The Securities and Exchange Commission has extended its review period for a proposed rule change that would allow options trading on Ethereum exchange-traded funds, according to an Oct. 11 notice.

The original 45-day review period was set to expire Oct. 19. However, the SEC has now designated Dec. 3 as the new deadline for a decision, according to the filing.

The proposal, filed by Cboe Exchange on August 19, seeks to amend Exchange Rule 4.3 to permit the listing and trading of options on shares of the nine Ethereum ETFs, including products from Fidelity, Grayscale and BlackRock’s iShares, the SEC filing stated.

The SEC stated in the notice that it “finds it appropriate to designate a longer period…so that it has sufficient time to consider the proposed rule change.”

Ethereum ETF Options

If approved, the rule change would enable options trading on ETFs tracking ether, the native token of the Ethereum smart contracts blockchain and second largest digital asset by market value. Last month, the SEC approved options trading on BlackRock’s iShares spot bitcoin ETF.

Options are financial contracts that offer investors the right to purchase or sell an asset at a pre-determined price.

Ether was recently trading at about $2,600, according to crypto markets data provider CoinMarketCap. It has risen about 6% over the past 24 hours, part of a wider upsurge in cryptocurrencies that started during Asia trading hours.

Read More: SEC Greenlights Options on BlackRock’s IBIT

Spot Ethereum ETFs have received mixed investor interest since their debut in July, shedding nearly $550 million in assets, according to data from U.K.-based asset manager Farside Investors. The number is skewed by more than $2.9 billion in net outflows from the Grayscale Ethereum Trust (ETHE), although that fund differs from the other fledgling products in that it is a conversion from a closed fund and carries by far the highest fee, 2.5%.

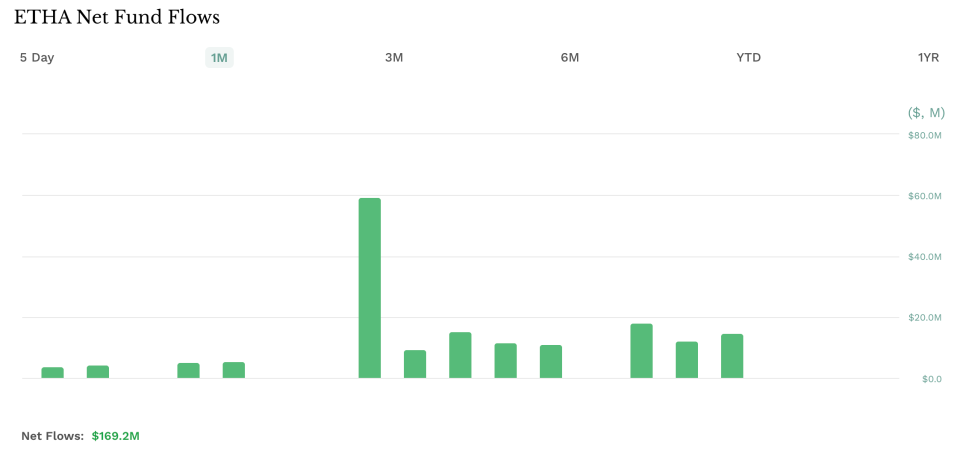

The iShares Ethereum Trust (ETHA) has generated about $1.2 billion in net inflows, the most among the funds, while the Fidelity Ethereum Fund (FETH) has received roughly $450 million in net inflows.

The Bitwise Ethereum ETF (ETHW) and VanEck Ethereum ETF (ETHV) have also seen positive inflows of $318 million and $68.9 million, respectively, according to Farside.