Updated Aug 16, 2024 23:02 IST

Not Rs 20,000 crore, India’s net monthly SIP inflow is Rs 10,000 crore – Here’s how

Indian investors have been vehemently displaying their commitment to long-term wealth creation over the decades gone by. The phenomenon has been reflecting in the monthly inflows of Systematic Investment Plans (SIPs), which have crossed a whopping Rs 20,000 crore mark over the past few months. But is this number a true reflection of the market impact of SIPs?

According to Nikunj Dalmia, Managing Editor, ET NOW and ET NOW SWADESH, the net monthly SIP inflow in the Indian markets is 50 per cent of Rs 20,000 crore, thanks to the net outflow and SIP stoppage numbers.

Not Rs 20,000 crore, India’s SIP inflow is Rs 10,000 crore – here’s how

“One of the most psychological hurrahs or the psychological factors at play is that every month, we get net SIP inflow of Rs 20,000 crore. So (it is considered that) Rs 20,000 crore is given and granted every month. That is not the story. The story is still very impressive. But the numbers are different. Which is that instead of Rs 20,000 crore, it is at Rs 10,000 crore. That is little over a billion dollars, but certainly not 2-2.5 billion dollars, which looks like an optical number,” Dalmia said.

Will SIP inflows balance the FII action? Nikunj Dalmia decodes

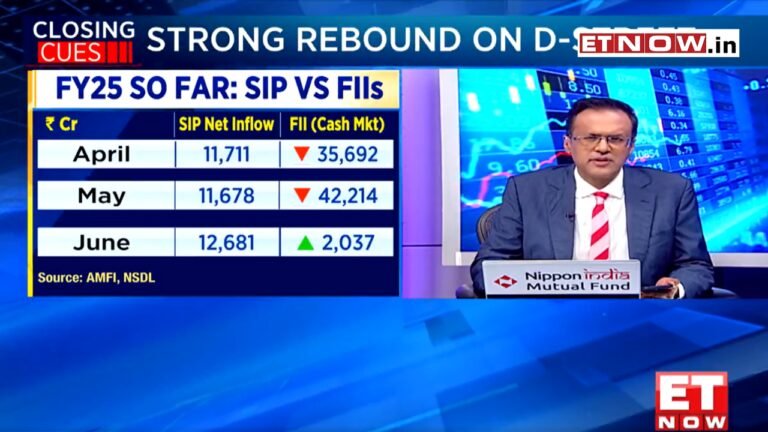

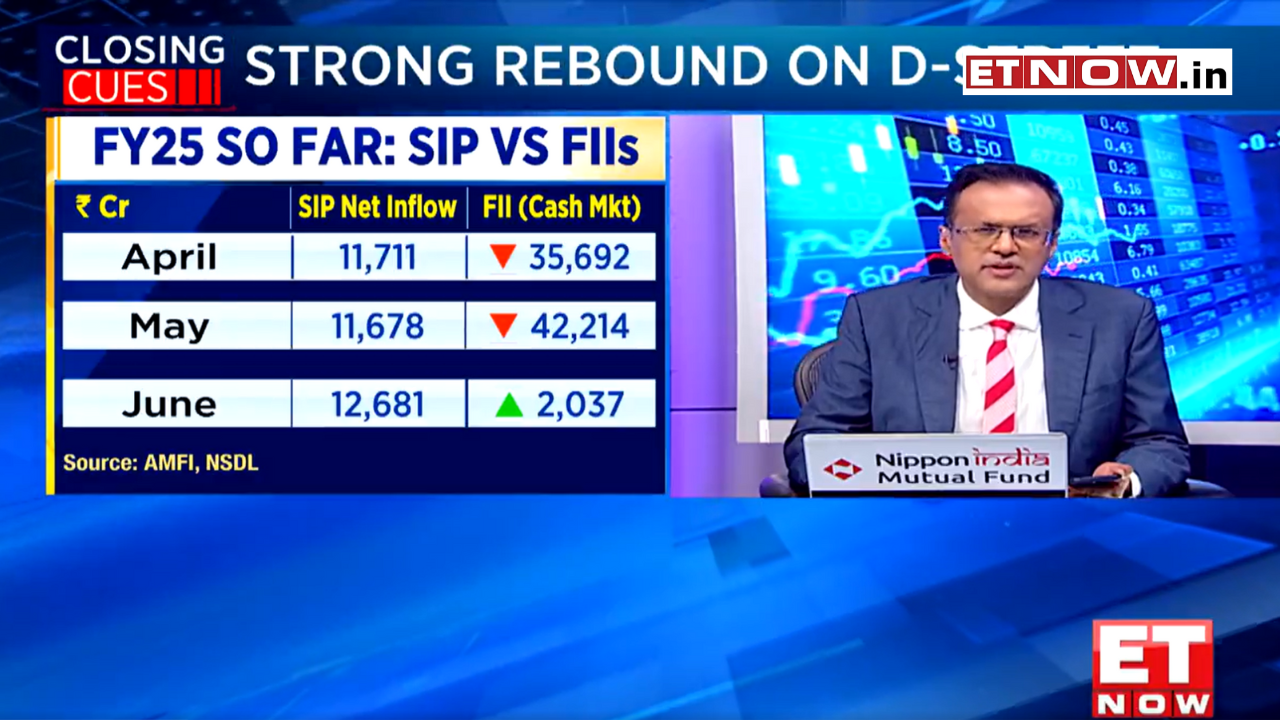

He further adds that the number could be a problem if the Foreign Institutional Investors (FII) intensity increases. “Up until now, when the FIIs are selling, the DIIs are buying and when the DIIs are selling, the FIIs are buying. But somewhere, the gap threatens to go higher. Like we have seen over the past few months, the FIIs selling is actually overpowering the SIP net number and which is what we need to bring up,” he adds.