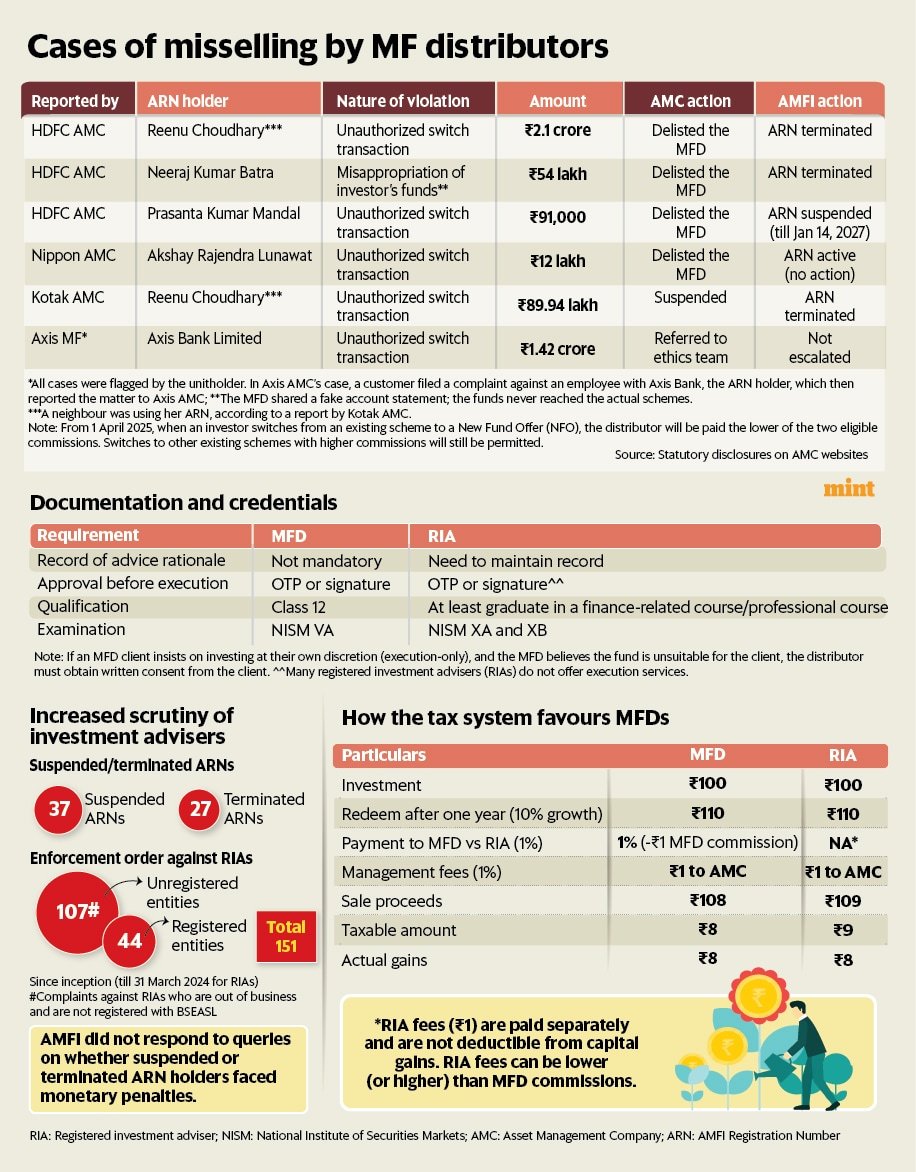

A review of the statutory disclosures provided by the top 20 asset management companies (AMCs) in the country shows that only four fund houses—HDFC AMC, Nippon AMC, Kotak AMC, and Axis AMC—reported six cases of mis-selling by MF distributors for the January-March period. Other companies marked the field as ‘NA/Nil’.

“Six reports of mis-selling cases among crores of investors seem like a drop in the ocean. A huge number goes unreported. However, it’s good for a start,” said Kavitha Menon, RIA and founder of Probitus Wealth.

Five of the six cases involved alleged unauthorised switch transactions, which involve distributors switching from one scheme to another without informing the client. This is generally done when the second scheme fetches the distributor a higher commission. When the first scheme is sold to buy the new scheme, the investor may be subject to capital gains tax.

Sebi mandated that from1 April 2025, switches from an existing scheme to an NFO will fetch the distributor the lower commission between the two schemes. Switches to the existing schemes with higher commission are still permitted.

For instance, Nippon AMC reported that a distributor did an unauthorised switch of ₹12 lakh from Nippon India Large Cap Fund to Nippon India Innovation Fund. The first fund has a regular total expense ratio (TER) of 1.54%, whereas the second fund has 1.99%. Higher regular TER suggests the distributor might be getting a higher commission on the second scheme.

TER is the cost that an AMC recovers for managing funds. Regular TER includes distributors’ commissions, while direct plans don’t include commissions.

Other instances of unauthorised switches do not mention the schemes involved. All six cases of mis-selling were reported by the unitholders themselves, although complaints can be received from various sources, including AMC’s Internal Monitoring & Surveillance mechanism, social media, the newspaper, another ARN holder, Sebi, and AMFI.

Emails sent on 20 May to the Securities and Exchange Board of India (Sebi), the Association of Mutual Funds in India (Amfi), HDFC AMC, Nippon AMC, Kotak AMC, and Axis AMCs that reported cases of mis-selling did not elicit any response.

View Full Image

Also Read: Why you cannot complain to Sebi about unregistered investment advisors

Fake identity

Kotak AMC received a complaint from a unitholder that a switch transaction of ₹90 lakh was done without their knowledge. The company’s attempts to contact the AMFI registration number (ARN) holder, Reenu Choudhary, in February and September 2024 failed.ARN is a unique number given to individuals and entities who have a licence to sell mutual funds and can earn a commission.

According to the report, senior officials were informed that she had shifted to a different location. Much later, the ARN holder’s spouse finally picked up the officials’ call and said the couple was unaware of such transaction.

The couple claimed that the ARN was used by a neighbour who had previously worked for Yes Bank. Kotak AMC said they found that this person had left the bank. “ARN holder has also given a written statement stating the facts,” said Kotak AMC in the quarterly mis-selling report.

HDFC AMC also reported an unauthorised switch transaction from the same ARN worth ₹2.1 crore. While HDFC AMC de-empanelled the ARN number, Kotak AMC suspended the ARN.

The AMFI website shows that the ARN has been terminated. AMFI lists the ARNs that are suspended or terminated on its website without giving more details. All other cases, except one by Axis AMC regarding ‘unauthorised switch transactions’, led to the ARN getting de-empanelled with the AMC.

Axis AMC found that one of the Axis Bank employees had taken signed slips of switch transaction forms without mentioning the schemes involved. The employee was referred to the internal ethics team for disciplinary action. Emails to Axis AMC remained unanswered.

Also Read: Is your mutual fund distributor letting you down? Here’s how to switch

Outright fraud

HDFC AMC reported another case of ‘misappropriation of investors’ funds.’ The ARN holder had shared fake screenshots of a mutual fund account statement, but the money was never received by the AMC. The case involved the misappropriation of ₹54 lakh. The ARN holder’s licence has been terminated by AMFI.

Questions sent to Amfi, Sebi, and the AMC asking if the client suffered any monetary loss and what was done to compensate them did not elicit any reply.

“Actions taken by AMFI include reprimand/ warning/ temporary suspension of ARN/ deactivation of ARN, or permanent cancellation of ARN and debarment from doing mutual fund business,” said a letter dated 9 January, 2025, by Sebi to AMFI, seen by Mint.

Many cases of misdealing or fraud by Sebi-registered investment advisors or research analysts attract fines. However, Mint could not ascertain whether any punitive action was taken against the rogue MFDs and what happened to the affected clients.

AMFI website shows 37 ARNs have been suspended and 27 terminatedsince inception. AMFI does not publicly disclose why those ARNs were suspended or terminated. There are 932 investment advisors and 1.73 lakh ARN holders in the country.

The solution

Vishranth Suresh, co-founder and CEO of Asset Plus, a platform for MF distributors, said that as the industry grows, mutual fund distributors can be held more accountable for handling people’s life savings.

When a registered investment advisor gives any kind of suggestion or advice to their clients, they have to follow strict record-keeping and suitability guidelines as per Sebi rules. On the other hand, MFDs are subjected to less scrutiny.

For starters, Sebi IAs can charge fees from the clients, whereas MFDs can only earn through commissions from AMCs. While IAs can do complete financial planning, MFD can only give incidental advice. Incidental advice allows MFDs to recommend a curated list of MF schemes based on the client’s goals, needs, and risk profile, etc.

Vivek Rege, an RIA and CEO of VR Wealth Managers, said that, as per IA regulations, they need to keep a record of every advice that can later be used for an audit.

“Every time advice is given, the IA needs to show the client and keep a record (be it email, physical paper, or voice record, etc) of the rationale of the advice given and why it is suitable for that particular client. It can be: buy order, sell order, switch, SIP, SWP, STP, etc,” said Rege.

He added that after the client’s consent is received, they can implement the advice. However, implementation is not execution. It simply means that the IA can send an execution order after the consent is received. The order finally has to be executed by the customer using OTP or a signature. Clients also choose to execute the order on their own, added Rege.

In contrast, MFDs don’t have to maintain any record of rationale or suitability while giving out advice. Typically, an MFD would talk to the client about the trade and execute it using OTP in the online mode or a signed form in offline mode.

“The transaction nature is well understood by investors and investors approve the transaction link using OTP. We discourage the sharing of OTP,” said Amol Joshi, an MFD and founder of Plan Rupee Investment Services.

However, when a client wants to invest in a scheme on their discretion (execution only), and if the MFD thinks it’s not suitable for them, the latter is required to record a written consent from the client.

AMFI requires MFDs to do a risk profiling to check if the investment aligns with their risk appetite, needs, and objectives, and assess the suitability/appropriateness of the MF product being recommended to clients. However, this is a one-time exercise and is not done every time a mutual fund is recommended.

Once an MFD crosses a certain threshold, they are subject to an enhanced due diligence process.Such thresholds include crossing ₹100 crore in AUM, more than ₹1 crore commission received per year (across industry), commission received is more than ₹50 lakh from a single AMC or is present in more than 20 locations.

“If an MFD suggests a client shift from large caps to small caps, they should be able to explain the rationale behind it,” said Vishranth, who runs a platform for MFDs and oversees more than ₹5,000 crore in assets. “Mandatorily keeping records might be practically impossible, especially in smaller towns and cities, but some form of record keeping could be encouraged.”

“Most mis-selling would happen in offline mode as the MFD might take a signature from clients without adequately informing them about the transaction. Online, at least the OTP comes, and the client needs to validate it,” said Vishranth.

Also Read: Sebi proposes to allow investment advisers, research analysts to charge advance fee for up to 1 year

Checking entry point

Qualifications of MFDs are also relaxed compared to IA. An IA needs to be at least a graduate, a diploma holder in certain finance-related fields, or a professional degree holder. To become an MFD, one needs to pass class 12 and clear the NISM VA exam.

“As the industry grows, we can move towards a stricter entry barrier(for MFDs)to maintain quality in the system. Maybe Sebi can start by making the entry barrier stricter for the top cities and slowly extend it to tier-2 and tier-3 cities,” said Vishranth.

Joshi of PlanRupee Investment Services said existing rules should be enforced more stringently instead of bringing in more rules.

Case for MFDs over RIAs

There’s one scenario where regular plans (sold via MFDs) can offer a tax advantage over direct plans (via RIAs). When a regular unitholder redeems a mutual fund unit, it is net of management fees and commissions.

Let’s say a direct investor (via RIA) and a regular investor (via MFDs) invest ₹100, and assume there is a 1% management fee and 1% commission charged by the MFD via AMC. Assuming the investment generated 10%, the investment would become ₹110.

However, when the direct investor (via RIA) redeems, a 1% management fee would have been deducted, and the investor would get capital gains of ₹9. On the contrary, when a regular investor redeems, the capital gains would be ₹8, accounting for 1% management fee plus 1% distributor commissions.

The fees paid to RIA cannot be adjusted against the capital gains. “The fees charged by RIA might be less or more than the commission paid,” said Manuj Jain, co-founder of ValueMetrics Technologies.

Another hurdle to moving from a mutual fund to an RIA is that a regular plan cannot be switched to a direct plan unless the unitholder redeems their fund. Selling may attract capital gains tax, which may act as a barrier while shifting from an MFD to an RIA. If one is shifting from one MFD to another, the new distributor may earn a lower commission than the other after a six-month cooling period.

Also Read: AMFI says 17 mutual fund distributors earn commissions above Sebi’s cap. But is the data accurate?