Also 25 ETFs that tend to outperform during May

Subscribers to Chart of the Week received this commentary on Sunday, May 4.

In early April, exchange traded funds (ETFs) took a hit alongside the broader indexes, another victim to U.S. President Donald Trump’s global tariff market meltdown. Trade war tensions pressured international allies to their furthest depth of patience and flexibility, with retaliatory levies pouring in from across the globe almost immediately. Tensions have been easing over the past few weeks, however, and things may finally be looking up for two of the (arguably) most popular ETFs.

VanEck Semiconductor ETF (NASDAQ:SMH) is jumping higher, slated to close out Friday with a third-straight daily pop and its first close above the 50-day moving average since late February. The shares pulled back to a nearly 14-month bottom of $170.11 on April 7, but have since rallied 24.8% (as of Thursday’s close) and are now facing off with the overhead $220 level. This area was a floor in March, and should today’s gains continue to build, could move in as such again.

Another ETF in recovery mode is the SPDR S&P 500 ETF Trust (SPY), looking to close out the week with a ninth-straight daily win, its longest win streak since last May. The equity has also been attempting to pivot off its April 7, 52-week low of $481.80. As of Thursday’s closing bell, the SPY has added nearly 16% since its pullback alongside the broader market, now enjoying newly emerged support at both the 360-day trendline and $540. The latter has been a historical level of support, capturing pullbacks in June, July, and September. The SPY remains below breakeven in 2025, however, leaving more to be desired.

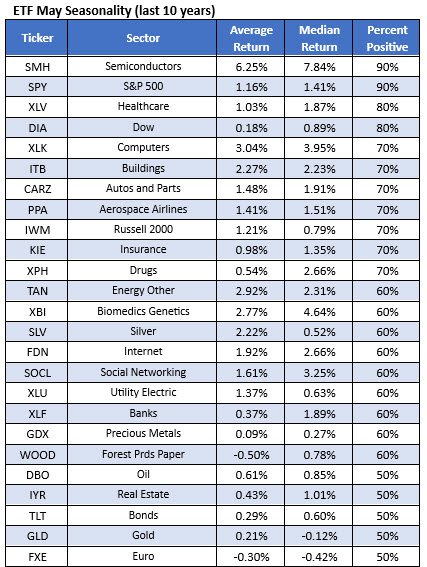

There’s good news for bulls, as history suggests May tends to be a decent performer for both ETFs. In fact, SMH and SPY both landed the top two spots on Schaeffer’s Senior Quantitative Analyst Rocky White’s list of 25 best ETF performers in May. Taken from data spanning the past decade, May seasonality has brought substantial growth. Respectively, SMH and SPY averaged returns of 6.3% and 1.2% over this time frame for the month, both positive 90% of the time. From their current levels, similar jumps would put SMH above $230 and SPY around $573 – closer to their March highs.

Over the past 10 trading days puts have been popular for SMH, with the most activity seen at the weekly 4/25 175-strike put, where 130,689 contracts have been traded. More than half of this has been selling activity, indicating investors were already expecting shares to remain well above the ETF’s early April lows.

Bulls have already been moving in on SPY. The most popular contracts during the past two weeks of trading has been the weekly 4/25 550-strike call, suggesting options traders have placed their bets on the ETF holding itself above water amid the tariff turmoil.

Options are looking affordable for both exchange traded funds, too. SMH and SPY’s Schaeffer’s Volatility Indexes (SVI) of 39% and 22% rank in the 22nd and 26th percentiles of the past year, meaning options are relatively cheap at the moment.

Undoubtedly tariff turmoil will be hard to avoid altogether, and with companies making short-term resolutions through bulk buying ahead of levy implementations, the long-term effects will likely be more severe. Headwinds look imminent for those staring down increased supply chain disruptions and prices. Look at how some sector ETFs have been and could be impacted by glancing at the chart below (pulled the day after the April 7 market selloff).

When reviewing White’s data and the multiple support pieces moving into place, however, ETFs look like they might be a more risk-adverse route for the bullish trader. But as always with Wall Street, proceed with caution and try to balance fundamentals and sentiment.