It was no contest in the first half of 2024: Vanguard Large-Cap ETF stole the show. Should you give up on Vanguard Small-Cap ETF?

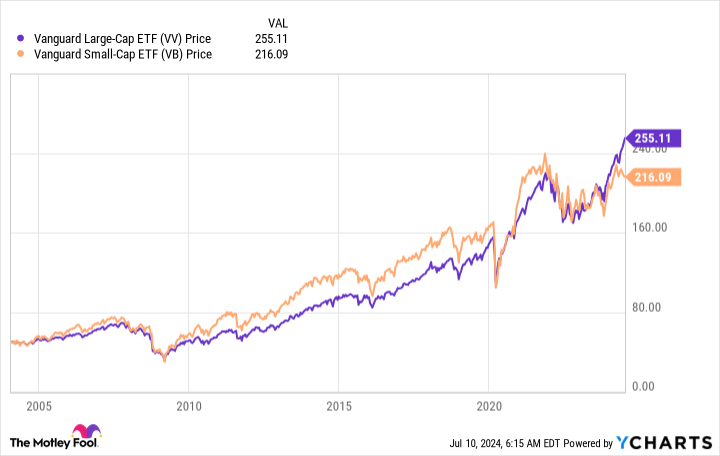

The first half of 2024 is over, and it was pretty clear: Bigger was better. To put some numbers on that, Vanguard Large-Cap ETF (VV 0.57%) rose roughly 16% over the six-month span, while Vanguard Small-Cap ETF (VB 0.99%) only gained 2% or so. That’s a 14-percentage-point difference! But don’t give up on small-cap stocks just yet.

The big guys ruled the roost in the first half

Given the performance comparison of the exchange-traded funds (ETFs) noted, the largest stocks vastly outdistanced the smallest stocks. This isn’t uncommon, actually, as large stocks and small stocks often trade places performance wise.

As the chart highlights, there are periods where each fund has performed better than the other. So, from this perspective, investors would probably benefit from having exposure to both large and small stocks in their portfolios.

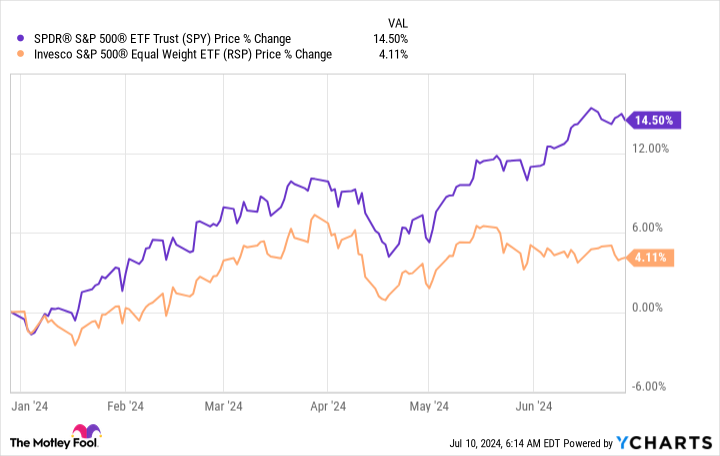

But there’s another wrinkle that’s important to understand today. The current strong performance by large-cap stocks is highly concentrated among a few companies. You can see that by comparing the performance of the regular S&P 500 index, which is market cap weighted, to Invesco S&P 500 Equal Weight ETF (NYSEMKT: RSP), which isn’t market cap weighted.

The chart shows that the market cap-weighted S&P 500 index easily outdistanced the equal-weighted version of the index.

Digging even further into the numbers

That means the largest stocks were the big driver within the predominantly large-cap S&P 500 index. You know the names. The S&P 500’s top five holdings are Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), Nvidia (NASDAQ: NVDA), Amazon (NASDAQ: AMZN), and Meta Platforms (NASDAQ: META). As the chart shows, all but one of these stocks outdistanced the broader index.

But the real issue is the margin of outperformance that some of these giant stocks achieved. Nvidia rose an astounding 149.5% in just six months! And while their performance pales in comparison to Nvidia, Meta was up a huge 42%, and Amazon advanced 27%.

Normally, those two figures would be pretty eye-catching. But the big story is still the fact that the biggest stocks, and largely those with a connection to technology, were the driving force behind the market in the first half of 2024.

There’s a risk in chasing performance

When you take a deeper look at what is driving the market today, the talking points really change. Is it a good idea to buy a fund like Vanguard Large-Cap ETF, which is concentrated in the top five largest stocks that are outperforming today? Or should you make sure you spread your bets just a little by investing in stocks that aren’t performing as well, by holding a laggard ETF like Vanguard Small-Cap ETF?

If history is any guide, when a small group of stocks achieves fad status, investors need to tread with increasing caution. Eventually the fad will end, and those hot stocks will fall, often very quickly and very hard. In other words, don’t give up on Vanguard Small-Cap ETF if you own it, and maybe consider adding it if you don’t.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Vanguard Index Funds – Vanguard Small-Cap ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.