This article first appeared in Wealth, The Edge Malaysia Weekly on July 22, 2024 – July 28, 2024

Junaid Wahedna, founder and chairman of financial technology (fintech) start-up Wahed, wants to help the man in the street invest in properties globally at a fraction of the price with a few taps on the smartphone.

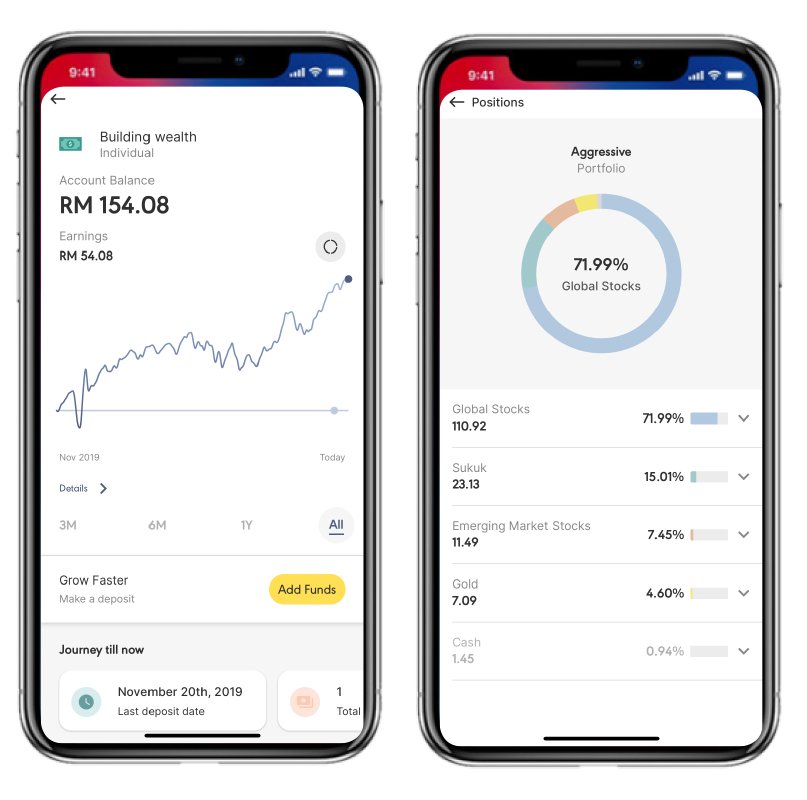

Wahed runs a halal robo-advisory platform in Malaysia, known as Wahed Invest, with the licence provided by the Securities Commission Malaysia (SC). It commenced operations in 2019.

Recently, the firm successfully applied for a licence for an equity crowdfunding (ECF) platform. The entity is called Wahed X Sdn Bhd, according to the SC’s official website.

Junaid tells Wealth in an interview that Wahed has set up offices globally, including in New York, London, Riyad, Mumbai and Jakarta. Its proposition of enabling people to invest in properties in smaller amounts had debuted in the UK this year.

How does it work? Junaid explains that Wahed raises funds from investors to purchase properties through auctions. It then rents out the properties for income, which is distributed to the investors. The firm also provides full management services to its users, overseeing the entire process from tenant acquisition to property management.

The returns? After deducting fees and charges, the net yield its UK investors have received is about 5%, according to Junaid. They would enjoy higher returns if the price of the properties were to go up and they were sold.

Junaid reveals that a special purpose vehicle (SPV) is set up to house each of its property investments, in which investors will hold shares.

As at May, Wahed had three properties in the UK and the response to them has been encouraging, says Junaid, adding that the first property launched on its online platform — accessible via the Wahed mobile application (app) — was fully subscribed 25 minutes after its launch.

“Everyone likes property exposure but, today, if you want to buy a property, you would have to buy the whole thing. You have to deal with the broker and the tax. It’s a nightmare.

“So, for someone with only RM10,000 [for example], what do they do? They can invest in private property through our app. We manage everything, with the rent coming straight to you via the app. When we sell the property, you get a share of the capital. Imagine doing this on a global level. You can invest in private properties in London, the US or Dubai, among others, all on your app,” he says.

Similar to other ECF platforms, the low hanging fruit for Wahed X is to raise funds for smaller businesses for their business expansion.

Share-ownership model in the works

A share-ownership model for home financing is in the works, whereby Wahed would co-own a property with first-time homebuyers. Doing so would facilitate homeownership without incurring debt for the people, says Junaid.

How it works is that Wahed would create an SPV to invest in a house with a homebuyer, who would make a down payment. Wahed would cover the remaining amount.

For instance, if Mr A buys a house and is only able to make a down payment of 10% of the current value of the house, Wahed would cover the 90%. Whenever Mr A comes into money, he can purchase more shares of the house.

Mr A can also pay a fixed amount of money every month to purchase shares of the house, akin to paying monthly rent, and stop doing so temporarily when he doesn’t have surplus cash.

There is no pressure on Mr A to pay off the remainder of the 90%, unlike a mortgage. However, if the price of the house goes up (its value is re-evaluated every year), it would be more expensive for Mr A to purchase it and Wahed would earn a profit, says Junaid.

Further down the line, Wahed plans to explore providing personal financing solutions to consumers through digital gold, instead of fiat currency that comes with tenure and interests, according to Junaid.

“In conventional terms, we give you a ‘gold loan’ of, let’s say, 10 grams. You pay back that 10 grams whenever you want. To us, it doesn’t matter what the price of the fiat currency is. We lend you 10 grams. You give us back 10 grams.

“If the US dollar weakens against the ringgit, you pay back less (as gold is denominated in US dollars). If it strengthens, you have to pay back more, as the value of the asset has increased.

“For us, we are just [moving] away from a system that is built on the foundation of money lending,” says Junaid.

What about defaults? “There’s always going to be a small percentage of people who can’t afford to pay back. And they might go bankrupt. So, that’s where the idea of wakaf (charitable endowment) or digital wakaf comes in.

“[As Muslims,] we are allowed to give charity, even like zakat, to help people get out of debt, right? So, that tiny default, which, let’s say, in the western world is about 3% for banks, or something around that range, we can easily cover that with wakaf. If someone’s poor and goes bankrupt, charities are supposed to kick in and provide them with stability,” he explains.

In the future, Wahed’s suite of products could include transactional banking through the application of an e-money licence from the central bank, says Junaid.

However, he says Wahed will not venture into the business of stockbroking. “Why? Because we know that 80% of retail investors who trade [the market] lose money. So, it’s our ethical duty not to push that and that’s why we would never venture into the brokerage business.”

Getting rid of riba or interest

The main reason behind Wahed’s plan to launch these products is to gradually eliminate interest or charges for borrowing money in the financial products it offers, which appeals to some Muslims investors.

Junaid acknowledges that the path he and Wahed are pursuing is deemed “radical” to some quarters, but it is his vision for the start-up.

At the time of writing, the investment portfolio Wahed offers through its robo-advisory platform had invested in local sukuk, which are bond-like instruments.

Wahed’s aggressive portfolio invested 14.72% of investors’ money in the Maybank Malaysia Sukuk Fund as at July 1. The portfolio has provided investors with a cumulative return of 57.9% since Nov 23, 2019, not long after it was officially launched locally.

Commenting on this, Junaid says Wahed is gradually phasing out sukuk and debt instruments from its global investment portfolio. “Yes, there are sukuk in our portfolio, which are the Islamic equivalent of conventional bonds. We are slowly phasing those out.”

Junaid adds that the start-up, which was worth US$300 million at the time of writing, only issues common shares to investors and has no preference shareholders.

“VCs (venture capitalists) wanted to invest. And we told them you can only do common stocks. You can imagine how hard that conversation was. But we did not budge,” he says.

On a personal level, Junaid says he keeps a minimum amount of money in a current account for his necessary short-term expenses, with the rest invested in various asset classes without the element of debt and loans.

“[I try to keep as little as possible in the current account] because even if the money is in the current account, it’s still being used for loans, right? Only that you might not see the interest [coming in to you],” he says.

Junaid is regarded as the face of the company but it is not something he needs to be. “I’m not the brand of the company, nor do I want to be. If our products are genuine and there’s substance, I don’t think it matters who I am or what I’m saying at all. The proof of the pudding is in the eating, and we’ve shown that and we’ll continue to show that.”

Now, he wants to focus on his role as chairman, where he is able to innovate and explore new ventures. This is compared to his previous day-to-day responsibilities as a CEO.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple’s App Store and Android’s Google Play.