Do you think you can have a stable life by yourself? With uncertainty and an unpredictable life where you have no clue what tomorrow brings, can you ensure you can smoothly work everything without any help or investment? With rising inflation and instability, the need to invest has become more outstanding. Planning for the future can give you a stable lifestyle and help you be stable in uncertainty. One of these investments is SIP (Systematic Investment Plan), an investment type that has come in demand for its high returns and flexibility to invest.

What is SIP?

SIP (Systematic Investment Plan). An SIP investment allows you to invest regularly. SIP can be a good investment option for people who do not have a significant amount of savings. SIP has made it possible for people to dream of investing and secure their future, especially for people who cannot invest a considerable amount but are willing to make investments. SIP is a disciplined investment that allows investors to invest a certain amount in small monthly, quarterly, or annual intervals. This amount can be adjusted according to your financial capacity over time. SIPs are best for long-term investments.

Is SIP Safe?

SIP is the safest method to invest in mutual funds. These investments are handled and monitored by professional fund managers who are experts in the field and have thorough knowledge of the market conditions. If you invest in a lump sum investment when the market is undervalued, depending on the market condition, you can pay a very high price for a mutual fund. To avoid this, investing in SIP mutual funds can be beneficial when the markets are downward, and to do this requires expertise. Let’s have a look at these factors.

1.Identify Your Goal

Before investing in a systematic investment plan, it is essential to know your goal. Having a goal in mind before investing can help you choose the right investment plan that best suits your goals. Whether it is for retirement, buying a home, funding education, or planning a wedding.

2.Identify The Value Of Investment Needed

Identifying your goals gives you a rough idea of how much you will need. This involves putting a value on your goal based on its current cost. Then, consider how much it will cost in the future when you plan to make the purchase. These two values will help you determine how much money you need to set aside. After that, it’s time to create a finance schedule.

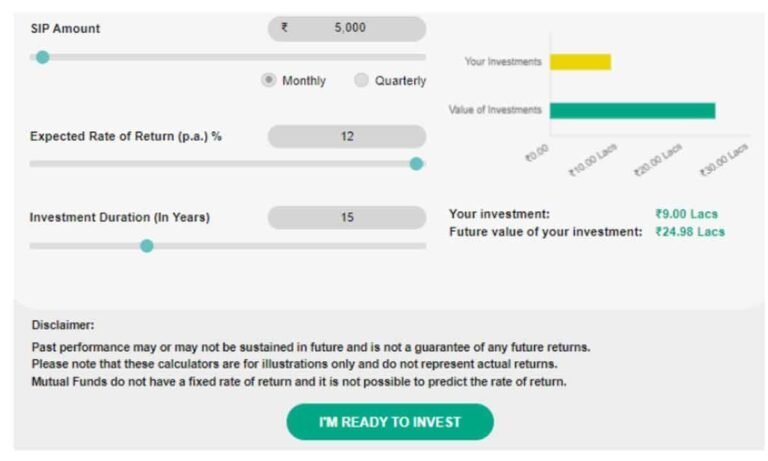

3.Evaluate Your SIP Amount Using SIP Calculator

Before choosing any investment scheme use a SIP calculator which will help you evaluate the amount of money required to fulfil your investment goals.

4.Create A Finance Schedule

Identify when you will need this money in the next five, seven, or ten years. This will help you Identify whether your goal will be achieved through a short-term, mid-term, or long-term mutual fund investment.

5.Choose The Right Scheme

Choose a suitable scheme to help you achieve your goals. You can do this by researching or asking an asset management company or fund house. Depending on your goals and time frame, AMCs can determine which mutual fund scheme fits best.

6.Identify Investments

Identify the suitable investment to help you reach your goal in the expected time. If you want high returns in a short time, you will have to look for schemes with a high-risk factor, like liquid funds, since the risk is directly proportional to the returns.

7.Choose a Suitable Scheme

Choose a suitable scheme to help you achieve your goals. You can do this by doing your own research or ask an asset management company or fund house. Depending on your goals and time frame, AMCs can determine which mutual fund scheme would be the best fit.

8.Monitor Regularly

Whether you are investing directly or through AMCs, regularly monitoring the fund’s performance is very important. If you have invested for a short term, it is essential to keep an eye on your scheme; whereas, if you have invested for a long term, then you should monitor your scheme at regular intervals to remain updated about market trends and schemes performance.

Conclusion

Everyone has their own goals and plans for life and SIP helps you achieve them all effortlessly. But before investing in SIP, it is essential to evaluate some things, like choosing the scheme that aligns with your needs and identifying goals and values to get high returns.

(No Hans India Journalist was involved in creation of this content)