Updated Aug 23, 2024 19:40 IST

SIP Inflow In July 2024: In conversation with Nikunj Dalmia, Managing Editor, ET NOW & ET NOW Swadesh, Chalasani revealed that there are more than 9.33 crore accounts who have been putting money in mutual fund.

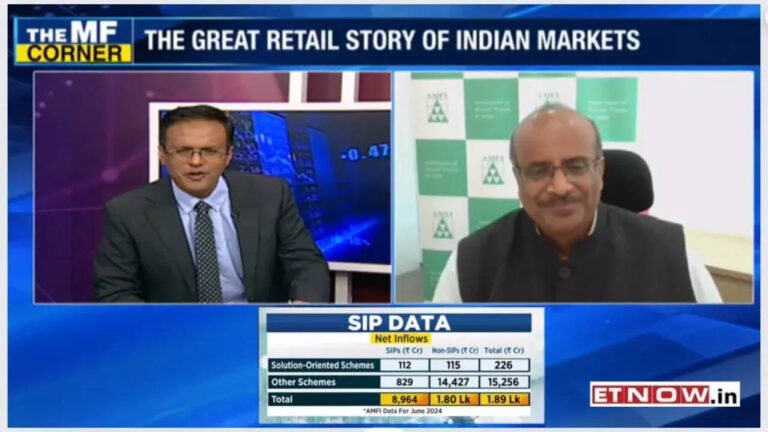

SIP Inflow In July 2024: Association of Mutual Funds in India (AMFI) CEO Venkat Nageswar Chalasani discussed the growth of Systematic Investment Plans (SIPs) in the mutual fund industry in India. He emphasizes that the gross inflows into SIPs, which amounted to Rs 23,332 in July, are a more accurate indicator of the health of the industry than net SIP inflows, which stood at just Rs 8,964 crore in July.

In conversation with Nikunj Dalmia, Managing Editor, ET NOW & ET NOW Swadesh, Chalasani disclosed that there are more than 9.33 crore accounts who have been putting money in mutual funds while around 72.62 lakh new accounts were added in the previous month.

“The retail investors are coming into the mutual fund fold. In fact on the SIP front, you have almost around 9.33 crore accounts are there as we speak now. The total investment under SIP…the AUM under SIPs is around Rs 13 lakh crore which constitutes almost around 20 per cent of the total AUM,” the AMFI CEO stated.

Further on reports that the net SIP inflow into mutual funds was just Rs 8,964 crore as against the gross SIP inflow of Rs 23,332 crore, Chalasani clarified that the two figures should not be compared. He stated that outflows do not necessarily mean that investors have stopped SIPS and emphasises that gross SIP flow is important number to watch out as that is the real money that is coming in system.

Chalasani of AMFI said, “Every month, we publish the gross inflows into SIP which happen to be approximately Rs 24,000 crore during the month of July. Now, there is a narrative that is building up in the market and we did see some of the reports which say that net SIP number is important and not the gross SIP.”

“But, let me tell you one thing. When we are giving the number of Rs 24,000 crore, it is a cumulative of the inflows that are coming into SIPs by these 9.33 crore accounts. From these 9.33 crore accounts, Rs 24,000 crore is the SIP amount that has come and that’s the gross amount,” he stated.

“When it comes to outflows, it happens to be a cumulative figure. Let’s say somebody who has invested 5 years back in SIP and decides that he will put every month around Rs 10,000 crore i.e. Rs 1.2 lakh crore per annum and for five years, it translates into Rs 6 lakh crore. And, he decides that this second goal for himself that he would like to buy a car or use it as a margin money for his house. Whatever, the goal he has set for himself and he redeems it. So, he is redeeming the procured investment he has done for the last five years. The second part of it is there could be some investors who was investing in SIPs over a period of five years and he decides that in this particular scheme I have invested and I will continue to invest in it but let me redeem a portion of it and invest in other scheme. So, this is the second way in which redemption happens. The third way of redemption is he decides that I will continue but let me redeem the entire amount and put it in some other scheme. The fourth is I can redeem by cancellation. So, the redemption or the outflows is a cumulative figure which investor has invested over a period of time and the redemption can be in any of the reasons that I had mentioned. And therefore, the gross numbers are the one which are important where it is a real inflow that is coming into the system and net flows are not that important at all,” he clarified.

“We do give the inflows in various schemes and the overall outflows that are going out of the schemes and the net flows that are happening for the total AUM of the industry. So, those numbers do capture. Whatever the redemption in SIPs is happening but we should not take the cumulative and reduce from the individual month’s figure and say that these are the net assessments,” he added.