_ultraforma_/iStock Unreleased via Getty Images

Thesis

The Jpmorgan Active Bond ETF (NYSE:JBND) is a new fixed income exchange-traded fund from JPMorgan. The vehicle represents another offering in the actively managed fund space, in addition to the ‘seasoned’ JPMorgan Income ETF (JPIE) which we covered here.

JBND is a new ETF, having IPO-ed in October 2023, thus having a relative short history. As per its own literature, the vehicle aims to “deliver total returns from an actively managed portfolio of U.S. investment grade bonds”. In this article, we are going to have a closer look at the name, its composition, and analytics, and articulate why the ETF is a good long-term buy and hold.

What does JBND do, and how is it different from JPIE?

JBND is also an active fixed income ETF, but in comparison to JPIE, the fund aims for a higher duration (6 years for JBND versus 3 years for JPIE). Furthermore, JBND aims to have a greater focus on securitized products versus JPIE which looks at corporate paper to a larger degree.

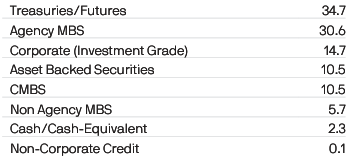

Let us have a look at the current JBND portfolio composition to better understand it:

Composition (Fund Website)

Treasury and treasury futures account for 34% of the fund, followed by Agency MBS paper at 30%, corporate bonds at 14% and ABS securities at 10%. Treasury futures are a balance sheet ‘light’ way of speculating on moves in interest rates, and active funds will use them in their build for shorter term speculative trades. By looking at the fund composition, we can see the ETF has interest rates as its main risk factor, which is further confirmed by its ratings breakdown:

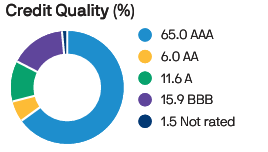

Ratings (Fund Website)

65% of the fund holdings are ‘AAA’, while the very highly rated sleeve represents over 80% of the fund holdings (AAA, AA, and A-rated names). When an ETF has such a high concentration in highly rated paper, an investor needs to understand the fund will have a very low sensitivity to credit spreads, and a high sensitivity to interest rates. Given the fund’s duration of 6 years, the ETF will be very dependent on the moves of the intermediate portion of the yield curve.

Conversely, the other ETF from JPMorgan, JPIE, takes much more credit risk, with only 45% of its holdings in AAA, AA, and A-rated assets. This translates into JPIE having a higher credit spread sensitivity, while JBND is more rates focused.

Performance and analytics

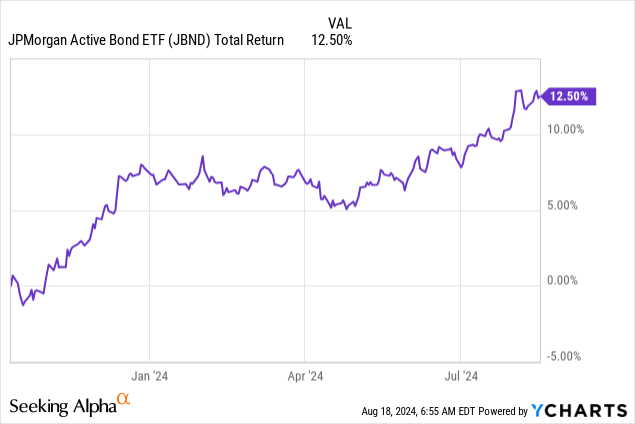

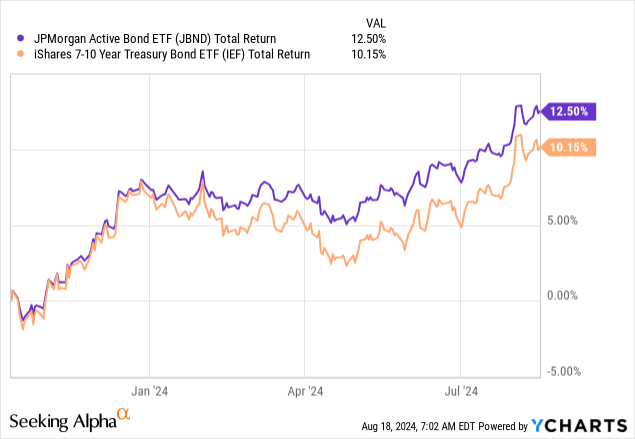

In its short history, the fund has posted a very robust total return of 12.5%:

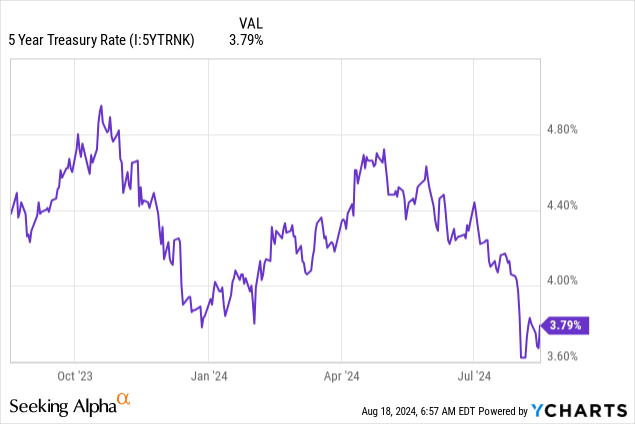

While the figure on its own is quite high, let us have a look at what intermediate rates have done since the fund issuance:

5-year rates have moved lower by roughly 100 bps since the ETF IPO-ed, thus being responsible for over half of the fund’s performance. Kindly keep in mind JBND has a 6-year duration, thus for every 100 bps of rate moves (lower rates that is), it posts a +6% NAV gain from duration. The fund also comes with a 4.3% 30-day SEC yield, but its main growth engine will be duration and the active management. Thus, duration and dividend yield are responsible for roughly 9% of its performance so far, while the rest comes down to active management and holdings choices.

We are of the belief that this stage of the macrocycle is very favorable for active funds since managers can take advantage of fixed income markets distortions in real time, addressing those pockets that present the best risk-adjusted rewards.

Let us also compare JBND with the iShares 7-10 Year Treasury Bond ETF (IEF) which has a 7-year duration:

IEF contains only treasuries, and targets the intermediate portion of the yield curve via its duration profile. Since JBND was issued, the name managed to outperform IEF by roughly 2.5%, which is down to active management. IEF has a slightly higher duration, which explains the additional 1% of total return versus our benchmark for JBND. Kindly also note the active management in the fund performance when rates moved higher at the beginning of the year. While IEF experienced a -3% drawdown, JBND had a much shallower one due to its active management and futures trading/positioning.

Thus, from a risk/reward perspective, JBND has proven its mettle, being able to outperform IEF with a lower drawdown and overall volatility.

Who should be interested in JBND?

We believe investors interested in the intermediate portion of the yield curve that desire a more active management are well served by JBND. We saw from the fund composition section that the name does not take notable credit spread risk; thus its objective is more geared towards interest rates-driven products for its maturity tenor. JBND, however, is not a pure Treasury/Agency MBS play, but has managed to show narrower drawdowns and higher total returns when compared to IEF.

We do not think JPIE and JBND investors overlap, since the two names represent different duration / composition choices. JPIE caters to lower duration, higher credit risk investors, while JBND is set up as an intermediate rates play. From a macro standpoint JBND makes sense at this point in the cycle, with the Fed set to cut rates in September 2024 and 2024 marking the end of a very fast monetary tightening cycle.

Conclusion

JBND is a fixed income ETF from JPMorgan. The fund came to market in October 2023 and has benefited from rates moving lower in 2024. The ETF is an active take on the intermediate portion of the yield curve, and currently consists of mostly AAA, AA, and A assets, which make up 80% of the holdings. The fund is up +12.5% since issuance, but an investor should look at the net spread of roughly +2.5% versus IEF’s performance (a treasuries only ETF). We are of the opinion the current macro regime is ideal for active funds, and that, broadly speaking, investors should buy and hold the intermediate portion of the curve with a 2-year time-horizon in mind. We like JBND’s active approach and its objectives, and thus are a ‘Buy’ for the name, with the above-mentioned holding period in mind.