The accumulation phase is just one part of the investing equation. Managing it wisely is the other half. The built-up corpus must remain intact and cover your expenses during the withdrawal phase. Mistakes in this phase can quickly cut down to size a hefty corpus built over many years. To ensure better outcomes, withdrawals also need to be carefully mapped out. Your SIP needs a companion who can take over when the time comes. Here is how the Systematic Withdrawal Plan (SWP) can be your SIP’s partner.

SIP-SWP combo creates a lifelong wealth management cycle

Passing the baton

SIP is an effective way to build wealth, but it does not guarantee successful outcomes. The exit point remains crucial to the overall return experience. It doesn’t matter how long your SIP has run or in which market conditions you initiated it. If the market misbehaves in the last leg of your SIP journey, it can whittle away a chunk of your corpus. Whether you are entering retirement or expecting a major expense, this scenario can disrupt your plans.

Let’s say an investor initiated a Rs.10,000 monthly SIP in the SBI Nifty Index Fund in January 2005. The target was to build a Rs.40 lakh down payment corpus for a house by mid-2020. The Rs.18 lakh invested would have grown to Rs.40.73 lakh by 31 January 2020. The investor’s target was well within reach. But then the market crashed. By 23 March, the corpus shrunk to Rs. 26 lakh. The investor was suddenly left staring at a shortfall of Rs.14 lakh. It would have taken another eight months for the investor to recover lost value. A better outcome would have been achieved if the investor had initiated a graded exit via SWP 12-18 months prior to the goal maturity.

SWP is simply the reverse of SIP. It allows withdrawal of a fixed sum at regular intervals over a chosen time period. This leaves less of your accumulated corpus exposed to market vagaries as your goalpost nears. The SWP effectively takes over from the SIP, ensuring a glide path towards the final goal. This also gives you the confidence to ride out turbulent phases, knowing some gains are already in the bank. Further, since only a portion of your corpus is withdrawn, the remaining investment continues to earn returns, capturing any upside in the last mile.

Experts insist SIP and SWP should not be perceived as two separate, isolated decisions. Both form two sides of the same coin, combining to create a lifelong wealth management cycle. A. Balasubramanian, Managing Director & CEO, Aditya Birla Sun Life AMC, observes, “The combination of SIP and SWP is, in many ways, a ‘SIP for life’. You save regularly when income is strong, and you withdraw systematically when income slows down—without breaking the compounding engine.” In retirement, the SIP-SWP combination marries wealth generation with steady cash flows. For other big-ticket outlays, this combination supports the transition from wealth accumulation to wealth preservation through calibrated exit. In that sense, SWP completes the SIP journey – SIP helps you build wealth, and SWP helps you use it efficiently, Balasubramanian says. “While SIP is the ‘engine of accumulation’, SWP is the ‘architecture of distribution’,” remarks Atul Shinghal, Founder and CEO, Scripbox.

Deferring SWP by few years yields superior outcomes

It allows for growth in initial capital and prevents withdrawals from eating into the capital sooner.

Note:Above illustration assumes monthly SWP of Rs.50,000 from SBI Equity Hybrid Fund. Initial corpus Rs.1 crore. Investment date considered as 1 Jan 2015. Monthly SWP considered on 1st business day of the month. Data as on 10 Feb 2026.

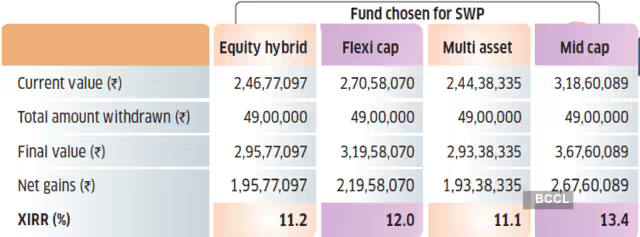

Choice of funds can impact SWP

A pure equity fund may not always yield superior outcomes.

Note:Above illustration monthly SWP of Rs.50,000 from SBI Equity Hybrid Fund, SBI Flexi Cap, SBI Multi Asset Allocation Fund and SBI Mid Cap Fund respectively. Initial corpus Rs.1 crore. Investment date 1 Jan 2015, SWP started on 1 Jan 2018.Monthly SWP considered on 1st business day of the month. Data as on 10 Feb 2026. Source: Advisorkhoj.com

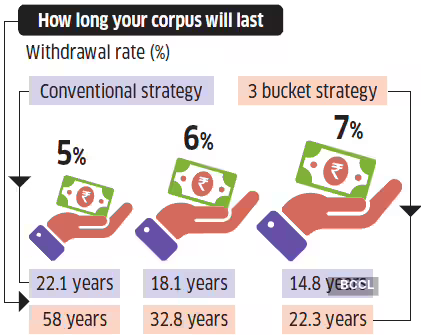

Bucket strategy for withdrawals can extend longevity of retirement savings

Note:The above illustration assumes retirement corpus Rs.5 crore, inflation rate of 5%. Retirement corpus is equally split into 3 buckets: 1/3rd in conservative hybrid fund at 6%, 1/3rd in aggressive hybrid at 9%, and 1/3rd in equity assets fetching 11%. Calculator courtesy: PGIM Mutual Fund

Beyond retirement

SWP need not be limited to post-retirement cash flows. Its utility extends far beyond that. “In the Indian context, SWP has long been pigeonholed as a retiree’s tool, but today, its utility has expanded significantly. It is now a critical tool for several non-retirement scenarios,” contends Shinghal. “SWP is evolving into a multi-purpose, flexible, tax-efficient cash flow tool for individuals across life stages,” says Abhishek Tiwari, CEO, PGIM India Mutual Fund.

It can support other recurring, predictable expenses, such as monthly loan EMIs or higher-education semester fees. “Instead of keeping a child’s university fund in a low-yield savings account, parents are keeping it in hybrid funds and using an SWP to pay quarterly tuition fees,” adds Shinghal.

It can also supplement income for those living on irregular cash flows. Niharika Tripathi, Head of Products and Research at Wealthy.in, says, “For freelancers, consultants, or business owners with cyclical cash flows, an SWP can provide a ‘baseline’ income. Invest surplus cash during high-income months and set up a modest SWP to cover fixed monthly expenses (like rent, utilities, EMIs). This stabilises lifestyle regardless of business fluctuations.” Further, SWP can facilitate graded exits for one-time outlays. “Instead of redeeming a large lump sum for a goal (like a wedding or home renovation), you can use an SWP to spread withdrawals over time,” says Tripathi.

How to transition to SWP

SWP works best when it is planned alongside SIP, not as an afterthought, avers Balasubramanian. This shift from SIP to SWP must allow for a transition period. It is advisable not to initiate the SWP immediately after the initial investment. Defer setting up the SWP until the investment has run for a few years. This will allow your original investment some time to grow before you begin withdrawing from it. This prevents you from immediately eating into your invested capital if market conditions sour.

“From a tax perspective, SWP is inherently more efficient than lump-sum redemptions. Each withdrawal consists of both principal and capital gains, and tax is applicable only on the gains portion,” says Balasubramanian. Deferring SWP by a year also ensures your withdrawals qualify as long-term capital gains (LTCG), under which the first Rs.1.25 lakh of gains per year is tax-exempt, according to Shinghal.

When planning a one-time outlay, withdrawals should begin well before the target date, even if the corpus is short of the target. For non-negotiable goals, waiting until the last year may put the goal at risk. For smoother outcomes, set up the SWP from the chosen fund 2-3 years in advance.

ABHISHEK TIWARI

CEO, PGIM INDIA MUTUAL FUNDx`

Note:“SWP is evolving into a multi-purpose, flexible, tax-efficient cash flow tool for individuals across life stages.”

How much to withdraw

When planning a SWP over many years, such as in retirement, the sustainability of your withdrawals is critical. How much you withdraw from your corpus will determine if the SWP can fund your lifestyle expenses for the next 20-25 years and beyond.

But this amount cannot be a random figure that simply covers your expenses. It must account for the unknown. Your withdrawals occur in a live market environment. Regular withdrawals, when combined with adverse market behaviour, can quickly erode your corpus. This is a double whammy for the longevity of savings. Tripathi says, “With an SIP, market volatility is your friend (you buy more units when markets fall). With an SWP, that’s not the case as you are forced to sell more units to get the same cash when markets fall.”

This is the sequence-of-returns risk— when the timing of withdrawals from an investment portfolio coincides with a period of poor investment returns. Tiwari contends that it is a risk many investors may not be familiar with. “It’s the risk of experiencing negative returns early in retirement when withdrawals are being made, which can significantly deplete portfolio value and increase the likelihood of running out of money later on.”

Determining how much to withdraw is a delicate balancing act. Balasubramanian asserts, “The withdrawal amount should be realistic and conservative. A sustainable withdrawal rate —typically lower than the long-term return potential of the portfolio— ensures that the capital is preserved for longer periods.” For a smoother glide path in retirement, you must determine a safe withdrawal rate. It targets optimal withdrawals from a retirement portfolio without prematurely depleting it. Tiwari asserts, “As a rule of thumb, your withdrawal rate can ideally be the ‘real rate of return’ which is investment return after adjusting for inflation.” If your investment return is 10% and inflation is 5%, your withdrawal rate should not exceed 5%. Shinghal suggests that the withdrawal rate should ideally be 2-3 percentage points lower than the chosen fund’s expected return to ensure sustainable, multi-decade cash flow. While studies have shown that a withdrawal rate of around 3.5-4% is associated with longevity, this may not suit everyone. Your asset allocation and lifestyle would determine the suitable withdrawal rate. Experts suggest retirees can use dynamic withdrawals to ensure their savings provide coverage for their entire lifespans. In this approach, withdrawals can be adjusted based on the corpus’s performance.

A. BALASUBRAMANIAN

MANAGING DIRECTOR & CEO, ADITYA BIRLA SUN LIFE AMC

Note:“The combination of SIP and SWP is like a ‘SIP for life’. You save when income is strong, and withdraw systematically when income slows down.”

Bucketed withdrawals

SWP can be initiated in any type of fund. However, not all funds are suitable for SWP, particularly in retirement, when the sustainability of withdrawals is critical. For retirement-linked withdrawals, a more refined strategy is needed. To get more value from the SWP, experts recommend a three-bucket strategy. Here, you allocate your retirement corpus across short, mid, and long-term buckets.

“In the first bucket (initial 3 years), you can keep your immediate living expenses in highly liquid, low-risk assets like liquid funds or overnight funds,” says Tiwari. The second bucket, for cash flows over 4-7 years, can be allocated to balanced advantage funds or conservative hybrid funds for moderate capital growth and stability. “The remainder can be invested in equity funds for long-term growth to combat inflation and ensure the corpus lasts for decades,” adds Tiwari. Withdrawals begin sequentially from bucket 1 until it’s depleted, then from bucket 2, and finally from bucket 3.

Your financial journey will look different than others, shaped by own circumstances. But a well-planned SWP can be a reliable partner in this journey, enabling a continuous cycle of wealth creation and income generation.