By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI Founder

Some people do not invest in real estate primarily for the long-term total returns that will help build their nest egg in retirement. Some people actually want to boost their income now and plan to spend that income during their “accumulation years.” However, given their other income, it is important to them that the income be taxed as minimally as possible. Luckily, there are several investments that allow for this. In this post, I’ll be going over some of the sources of our 2022 investment income to evaluate them for tax efficiency.

Stocks and Bonds

The largest part of our portfolio is in our trust taxable account at Vanguard. For tax purposes, all of the information on this comes from our consolidated 1099 from Vanguard. Of the dividends we received in 2022, 85% of them were qualified. In our case, that means we pay only 28.8% in tax on those dividends instead of 45.8%. That saves us 17%—or about 37% of the tax bill that we would have paid. Some of the remaining 15% of non-qualified dividends (about 22%) also qualify as 199A dividends, lowering the tax bill on that income by 20%. We also had another $19,000 in federal tax-free municipal bond and money market fund interest. We still have to pay our 5% state tax on that interest, but that lowers our tax bill on that income by 88%.

In addition to income, one can also have capital gains. 2022 was not a great year for stocks and we rarely realize capital gains anyway, but we tax-loss harvested seven figures of losses. We used those to offset capital gains (including some from real estate investments), but we also took $3,000 against our ordinary income.

Debt Funds

We own several debt funds. These are incredibly tax-inefficient investments. Basically, the entire return from these investments is paid out every year as ordinary taxable income. So, we try to place them in retirement accounts as much as possible. We’ve now got two of the three funds we own in retirement accounts, but that wasn’t the case for 2022. Here’s an example K-1 from a debt fund from 2022.

As you can see, all of the income is basically an ordinary dividend, fully taxable at my ordinary marginal tax rate (45.8% in our case). However, if you scroll all the way down to line 20 under code Z, you’ll also see this fund is structured as a REIT. Thus, it qualifies for the 199A tax deduction. The tax rate I’m really paying on this income is 38.4%.

More information here:

Comparing Private Real Estate Lending Funds

How the IRS Treats You as a Real Estate Investor

Equity Investments

We are also limited partners in several equity funds and syndications. Fortunately, the income from these is generally dramatically more tax-efficient than the income from those debt funds, rivaling and often exceeding that of the index funds in the taxable account. Each of these partnerships is different in what it actually owns and how tax-efficient the investment is. We’ll give a few examples.

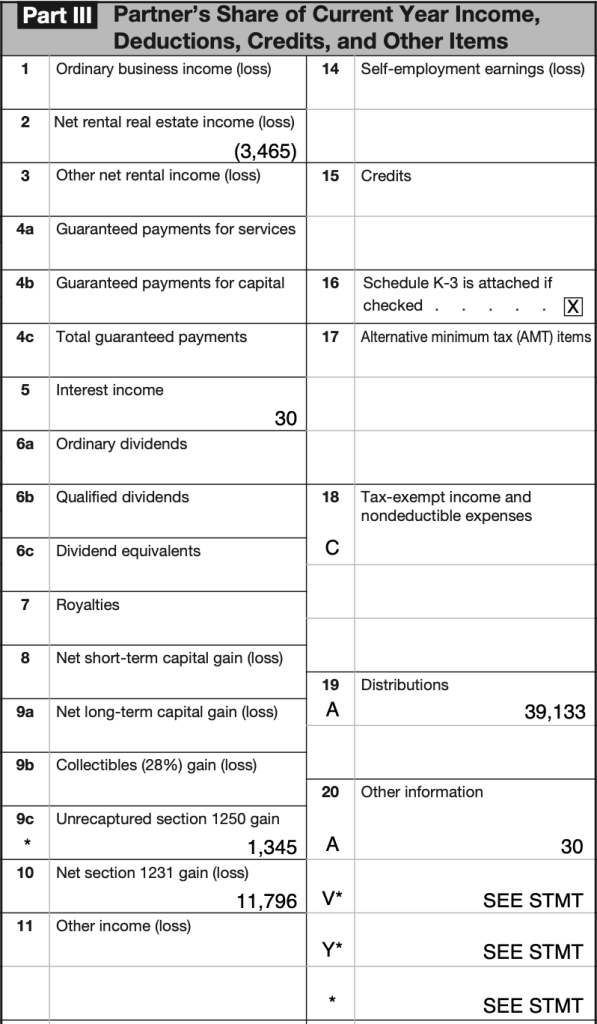

Our first one is from MLG Fund IV. This is kind of a classic closed equity fund. I’m in the “middle years” with this fund after all of the capital calls have been made but before the distributions as properties are sold really begin.

The fund sent me plenty of money ($39,133) in 2022, as you can see in line 19. But how much of it was actually taxable? There was no ordinary business income. The real estate income was minus-$3,465 thanks to depreciation. There was $30 in interest but no dividends and no capital gains. There was a 1250 gain and a substantial 1231 gain. Think of 1231 gains as long-term capital gains for real estate with a wrinkle. If 1231 gains exceed losses, they’re treated as capital gains. However, that’s not the case if losses exceed gains. I think all those capital losses from our trust taxable account will wipe out those gains. At any rate, $13,171/$39,133 = 34% of the income was taxable in some manner.

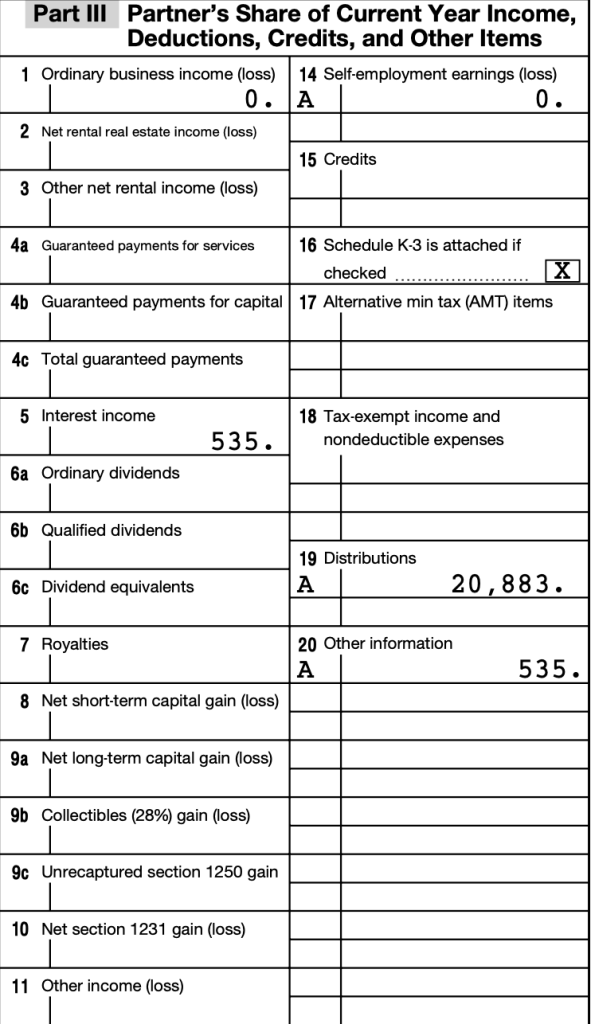

Our next example is the DLP Housing Fund. This is an evergreen fund that has always done a very nice job of maintaining tax efficiency.

I had $20,883 of income, but only $535 (3%) was taxable. While there weren’t a bunch of losses passed through from depreciation, there were apparently enough to zero out all of the real estate and business income.

Our next example is a simple syndication through 37th Parallel. It’s been underperforming pro forma so far, but it still has many years to run.

I received $2,426 in distributions, but only $12 (0.5%) was taxable. I also received a $5,000 depreciation loss that could be used elsewhere.

Finally, let’s look at the Origin Income Plus fund:

This is a little different than a more standard straight equity fund. This multi-strategy fund has had increasing amounts of preferred equity in it (now 55% of the fund) over the last few years, but there are also some core equity real estate and some ground-up development projects. Due to the special way Origin structures the preferred equity portion of the fund, it still manages to be very tax-efficient despite more than half of the fund essentially being a debt fund. Of $7,085 of income, only $1,464 (21%) is taxable, and given the capital losses I have saved up, I’m only paying tax on $332 (5%) of income.

More information here:

A Tale of 2 Sponsors: How My Real Estate Investments Have Had Vastly Different Results

The 60+ Worst Mistakes You Can Make in Real Estate Investing

Tax-Efficient Income

There are some lessons you can take from this post and its examples. The first is that unwanted income is usually bad from a tax perspective. If you don’t want to spend income, it’s better just to not get it. You’d rather just have the business reinvest those earnings so it can keep growing.

However, if you actually want the income, you can maximize how much you get by investing on the debt side. As a percentage of my investment, I get far more income from debt investments than equity investments.

If your goal is tax-efficient income, however, you’re going to do much better with equity real estate. Add up those four equity investments above. There was a total amount invested there of about $750,000 originally (somewhat more now due to appreciation and the reinvestment of income where possible). In 2022, it provided about $70,000 in income, but I am really only paying taxes on less than $1,000 of it. If you’ve ever paid 30%, 40%, 50%, or more as a marginal tax rate, you know how good it feels to not pay any significant tax on real income that you can go out and spend on whatever you like.

If you’re interested in learning more about some of our real estate partners, you can click on their links in the chart below:

Featured Real Estate Partners

DLP Capital

Type of Offering:

Fund

Primary Focus:

Multi-Family

Minimum Investment:

$100,000

Year Founded:

2008

CrowdStreet

Type of Offering:

Platform / REIT

Primary Focus:

Commercial

Minimum Investment:

$25,000

Year Founded:

Origin Investments

Type of Offering:

Fund

Primary Focus:

Multi-Family

Minimum Investment:

$50,000

Year Founded:

2007

37th Parallel

Type of Offering:

Fund / Syndication

Primary Focus:

Multi-Family

Minimum Investment:

$100,000

Year Founded:

2008

Southern Impression Homes

Type of Offering:

Turnkey

Primary Focus:

Single Family

Minimum Investment:

$60,000

Year Founded:

2017

Wellings Capital

Type of Offering:

Fund

Primary Focus:

Self-Storage / Mobile Homes

Minimum Investment:

$50,000

Year Founded:

2014

MLG Capital

Type of Offering:

Fund

Primary Focus:

Multi-Family

Minimum Investment:

$50,000

Year Founded:

1987

Mortar Group

Type of Offering:

Syndication

Primary Focus:

Multi-Family

Minimum Investment:

$50,000

Year Founded:

2001

* Please consider this an introduction to these companies and not a recommendation. You should do your own due diligence on any investment before investing. Most of these opportunities require accredited investor status.

What do you think? How important is tax-advantaged income to you? What consideration do you give to the tax efficiency of the income when you buy an investment? Comment below!