HOUSTON, Texas – The Houston Independent School District named the 13 people who will now oversee the district’s $4.4 billion school board bond if approved by voters in the November election.

The announcement of the Bond Oversight Committee members, appointed by the state-appointed superintendent Mike Miles, concluded Thursday’s more than seven-hour school board meeting.

To be considered for the committee, interested candidates had to fill out a detailed application, explaining why they wanted to serve on the committee, relevant experience and skills that would assist them in their duties.

According to the district, up to nine unpaid voting members, including a chair and vice chair, will serve on the committee, which will hold public meetings at least once every three months, monitor the progress of bond projects, provide regular updates to district leaders, communicate allegations of wrongdoing, potential waste or fraud to the superintendent and other oversight duties related to the bond.

The committee will serve for the period it takes for the bond to be fully executed and complete. If a board member no longer wishes to continue with their duties, they must provide the superintendent with a written notice of their internet to no long serve on the committee.

All of the committee meetings will be open to the public.

The committee members, which consist of parents, business representatives and people with expertise in construction and building design are listed below:

Andy Canales

Andy Canales is the Principal and Operating Partner at Broadtree Partners and the Founding Executive Director of Latinos for Education. With experience in teaching and nonprofit management, he is committed to overcoming barriers faced by Latino students and ensuring their access to quality education.

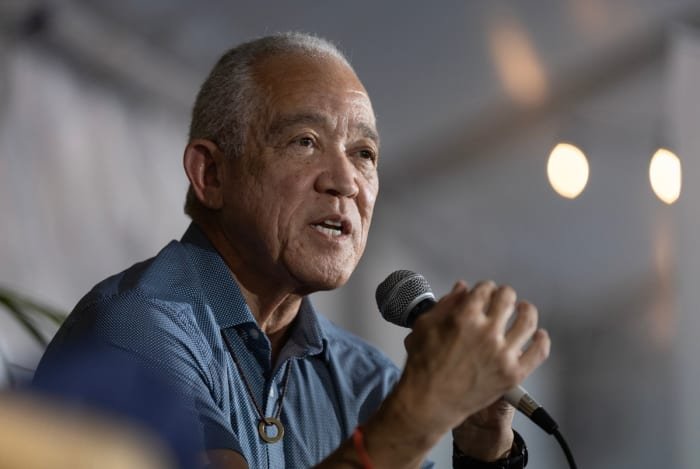

Andy Chan

Andy Chan, former Mayor of Southside Place and Houston’s first Asian American Mayor, has served on various HISD committees, advocating for transparency in public funds and supporting educational initiatives.

Bob Eury

Bob Eury, retired president of Central Houston, Inc., led urban development efforts for four decades. With expertise in environmental design and large-scale development, Bob contributes as a consultant and civic board member.

Chris Brown

Chris Brown, former Houston City Controller, reformed Houston’s pension liability, reducing it by $6 billion. He has overseen $4 billion in bonds and led transparency efforts like the Open Finance Initiative. As an HISD parent, Chris advocates for bond oversight and fiscal responsibility.

Christopher Cola

Christopher Cola, a CPA and former CFO/COO, brings financial expertise to ensure bond compliance and performance. As an HISD parent, he has served on multiple school committees.

Daria Wenas

Daria Wenas, Managing Director at Ernst & Young LLP, specializes in US partnership taxation and financial modeling. As an HISD parent, Daria aims to ensure bond funds are properly allocated, leveraging her expertise in financial due diligence and transparency.

Felix Chevalier

Felix Chevalier, an attorney with experience in government and corporate law, offers insights into risk management and governance. His focus on ensuring the effective use of taxpayer dollars stems from his deep commitment to public education.

Lauren Haller Fontaine

Lauren Haller Fontaine, Senior Director at Pattern Energy, is a legal expert focused on compliance and financial oversight. As a parent of an HISD student, she is committed to sustainable fiscal practices that benefit the district.

Marcos Rosales

Marcos Rosales, a trial lawyer and former general counsel, has extensive business and construction experience. An HISD parent.

Mark Mallette

Mark Mallette, retired COO of Freeport LNG, brings over 41 years of experience in managing large-scale projects.

Michael Davis

Michael G. Davis, founder of Brooks & Davis Real Estate Firm, is a real estate broker and certified success coach. An HISD parent and former Bond Oversight Committee member.

Taylor Chapman

Taylor Chapman, Investment Principal at New Climate Ventures, leads efforts in decarbonization technologies. Passionate about education, Taylor supports strategic decision-making in public institutions for lasting student impact.

Wendell Robbins III

Dr. Wendell Robbins III, President of W.A. Robbins Construction Co., brings 25 years of construction expertise. A former HISD student and contractor.

Jarred Morgan (Alternate)

Jarred Morgan, Principal Consultant at AG Consulting Partners, has over 15 years of experience in change management. An HISD graduate and community leader.

Karen Duffy (Alternate)

Karen Duffy, an active community volunteer, serves on the HISD District Advisory Committee. With over 20 years of nonprofit leadership experience, Karen is committed to transparency and effective bond oversight to benefit HISD students.

Copyright 2024 by KPRC Click2Houston – All rights reserved.