Spot Bitcoin exchange-traded funds in the United States have seen net outflows of $127.05 million on Aug. 28 led by ARK 21Shares’ ARKB.

Data from SoSoValue indicates that the 12 U.S. spot Bitcoin exchange-traded funds experienced net outflows on Aug. 28, breaking an eight-day streak of positive inflows. During this eight-day period, these funds had attracted $756 million in inflows.

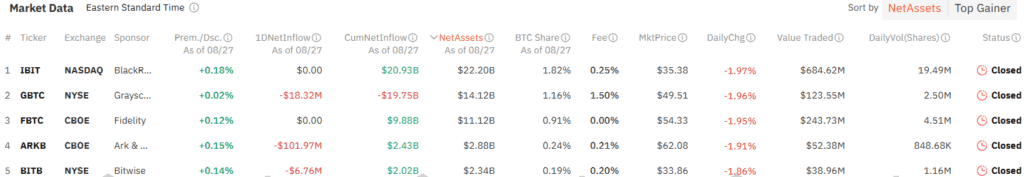

On Tuesday, the U.S. spot Bitcoin funds saw net outflows amounting to $127.05 million. Notably, ARK 21Shares’ ARKB led the outflows with $101.97 million in negative flows — its largest outflow to date, according to SoSoValue’s data. Grayscale’s GBTC reported net outflows of $18.32 million, while Bitwise’s BITB saw $6.76 million in outflows. Valkyrie’s BRRR was not updated at the time of writing.

Meanwhile, the remaining eight funds, including BlackRock’s IBIT, saw no flows on the day. Excluding BRRR, the total trade volume for U.S. spot Bitcoin funds reached $1.2 billion. Since January, these funds have collectively seen net inflows totaling $17.95 billion.

At the same time, the broader market is seeing developments that could impact investor behavior.

Nasdaq has filed with the U.S. Securities and Exchange Commission to list Bitcoin Index Options, which will track Bitcoin’s price via the CME CF Bitcoin Real-Time Index. This move, pending regulatory approval, aims to improve market transparency and offer investors better tools to manage and hedge their crypto positions.

Additionally, CME Group is planning to introduce smaller-sized Bitcoin futures contracts, which could appeal to retail investors.

At the time of writing, Bitcoin (BTC) was down 5.8% over the past day, trading at $59,160, per data from crypto.news.

Ether ETFs continue to record outflows

Meanwhile, the nine-spot Ethereum ETFs collectively saw a significant drop in outflows, which stood at $3.45 million on Aug. 28, marking the ninth consecutive day of outflows.

Grayscale’s ETHE led the outflows once again, with $9.2 million leaving the fund, bringing its total outflows to the $2.55 billion mark since its launch on July 23. Meanwhile, Fidelity’s FETH and Bitwise’s ETHW were the only offerings to record inflows of $3.9 million and $1.9 million, respectively. The remaining six ETH ETFs saw no flows on the day.

These investment vehicles have also seen their daily trading volume rise to $129.9 million on Aug. 28, an increase over the previous day. The spot Ether ETFs have experienced a cumulative net outflow of $481.32 million to date. At the time of publication, Ethereum (ETH) was also down 8%, exchanging hands at $2,463.