RALEIGH – Cabarrus County officials are requesting approval from the Local Government Commission (LGC) for $186 million in limited obligation bonds to pay for costs of multiple general government projects. How the county pays for projects was a topic of extended discussion at the commission’s July meeting.

If approved at the LGC meeting on Tuesday, Aug. 6, proceeds of the fixed-rate bonds would pay off bond anticipation notes previously issued at a variable rate and pay for additional project costs. Bond anticipation notes are short-term securities issued to pay for upcoming projects in advance of a larger future bond issue.

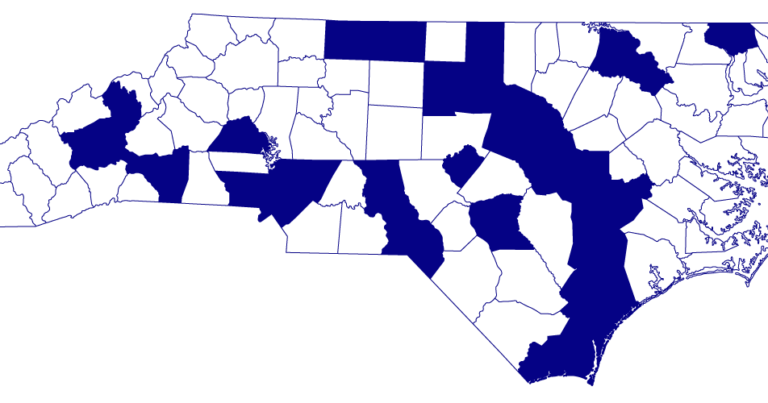

The LGC is chaired by State Treasurer Dale R. Folwell, CPA, and staffed by the Department of State Treasurer (DST). It has a statutory duty to approve most debt issued by units of local government and public authorities in the state. The commission examines whether the amount of money that units borrow is adequate and reasonable for proposed projects and confirms the governmental units can reasonably afford to repay the debt. It also monitors the financial well-being of more than 1,100 local government units.

People are also reading…

Other items on the agenda

Other items on the agenda for Tuesday’s meeting include resolutions to approve the return of financial control to the town of Eureka (Wayne County) and to Cliffside Sanitary District (Rutherford County). The General Assembly temporarily suspended Eureka’s town charter June 17, 2019, with an expiration date of June 30, 2024. The LGC has corrected deficiencies that led to the charter suspension. The LGC assumed financial control of Cliffside Sanitary District on Sept. 10, 2019. Last month the LGC returned financial control to Spring Lake (Cumberland County).

The city of Charlotte (Mecklenburg County) is asking the LGC to approve $205 million in revenue bonds for stormwater projects. Proceeds from the bonds would be used to prepay prior storm water revenue bond anticipation notes.

Johnston County is seeking approval of $75 million in revenue bonds for water and sewer system improvements. Projects to be funded by the bonds include the purchase of water supply from the town of Wilson, transmission pipe upgrades for Wilson and Johnston County and upgrading a wastewater treatment facility.

Pender County has a request on the agenda for approval of $68 million in limited obligation bonds to build a 10,000-square-foot law enforcement center. It will house a detention center, a sheriff’s office, 911 operations center and an evidence storage facility.

Holly Springs (Wake County) is looking for a green light on issuing $42 million in limited obligation bonds to build and equip an Operations Center on a 30-acre plot of land. A new administration building, operations building, citizens convenience center and storage for vehicles and equipment are planned.

New Hanover County has an application before the LGC for $37.5 million in limited obligation bonds to build a nearly 20,000-square-foot library, two fire stations, an ammunition warehouse and office/classroom building at the Sheriff’s Department firing range and roof replacement at the county Senior Center.

If approved, Asheville (Buncombe County) would issue $30 million in revenue bonds for water system improvements. Extensions, additions, capital improvements and replacement of capital assets would be part of the work.

The LGC will consider a request from Person County to issue $22 million in limited obligation bonds. Proceeds would fund the acquisition of a portion of a building the county currently leases for the Health Department and Social Services Department, to acquire a building for use by Piedmont Community College, roof repairs at South Elementary School and improvements to the county recycling center. The work is expected to reduce lease expenses, provide additional space for the college, and make the elementary school safer.

Stokes County is asking for the go-ahead on an $11 million installment purchase to improve and expand the County Courthouse. The current Courthouse is filled to capacity and needs to expand. In an installment purchase costs are paid over time instead of up front.[FL1]

The town of Mebane (Alamance and Orange counties) is seeking the LGC’s stamp of approval for a $7.6 million installment purchase for a spillway replacement in Lake Michael Park. The project is needed to provide safety during heavy rainfall.

LGC members will vote on an application from Richmond County to pursue a $7.5 million installment purchase for improvements and expansion of the county building that houses offices and the Board of Commissioners chambers.

Other projects considered

Other financing requests on the agenda were received from:

• Belmont (Gaston County), $2.6 million for vehicle purchases;

• Morrisville (Wake and Durham counties), $1.7 million for street and sidewalk repairs;

• Wallace (Duplin and Pender counties), $1.8 million to rehabilitate Maple Creek Pump Station.

The Wake County Housing Authority will come before the LGC with a host of financing requests totaling more than $40 million for various conduit revenue bond requests to acquire, build and equip rental housing developments. Those types of bonds are used to loan money to third parties. The developments involved are:

• Avonlea, $5.2 million;

• Highland Village, $4 million;

• Jeffries Ridge, $3.5 million;

• Madison Glen, $14.9 million;

• Ripley Station, $4.8 million;

• Sedgebrook, $3.7 million;

• Tryon Grove, $5.5 million.

The Durham Housing Authority is asking the LGC to approve a $5.1 million conduit revenue bond, proceeds of which would be loaned to Village Capital Corporation, an Indiana corporation, for a 168-unit multifamily rental housing development to be known as Trails at Twin Lakes Apartment Homes on Ross Road.

LGC members also will consider financing for multiple lead service line inventories in Belmont (Gaston County), Burnsville (Yancey County), Eden (Rockingham County), Gates County, Hobgood (Halifax County), Kinston (Lenoir County), Laurinburg (Scotland County), Newton (Catawba County), Ranlo (Gaston County), Richmond County, Troy (Montgomery County), and Weldon (Halifax County).

Attend or watch

Local Government Commission August meeting

Tuesday, Aug. 6, at 1:30 p.m.

N.C. Department of State Treasurer,

3200 Atlantic Ave., Raleigh