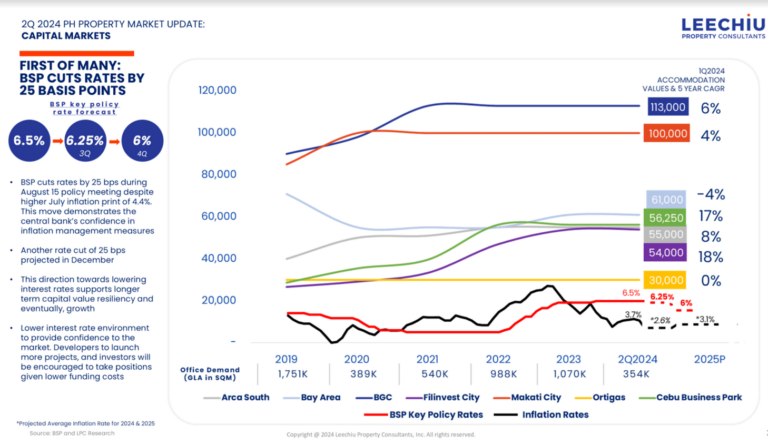

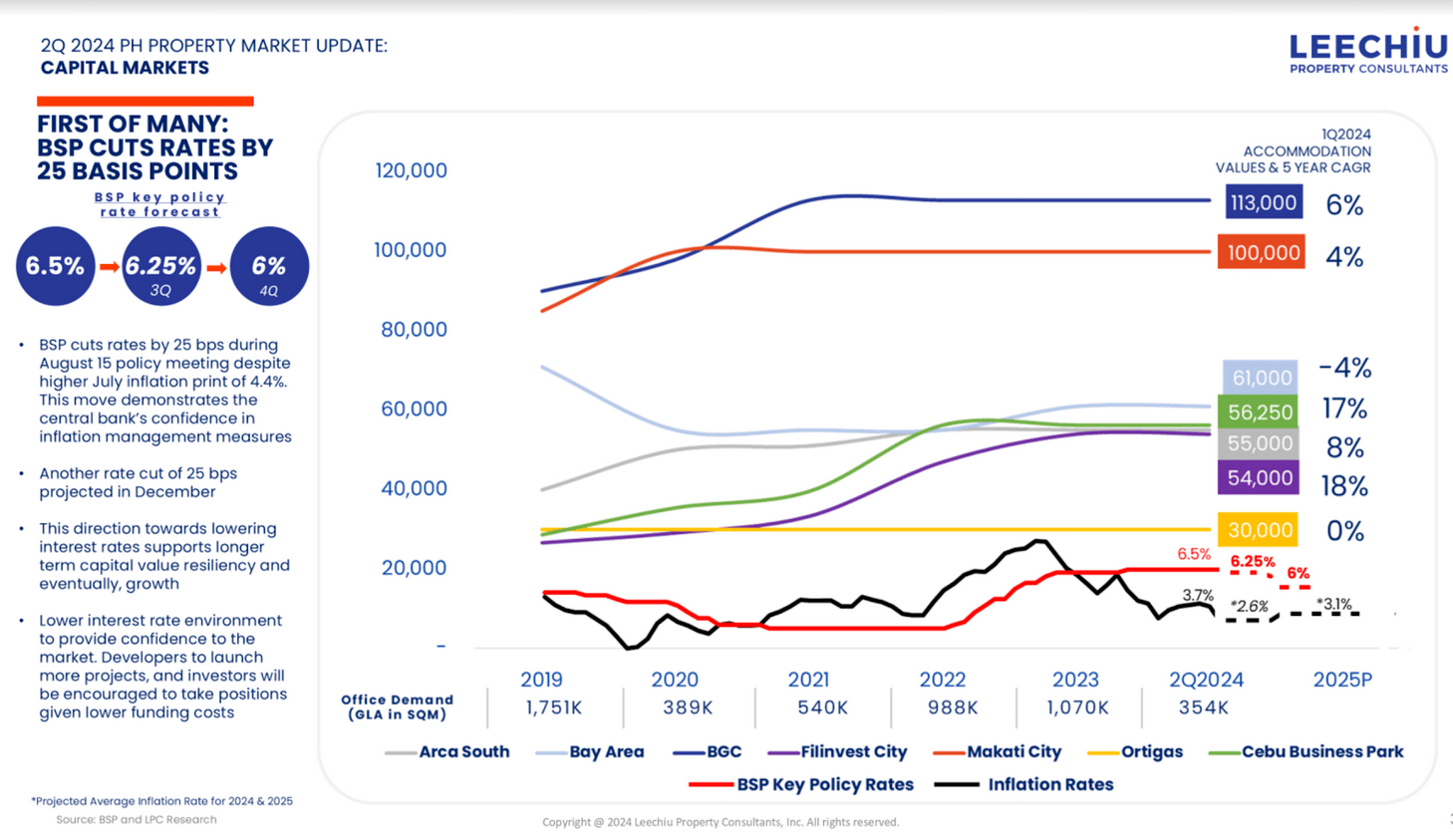

The Bangko Sentral ng Pilipinas (BSP)’s decision on Aug. 15 to cut its key policy rate by 25 basis points to 6.25 percent marks a significant shift in monetary policy.

This brave move is expected to have a positive impact on the Philippine real estate sector, as outlined in Leechiu Property Consultants’ Q2 2024 market update.

Unlocking affordability, stimulating demand

For an extended period, the property market has navigated a challenging landscape characterized by higher-for-longer interest rates. The BSP’s policy adjustment, despite the high July inflation rate, is therefore a welcome development, as it is expected to stimulate economic activity and boost investor confidence.

As lower interest rates allow for reduction in borrowing costs, this translates to more affordable homeownership and property investments for individuals and businesses alike.

As mortgage rates become more competitive, a larger segment of the population will be able to enter or re-enter the property market, thereby driving up demand, allowing stability and growth for property values. Moreover, the decreased cost of capital will incentivize developers to undertake new projects and activate existing land banks.

Beyond the residential sector, the rate cut is also expected to benefit commercial real estate.

Lower interest rates, in general, stimulate more market spending. Higher office space demand, heavier foot traffic for retail malls and establishments, and an extra boost for the already bustling tourism sector are some of the potential real term effects we will experience.

These will drive rental rates and capital values upward and stimulate investment in commercial property development.

Investment opportunities, market confidence

A declining interest rate environment typically shifts capital flows into equities, potentially leading to higher trading volumes in the stock market and real estate investment trusts (REITs).

Combined with capital shifting back into equities, the REIT companies’ diversification strategy approach and away from office-centric portfolios should drive marketability and market action for the REITs.

Ayala Land’s AREIT leads the charge on the balanced portfolio approach with the planned inclusion of the iconic ATG 2 building alongside two malls and two hotels. Similarly, RL Commercial REIT Inc. (RCR) is also aiming for a more diversified REIT portfolio offering with its P34-billion asset infusion, including malls and office buildings.

This new focus on asset diversification and higher asset quality infusion are timely adjustments as it positions REIT companies well to capitalize on the upcoming lower interest rate environment.

Cautious optimism and the road ahead

While the rate cut is undoubtedly positive for the real estate sector and overall sentiment, it’s essential to consider other economic factors. Inflation, employment rates, and government policies will continue to influence market dynamics.

Additionally, the potential impact of a weaker peso due to lower interest rates should be monitored, as it could affect the cost of construction materials and overall property development costs.

The real estate industry is cautiously optimistic about the BSP’s rate cut. While challenges persist, the lower interest rate environment is expected to create new opportunities for both buyers and developers. However, a balanced approach is necessary to ensure sustainable growth and avoid market imbalances.

To fully assess the impact of the rate cut on the Philippine real estate market, it is crucial to monitor key indicators such as property prices, sales volume, inventory levels, and developer confidence. By closely monitoring these indicators, stakeholders can gain a clearer picture of the real estate market’s trajectory and make informed decisions.

The author is the director for Investment Sales at Leechiu Property Consultants Inc.