(Bloomberg) — Short-dated municipal bonds posted their best day in five months after signs of slowing inflation fueled speculation the Federal Reserve will be able to cut rates as soon as September.

Most Read from Bloomberg

Shorter-dated securities extended a rally on Friday afternoon after state and local government bond yields dropped as much as 8 basis points on Thursday, further boosting prices. The biggest gains came at the front of the yield curve with top-rated benchmark bonds maturing in one and two years posting their best daily gains since early February.

“We’ve gone through several false starts in the first and second quarter, hence the market was going in a little cautious,” said James Pruskowski, chief investment officer at 16Rock Asset Management, referencing inflation data that had been stubborn until recently. “I think this seals the fate as the Fed is laying the groundwork for a pivot.”

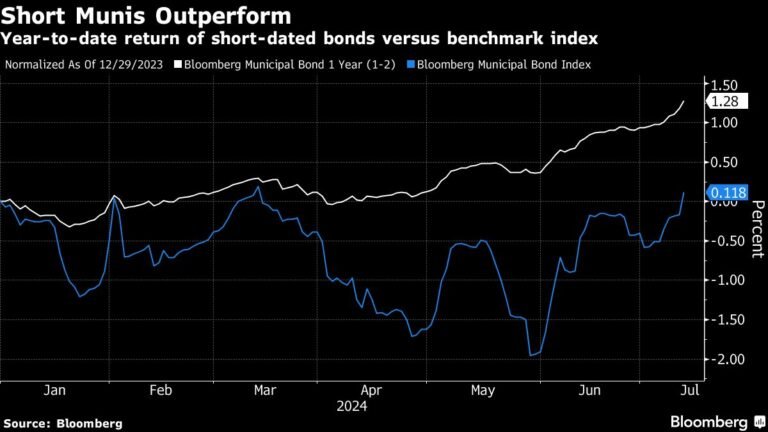

It’s a welcome development for muni investors who have seen essentially flat returns. A benchmark of municipal bonds has gained 0.12% in 2024, according to data compiled by Bloomberg.

The strong performance may help boost flows into municipal funds which have been sporadic for much of the year. Investors added about $775 million to such products during the week ended Wednesday, the biggest weekly inflow since May, according to LSEG Lipper Global Fund Flows data.

Short-dated state and local government debt has been the best performing part of the curve this year. Bonds that mature in two years or less have jumped 1.3% since January, according to data compiled by Bloomberg.

“We believe that the Fed is likely to cut at least three times in the next 12 months,” said Matthew Caggiano, co-head of municipal bond strategy at DWS Investment Management. “That should put downward pressure on yields in the short end of Treasuries and munis should follow.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.