As the Treasury Department’s antiquated website has been giving bond investors fits, F/m Investments is hoping to seize on the opportunity to offer smoother access to government bonds through its suite of single-security ETFs that cover a full spectrum of the yield curve.

The federal government’s TreasuryDirect website has reportedly become so overwhelmed with demand for Treasury bonds, investors are being told they might have to wait up to a year to get liquidity by moving their Treasury bonds to outside brokerage accounts.

Alex Morris, chief executive of F/m Investments in Washington, DC, can’t do much about the estimated four million accounts stuck in TreasuryDirect, but his firm has been offering an alternative for the past two years.

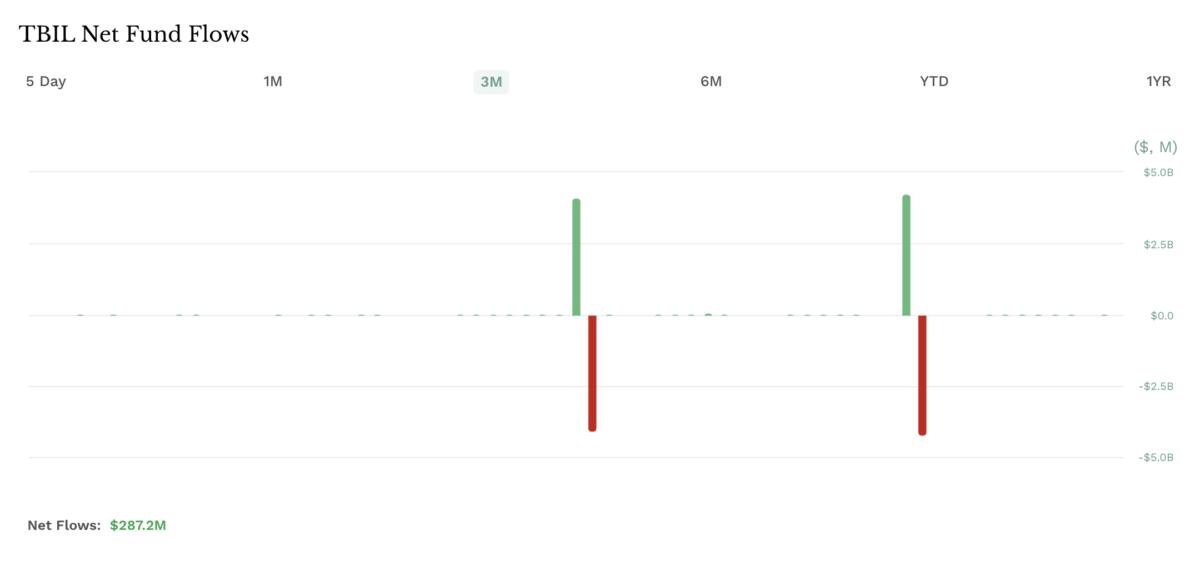

Anchored by the flagship $4.3 billion US Treasury 3 Month Bill ETF (TBIL), F/m Investments manages nearly $6 billion across a suite of 10 ETFs offering exposure to individual Treasury bonds.

In its first full calendar year in 2023, TBIL was awarded etf.com’s award for Best New ETF.

Introduced in August 2022, these were the original single-security ETFs, before creativity started sweeping across the ETF space with leveraged and inverse exposure to popular stocks like Tesla and Nvidia.

Easier Way to Trade Treasuries?

Unlike the levered-up single-stock versions that employ derivatives to soup up performance, the F/m single-security ETFs are nothing more than an easier way to trade Treasuries.

“We hold the same bond with substantially more liquidity, and we transact on the secondary market,” Morris said.

The issue F/m Investments is seeking to address with its ETF suite emerged in late 2020 when the federal government’s response to the Covid pandemic was to drastically raise interest rates, which drove inflation to historic levels and made certain Treasury bonds look like a sure bet.

The sudden popularity of I-Bonds, which had lived in relative obscurity for decades prior to inflation hitting a 40-year high, helped increase the number of accounts on TreasuryDirect from around 600,000 in 2019 to nearly four million today.

As the Wall Street Journal reported last week, the TreasuryDirect website is so outdated and under-supported, some investors are having to wait months just to navigate their bonds off the government website and onto an outside brokerage platform where they can be sold.

“TreasuryDirect is kind of a cool service because everyone can participate directly; buying bonds right alongside institutional investors like Goldman Sachs,” said Morris. “But the downside is, TreasuryDirect is not designed to be a retail broker.”

In essence, the website was originally set up as a way to buy government bonds to be held to maturity. For investors looking to sell before the bonds mature, the process involves a slow and outdated method of moving those bonds onto a brokerage account.

“You can buy things on TreasuryDirect, but there is no sell button,” Morris said. “It’s far from easy to move bonds to an outside brokerage account, and I think a lot of people forgot that.”

Permalink | © Copyright 2024 etf.com. All rights reserved