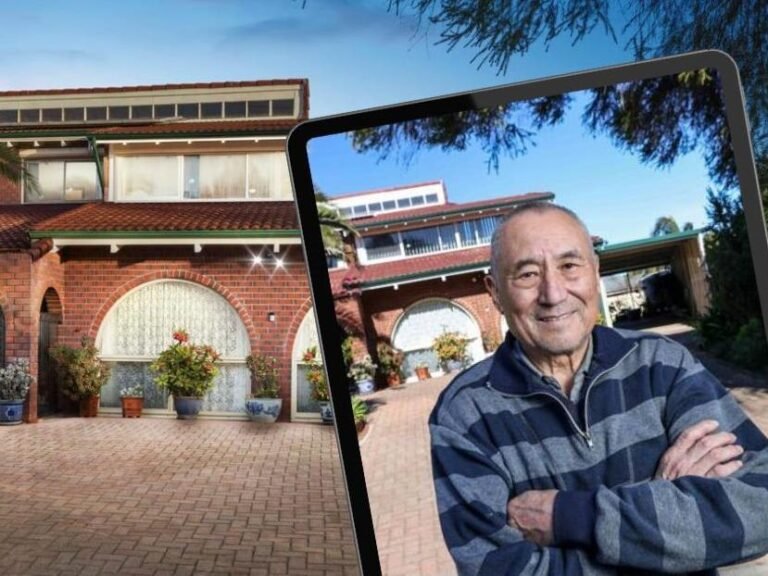

Property owner Xing Zhao in front of his West Lakes home which recently sold for $1.18m to a local family. Image/Russell Millard Photography

Selling agent Tristian Kennedy of Ray White Grange, who recently sold 2 Gretel Grove, West Lakes for $1.18m, said he was unsurprised to see popular western suburb named as one of Adelaide’s top 10 star performers.

According to PropTrack, West Lakes house prices jumped by 35.7 per cent over the past year to a median of $1,177,500.

“It’s such a unique suburb in terms of locality. You’re only 20 minutes from the city. You’re minutes from a world-class shoreline but then there’s also the uniqueness of the lake, there’s nothing like it anywhere in SA,” he said.

“I wouldn’t necessarily say West Lakes is a hidden gem – it’s always been popular – but I would say that people are realising opportunities here more and more.

“More homes are getting knocked over and replaced with new, modern ones, so the streetscape is changing and I predict we’ll see more traction with buyers moving forward.”

Daniel Seach of Ray White Black Forest, who sold a number of homes in Wayville in recent months, said Adelaide’s inner-south had experienced exponential growth, with demand fuelled by both first home buyers and foreign investors.

“I’m not surprised to see Wayville named as the top investor hotspot. The fact that it’s tightly held would be a contributing factor but also, it’s such a vibrant community and close to the southern parklands and you can walk to China town,” he said.

“We recently sold a home at 1/22 Davenport Tce and with that one, we had 17 offers after the first weekend of opening.

“We ended up selling it for $540,000 – $50,000 above the vendor’s price expectation.

“The majority of interest came from local buyers, there were a lot of first home buyers looking to get into the market, but also investors as the property came with great rental yields.”