PM Images

Amid growing concerns over a hard landing scenario following the latest set of weak economic indicators, U.S. two and ten-year Treasury notes are back below 4%. Now, expectations are that the Fed will lower rates by 100 bps by year-end. With lower rates and a more risk-off sentiment, dividend stocks have turned more appealing, as well as dividend-focused funds like the WisdomTree U.S. High Dividend Fund ETF (NYSEARCA:DHS).

While its dividend-weighted constitution does not specifically target low-valuation stocks, DHS’s valuation is quite attractive at a 13x price/earnings ratio, driven by this allocation bias toward energy, financial services, and utilities. On the other hand, DHS’s performance has not been as strong, as other dividend funds, especially those with a greater focus on growth, have outpaced DHS over time.

That said, while DHS is a fund worth considering for income-oriented investors as part of a diversified portfolio, long-term total returns may be subdued if value stocks continue to underperform the broader market.

ETF Description & Highlights

DHS is an exchange-traded fund that offers exposure to high dividend-yielding companies across a broad range of market capitalization in the U.S. market. The fund tracks the WisdomTree U.S. High Dividend Index. This index is constructed based on an initial universe of companies that paid regular dividends in the previous twelve months, with a market capitalization of at least $200 million, which is just below the common definition of micro-cap stocks at $300 million.

Eligible companies are then ranked according to the projected annual dividend yield, with the top 30% selected for inclusion in the index at annual reconstitution. The selected companies are assigned weights based on total cash dividends estimated for the next year, subjected to cap adjustment to avoid the concentration of individual companies and groups of companies in the index.

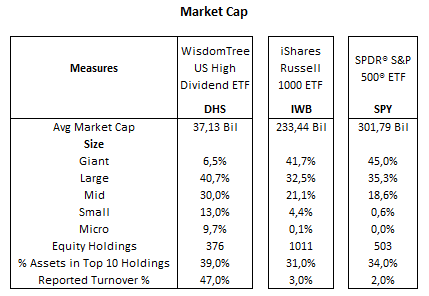

As of July 30, 2024, DHS has allocations in 376 companies, with an average market cap of $37.1 billion and a bias toward mid and large caps, where 30.0% and 40.7% of total assets are allocated, respectively. In contrast, the Russell 1000 index, used as a benchmark for this fund and represented in this analysis by the iShares Russell 1000 ETF (IWB), has higher exposure to larger companies due to its market cap weighted composition, with nearly 41.7% of total assets in mega caps and 32.5% in large caps.

DHS’s top ten holdings (Exxon Mobil, AbbVie, Altria, Chevron, IBM, Philip Morris, Morgan Stanley, Citigroup, Bristol-Myers Squibb, and UPS) account for 39% of total assets, distributed across several sectors such as energy, financial services, and healthcare.

Morningstar, consolidated by the author

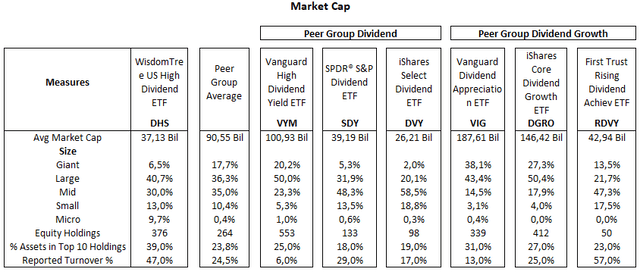

Below is a table with other dividend-focused ETFs that will be compared with DHS. The first peer group comprises funds primarily focusing on dividend yield and safety (VYM, SDY and DVY), where VYM is a market cap-weighted fund, SDY is based on the S&P High Yield Dividend Aristocrats index and weighted by dividend yield, and DVY is a relatively concentrated fund with nearly 100 holdings and also weighted by dividends.

On the other hand, the second peer group seeks dividend growth over time (VIG, DGRO and RDVY), where VIG is weighted by market cap, DGRO is weighted by dividend dollars, and RDGY holds a concentrated portfolio of 50 equally weighted companies.

Morningstar, consolidated by the author

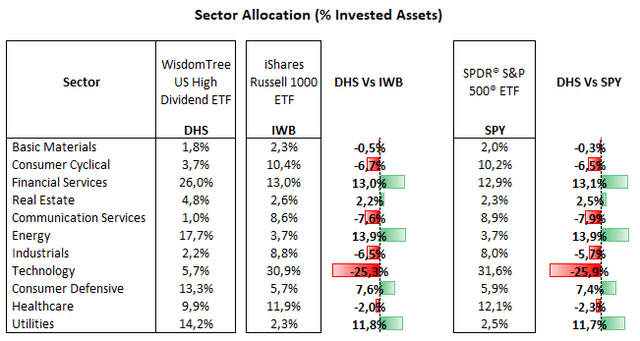

From a sector allocation perspective, DHS‘s largest allocation is to the financial services sector, with 26.0% of total equities, followed by energy at 17.7%, utilities at 14.2%, consumer defensive at 13.3%, healthcare at 9.9%, real estate at 4.8%, consumer cyclical at 3.7%, technology at 5.7%, industrials at 2.2%, basic materials at 1.8%, and communication services at 1.0%.

Relative to the Russell 1000 index, DHS is overweight in energy (+13.9%), financial services (+13.0%), utilities (+11.8%) and consumer defensive (+7.6%). However, it is heavily underweight in technology (-25.3%), communication services (-7.6%), and consumer cyclical (-6.7%). This reflects DHS’s allocation toward high-yielding sectors, where dividends are generally above 2.5% as opposed to the broader market, measured by the S&P 500 and the Russell 1000 indexes, where yields are around 1.2%.

Morningstar, consolidated by the author

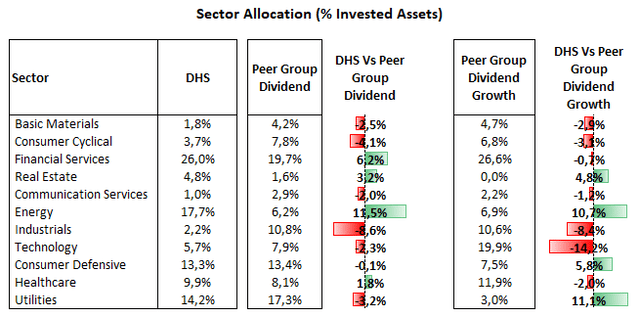

Compared to the peer group of dividend ETFs, DHS is overweight in energy and financial services and underweight in industrials, reflecting DHS’s stronger bias toward higher yields sectors, as the industrial companies typically have modest payout rates, given the capital-intensive nature of most businesses in the sector. This is more evident in comparison with the peer group of dividend growth ETFs. Relative to these ETFs, DHS also appears overweight in utilities and consumer defensive, two slow-growth sectors, and heavily underweight in technology, as these funds favor companies with higher dividend growth potential.

Morningstar, consolidated by the author

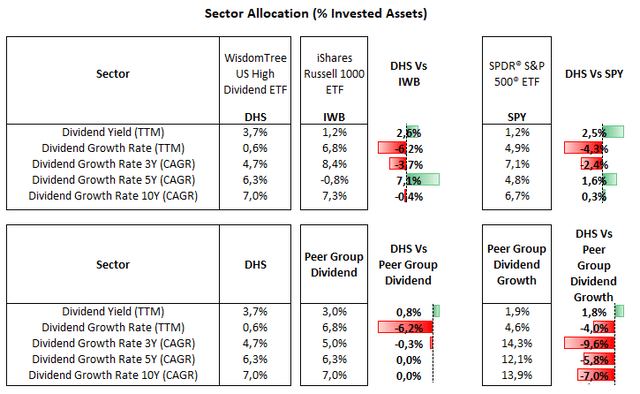

DHS’s sector allocation profile resulted in a dividend yield of nearly 3.7%, above the peer group of dividend ETFs yield of 3.0% and the dividend growth ETFs yield of 1.9%. Meanwhile, DHS’s dividend growth has been in line with the peer group of dividend ETFs over time. Still, it lags behind dividend growth ETFs that have generated two to three times faster dividend growth than DHS, given their focus on increasing dividends rather than yields per se.

Seeking Alpha, consolidated by the author

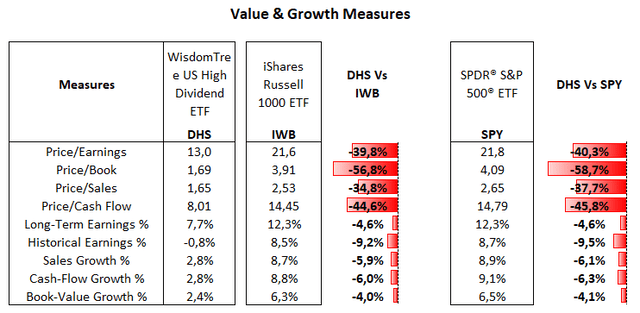

From a valuation standpoint, despite the recent downturn in equities that have contracted multiples somewhat, the table below, updated as of July 30, 2024, shows a compelling valuation for DHS at nearly a 40% discount compared to benchmarks. This reflects DHS’s allocation bias toward value sectors that trade at lower multiples and in more stable and slower growth segments of the market. This is also influenced by DHS’s top picks in certain sectors, such as UPS or IBM, which trade at roughly 18x PE ratio, substantially lower than the industrial and technology averages.

Morningstar, consolidated by the author

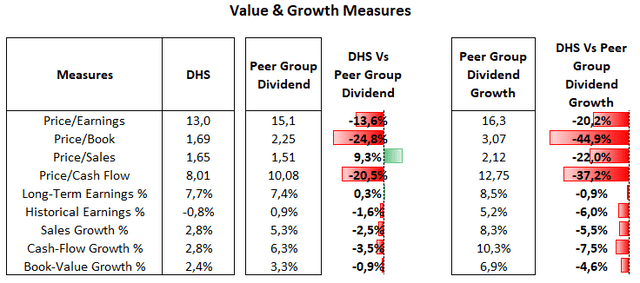

While dividends are essentially the only metric adopted by DHS for stock selection and weighting, this fund is arguably a deep-value player with price/earnings ratio of 13.0x compared to 15.1x for the peer group of dividend ETFs and 16.3x for the peer group of dividend growth ETFs. However, this comes at a cost, as DHS has a largely low growth profile compared to its peers.

Morningstar, consolidated by the author

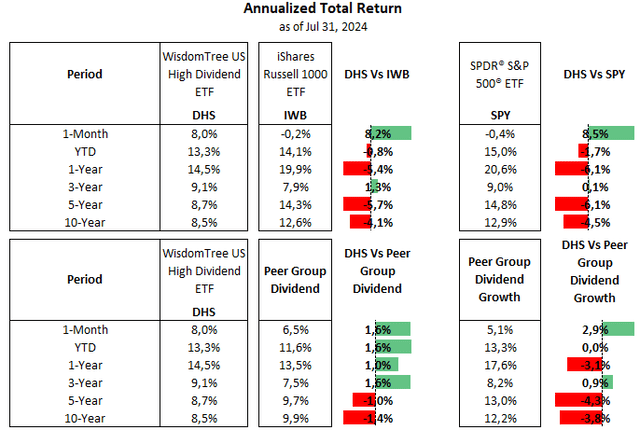

Underperforming The Broader Market And The Peer Group

While growth is not the main focus for income-oriented investors, total return matters in the long run. This can be observed when assessing DHS’s less-than-stellar performance. DHS’s underperformance relative to benchmarks like the Russell 1000 index is largely expected, given value stocks have been out of favor for much of the past years. On the other hand, the fund has also struggled against other dividend ETFs, particularly growth dividend ETFs, dragged down by weakness in sectors overweighted by the fund, such as energy and utilities.

Morningstar, consolidated by the author

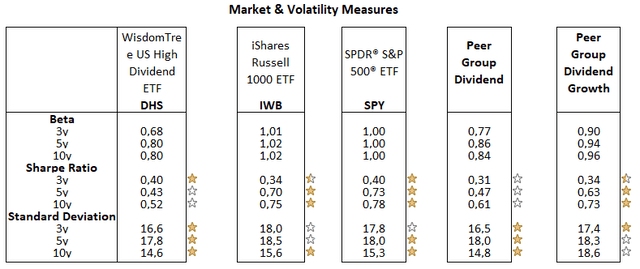

Despite the volatility in oil prices that has impacted energy stocks as a whole, DHS has experienced a somewhat modest price action over time, as evidenced by measures like beta and standard deviation, which have been consistently lower than the Russell 1000 index and dividend growth ETFs. That is a notable effect of DHS’s overweight exposure to value sectors like energy and utilities compared to other, more volatile areas such as technology and industrials.

Morningstar, consolidated by the author

On balance, DHS’s sub-par total returns may overshadow some interesting characteristics of this fund, such as above-average yields, attractive valuations, and relatively low volatility. However, as we may be entering a period where the stock market remains under pressure for some time due to a weaker macroeconomic outlook and a mixed earnings season, dividend funds offer an alternative to stay invested in the stock market, probably with lower volatility than the broader market, while still benefiting from an investment with competitive source of income.

With the U.S. two-year Treasury note now yielding 3.9%, DHS provides competitive dividends for long-term investors who can afford the stock market to recover from potential losses that may come as the stock market should remain vulnerable for an extended period of time. This is a risk for the overall stock and is also applicable to DHS’s core holdings, specifically the energy sector, driven by potential weakness in oil demand.