Torsten Asmus

As changes in geopolitical risk, volatility and monetary policy continue to sway financial markets, a number of these key themes are being seen across ETF securities lending activity.

Over the past month, financial markets have been navigating multiple events that were not present during the first half of the year. Central bank interest rate policy divergence has become a reality, there have been increased levels of geopolitical risk due to rising tensions in the Middle East and political change has swept across Europe. Additionally, there have been new developments in the US Presidential race and an increase in market volatility, which recently caused the Cboe Volatility Index (VIX) to register its largest intraday jump on record.

With the financial landscape changing at pace, many of the recent themes impacting markets have also been seen in ETF securities lending activity. The growing use of ETFs to express investor sentiment and to hedge portfolio risk has been working to the benefit of ETF lenders, as securities lending revenues for both June and July 2024 have shown positive growth when compared on a year-on-year basis (June revenues +26%, July revenues +19%) – one of the only asset classes to do so.

Interest rate policy and recessionary risk

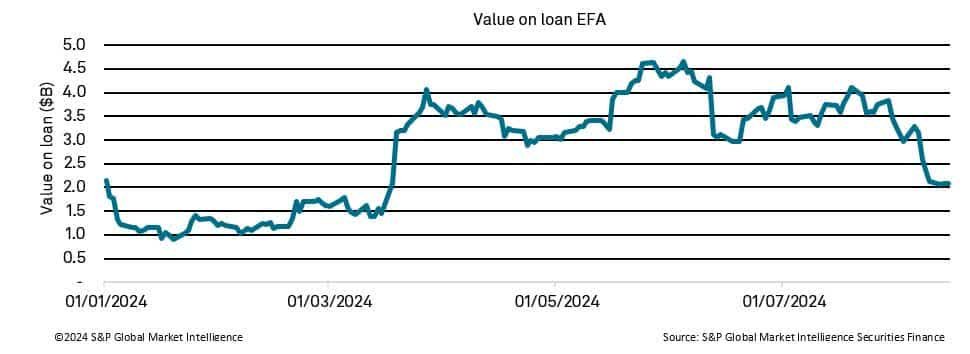

At the beginning of March, borrowing activity in the iShares MSCI EAFE ETF (EFA) started to grow, reaching its peak towards the end of May, just before the European Central Bank started to cut interest rates. This ETF tracks the MSCI EAFE Index, which focuses on developed markets outside of the US and Canada. The borrowing and subsequent shorting of this ETF has allowed investors to hedge against a number of different economic circumstances that have recently been playing out across the global economy. Some of these scenarios include currency depreciation versus the US dollar, interest rate differentials and central bank policy divergence, strong US economic growth and the potential for any market correction following a period of increasing equity valuations.

Bearish sentiment regarding a mega tech come back

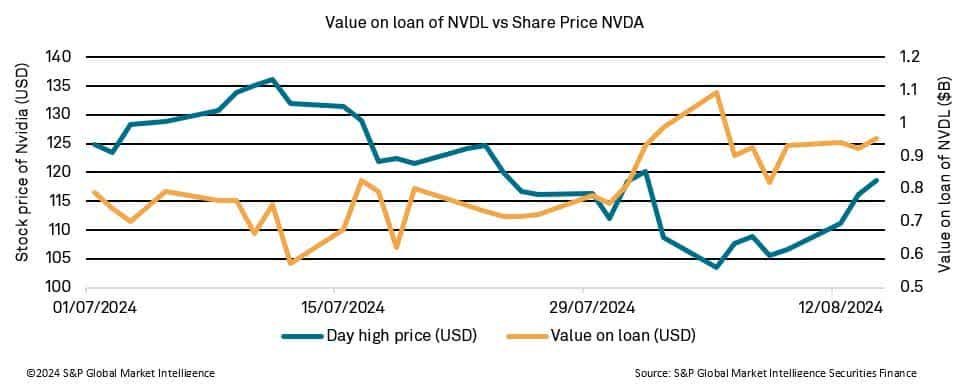

The GraniteShares Nvidia 2x Long Daily ETF (NVDL) seeks to generate two times the daily percentage change of the common stock of NVIDIA (NVDA). The recent market sell-off that centered around big tech stocks reduced the share price of NVIDIA from $135 a share during early July to just shy of $100 per share during August, a decline of 35%. As a result, an increase in the amount of shorting of the GraniteShares Nvidia 2x Long Daily ETF has been seen, as investors remain bearish regarding a full recovery in the company’s share price. A slowdown in earnings across the AI related tech sector and a reduction in leverage following a recent increase in Japanese interest rates have been touted as possible reasons as to why big tech share prices may struggle to climb back to their previous highs.

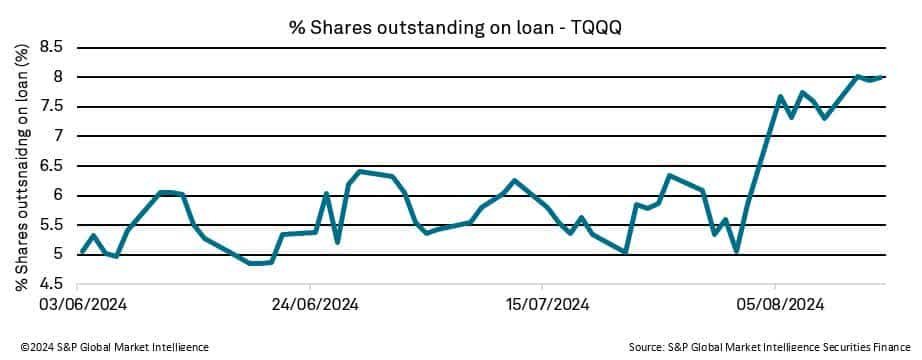

An increase in the borrowing activity of other big tech ETFs has also been seen, including the ProShares Ultrapro QQQ ETF (TQQQ). This ETF seeks daily investment results that correspond to three times the daily performance of its underlying benchmark. The fund invests in 100 of the largest domestic and international non-financial companies listed on the tech-focused Nasdaq stock market, based on market capitalization. By shorting this stock, any moves lower in the benchmark will be amplified by three times. This increase would therefore suggest further bearish sentiment by investors following the recent sell-off across the big tech sector.

Geopolitical risk intensifies as conflict grows

Over the last month, borrowing activity has increased to all-time highs in the iShares MSCI Saudi Arabia ETF (KSA). Whilst there are many reasons as to why an investor may borrow this asset, growing conflict in the Middle East and the large allocation that this ETF has to regional oil producers may suggest bearish sentiment towards any imminent resolution to the regional conflict and any future improvement in major commodity prices.

ETFs have become crucial tools in both hedging and investment strategies due to their flexibility, liquidity, and diversity. Their importance as an asset class continues to grow as they allow for investors to respond flexibly to market conditions across a wide range of asset classes and sectors. Their value also continues to increase in the securities lending markets as both lenders and borrowers reap the mutual benefits of current market dynamics. Over the last couple of months, exchange-traded funds have been one of the standout asset classes within the securities lending market, offering strong growth in year-on-year revenues. As uncertainty grows across both the political and financial spectrums, interest in ETFs within the securities lending market is expected to grow further.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.