Key Takeaways

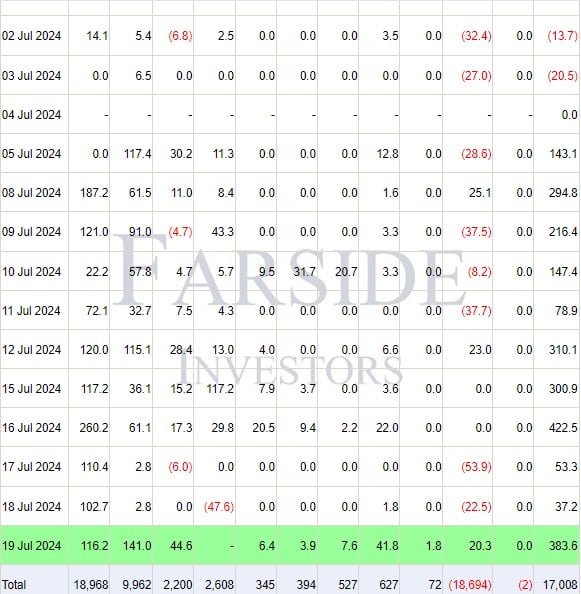

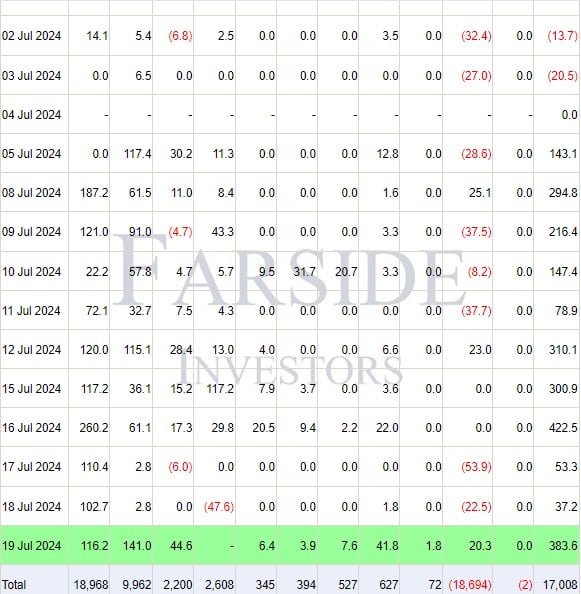

- US spot Bitcoin ETFs saw strong inflows this week, with funds collectively capturing over $1 billion.

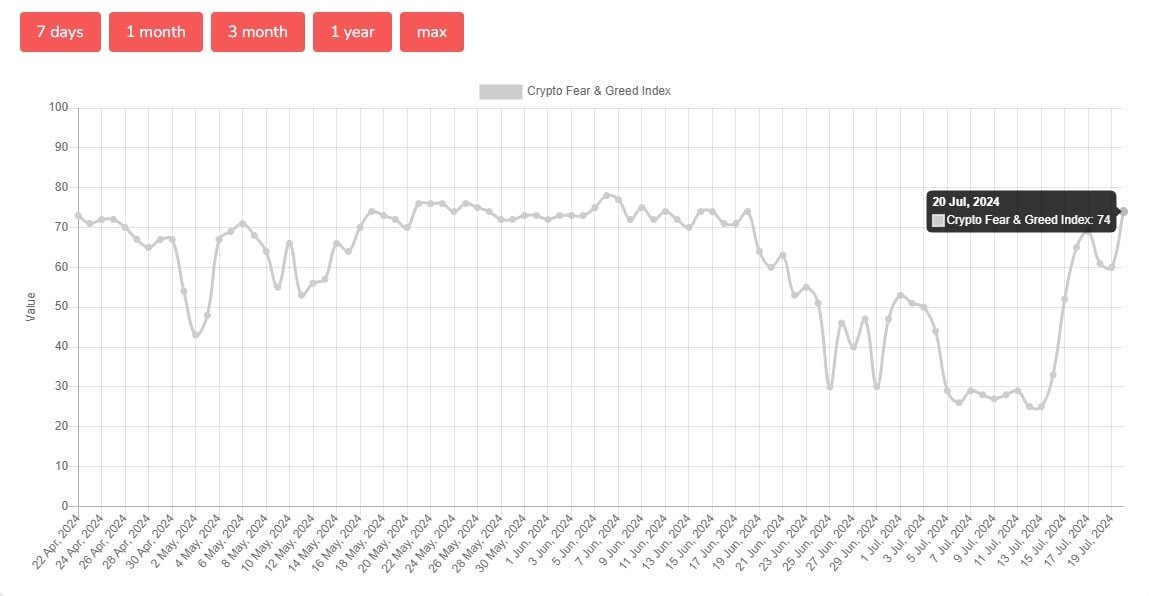

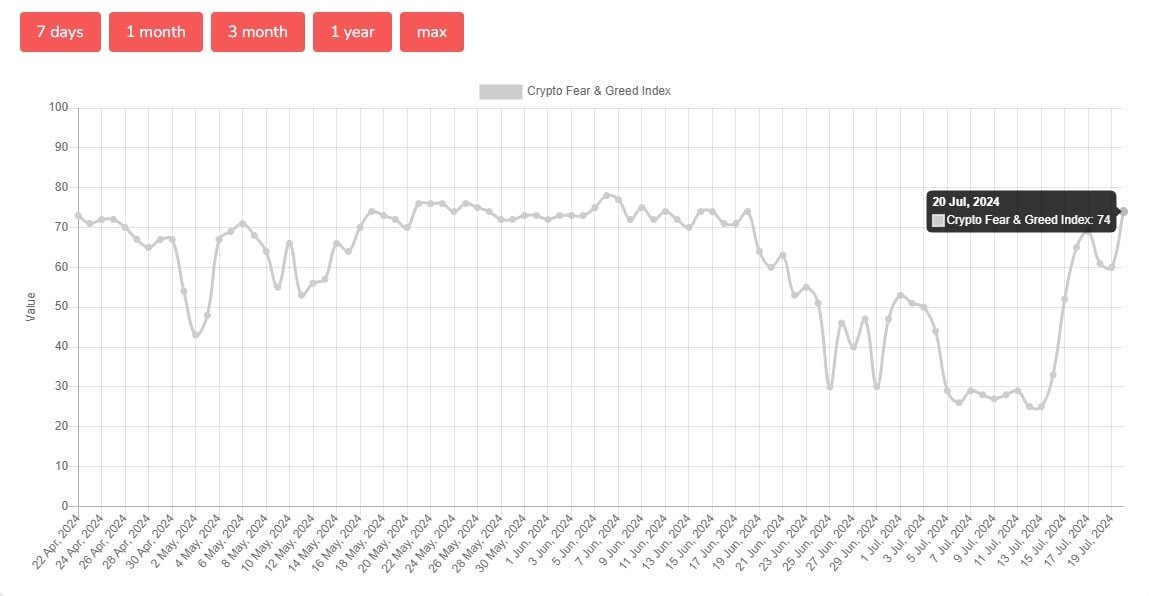

- Crypto market sentiment is turning positive, with the Crypto Fear and Greed Index hitting 74.

Share this article

US spot Bitcoin exchange-traded funds (ETFs) have drawn in over $2 billion from investors over the past two weeks amid renewed market optimism, with the Crypto Fear and Greed Index hitting its highest level since late June, according to data from SoSoValue and Alternative.me.

(Note: ARKB’s Friday flows are not included as there was no update observed at the time of reporting).

Data from Alternative.me shows that the Crypto Fear and Greed Index jumped 14 points to 74 on Saturday. The increasing index score came as the price of Bitcoin (BTC) hit a high of $66,800 on Friday evening, TradingView’s data shows.

Last week, the index remained in the “fear” zone. Despite bearish market sentiment, US spot Bitcoin ETFs attracted over $1 billion in inflows over the week.

Building on that success, US spot Bitcoin ETFs have continued to attract substantial inflows this week.

The Bitcoin ETFs started the week on a high note with $301 million capital flowing into the funds on Monday. These funds collectively garnered over $1 billion in weekly inflows (excluding ARKB’s Friday flows due to no update), with Tuesday witnessing the largest daily inflow of over $422 million.

This week alone, BlackRock’s IBIT led the pack with around $706 million in inflows, according to data from SoSoValue and Farside.

IBIT’s inflows topped $1.2 billion in the last two weeks, accounting for 50% of total flows into eleven spot funds during that period. The fund remains the largest spot Bitcoin ETF with almost $22 billion in assets under management (AUM) as of July 19.

Fidelity’s FBTC saw approximately $244 million in inflows this week, while Bitwise’s BITB reported over $70 million. Other gains were also seen in ARK Invest’s ARKB, VanEck’s HODL, Invesco’s BTCO, Franklin Templeton’s EZBC, Valkyrie’s BRRR, and WisdomTree’s BTCW.

Despite over $20 million in net inflows reported on Friday, Grayscale’s GBTC saw around $56 million in outflows.

With Friday’s gain (excluding ARKB), these ETFs have experienced sustained inflows for eleven consecutive trading days.

Share this article