For today’s celebrities, many of whom have become High Networth Individuals (HNIs), real estate has become more than just a status symbol. It has become one of their strategic investment tools.

The economic liberalisation of the 1990s has opened up vast opportunities for Indian celebrities, ranging from films, brand endorsements, a growing number of multiplexes, rising international appeal, global tours, social media exposure to OTT platforms, adding tremendously to their income, according to analysts.

As their earnings soared over the past few decades, many of them entered the league of HNIs and Ultra High Net-Worth Individuals (UHNIs) with a growing interest in wealth-building through diversified income streams beyond just acting and investments in assets, including real estate, they added.

For example, celebrities such as Shah Rukh Khan entered the Hurun India Rich List 2024 and joined other names such as Juhi Chawla, Hrithik Roshan, Amitabh Bachchan (right) and Karan Johar.

Shah Rukh Khan

| Photo Credit:

AP

Thus, the portfolios of the celebrities today include everything from luxury residences and holiday homes to commercial offices and land, driven by a mix of personal lifestyle choices as well as long-term financial planning. Today, they are seen actively buying, selling, renting or leasing out these properties.

Prime reason

Recent trends show that many celebrities are selling their luxury apartments in Mumbai and elsewhere, making people curious about their moves. What are the key reasons for selling?

While there is no single reason behind these decisions, tax implications and planning seems to be the prime reason behind investment in real estate. In the Union Budget 2024, the government introduced a flat 12.5% tax on long-term capital gains (LTCG) from property sales, but without the benefit of indexation. This means there’s no inflation adjustment on the purchase price, so properties bought years ago could now attract significantly higher taxable gains.

In a major relief, the government had allowed a grandfathering rule for assets bought before 23 July, 2024. These can still be taxed at either 20% with indexation or 12.5% without, whichever one chooses. “To lock in these benefits and for certainty, many HNWIs and UHNIs are choosing to sell properties. Additionally, reinvesting the gains into another residential property can offer tax exemptions with a cap of up to ₹10 crore. Anything over and above will be taxed as per LTCG,” says Renuka Kulkarni, Head of Research, Square Yards. (Gains from properties sold within two years are taxed as short-term capital gains at the individual’s income tax slab rate.)

Capitalising on market gains is another reason behind the sale of properties. Since the pandemic triggered a strong revival in the residential real estate market, especially in the luxury segment, due to lifestyle changes, low interest rates, and increased disposable income, property prices as per Square Yards data increased sharply by up to 60% in Mumbai MMR, Delhi NCR, Pune, Hyderabad, and Bengaluru. High-net-worth individuals, including celebrities, actively participated in this upcycle.

Tax implications and planning seems to be the prime reason behind investment in real estate (Mumbai high-rise for representational purpose)

| Photo Credit:

Getty Images/iStockphoto

Insights from Square Yards, which collects and aggregates diverse real estate data, reveal that 63% of real estate transactions done by celebrities post-2020 were residential, 33% commercial, and the rest across other asset classes.

“However, post this boom in residential segment, the market is now normalising, and the price growth moderating from its post-pandemic highs. Celebrities — like many HNWIs — are re-evaluating their holdings and are choosing to sell to cash in on the strong returns on these high-value properties, purchased at much lower rates in preceding years,” Kulkarni says.

High-yielding investments

Another factor is to have increased liquidity to explore high-yielding investments and for the purpose of relocation. “Portfolio rebalancing and upgrading is the norm. Proceeds from sales are often deployed into newer, better-located properties, commercial real estate, or even global assets. Some celebrities are also selling older real estate holdings to upgrade lifestyle, buy bigger or better-located homes, or shift investment focus,” Kulkarni shares.

With recent geopolitical uncertainties and bearish trends in the stock market, many individuals are selling real estate to book profits and offset their capital losses in equities. “By setting off gains from real estate against losses in their stock market portfolios, they can reduce their overall tax liability. This strategy supports effective tax planning by balancing gains and losses across asset classes, and carries forward unused losses to reduce tax liabilities in the next years,” Kulkarni adds.

Notable celebrity sale transactions in 2025

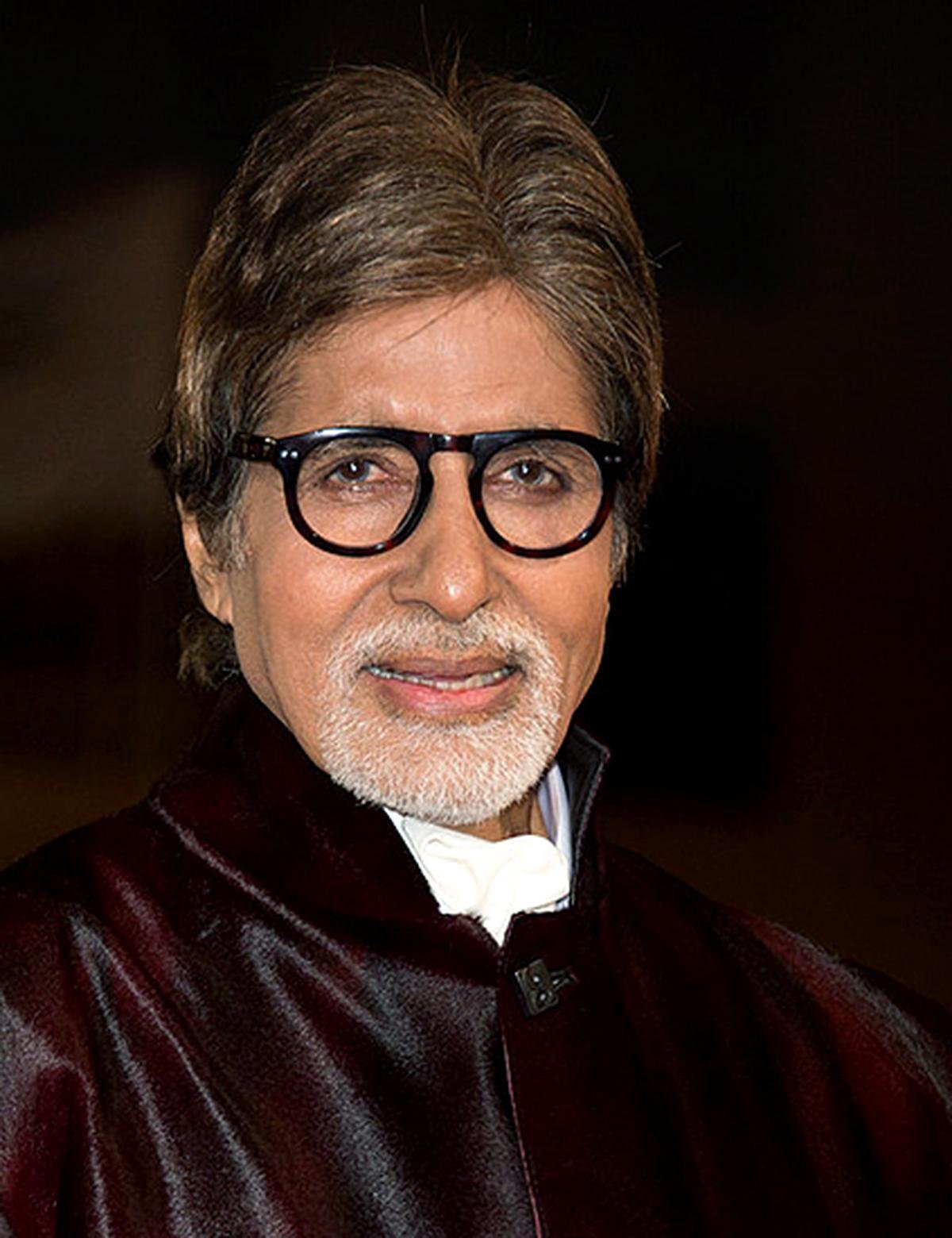

Amitabh Bachchan

Name of project and locality: The Atlantis, Andheri

Type of property: residential

Purchase value and date: ₹31 crore (April 2021)

Selling value and date: ₹83 crore (January 2025)

Appreciation: 168%

Amitabh Bachchan

| Photo Credit:

Getty Images

Sonakshi Sinha

Name of project and locality: 81 Aureate, Bandra West

Type of property: residential

Purchase value and date: ₹14 crore (March 2020)

Selling value and date: ₹22.50 crore (January 2025)

Appreciation: 61%

Akshay Kumar

Name of project and locality: Oberoi Sky City, Borivali East

Type of property: residential

Purchase value and date: ₹2.37 crore (November 2017)

Selling value and date: ₹4.35 crore (March 2025)

Appreciation: 84%

(Also, sold another unit in the same building for ₹4.25 crore, which was bought in 2017)

Anu Malik & Anju Malik (two flats)

Name of project and locality: Khushi Belmondo, Santacruz West

Type of property: residential

Purchase value and date: NA

Selling value and date: ₹14.49 crore (February 2025) combined value

Appreciation: NA

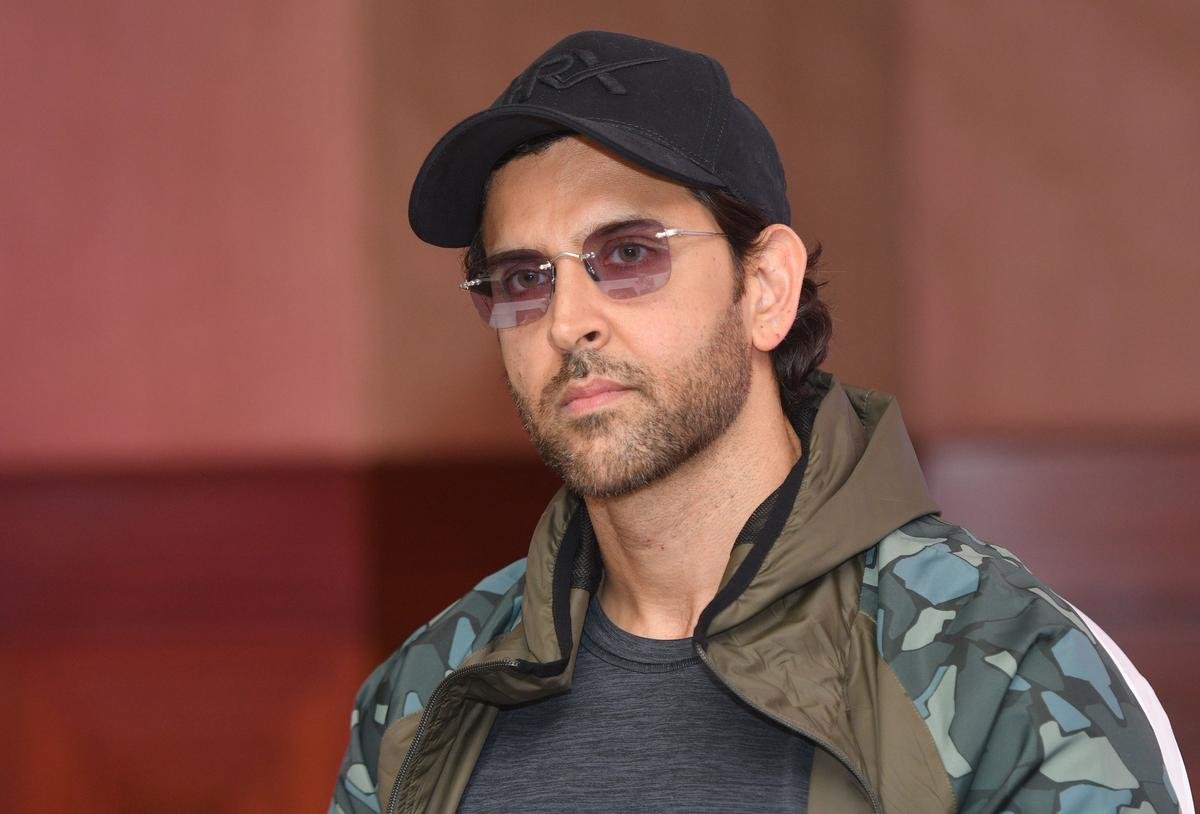

Hrithik Roshan

Name of project and locality: Raheja Classique, Andheri West

Type of property: residential

Purchase value and date: NA

Selling value and date: ₹80 lakh (May 2025)

Appreciation: NA

Hrithik Roshan

| Photo Credit:

Nagara Gopal

Rakesh Roshan (transaction 1)

Name of project and locality: Raheja Classique, Andheri West

Type of property: residential

Purchase value and date: NA

Selling value and date: ₹2.20 crore (May 2025)

Appreciation: NA

Rakesh Roshan (transaction 2)

Name of project and locality: Veejays Niwas CHS, Andheri West

Type of property: residential

Purchase value and date: NA

Selling value and date: ₹3.75 crore (May 2025)

Appreciation: NA

Source: IGR, Square Yards

According to analysts, many celebrities, such as Amitabh Bachchan, are now investing in land in Alibaug and elsewhere. Abhinandan Lodha, Chairman, The House of Abhinandan Lodha, says,“For many celebrities, investing in land is a rewarding way to diversify their wealth beyond their main profession. Land in India, for centuries, has always been stable asset with very little volatility compared to the other asset classes. It also offers the flexibility of personal use — such as building a private retreat or holiday home — while holding emotional value as a legacy, allowing them to leave something meaningful for generations to follow.”

In recent years, the rise of branded, gated community-style land developments has added credibility and structure to what was once considered a complex and opaque process of investing in land. Lodha states that due to the strong emphasis on quality, security of the property, convenience, and transparency at his company, many celebrities, including top Bollywood stars, musicians, and people in sports, are finding value.

“People all around the world are now buying land through a completely hassle-free virtual experience [i.e. purchasing land without any physical interaction], which is a first in India and probably even globally,” he says. “Due to all these factors, celebrities are viewing land not just as a wealth creator but as a lifestyle choice — one that aligns with their personal aspirations while strengthening their investment portfolio. It’s a tangible, long-term play with both emotional and economic returns,” he concludes.