The Solana and XRP ETFs are enjoying a solid start to life on Wall Street, with institutional investors showing notable interest in these funds, as evidenced by the inflows. These funds again attracted fresh inflows even as the crypto market extended its decline, led by Bitcoin.

Solana and XRP ETFs Record Net Inflows

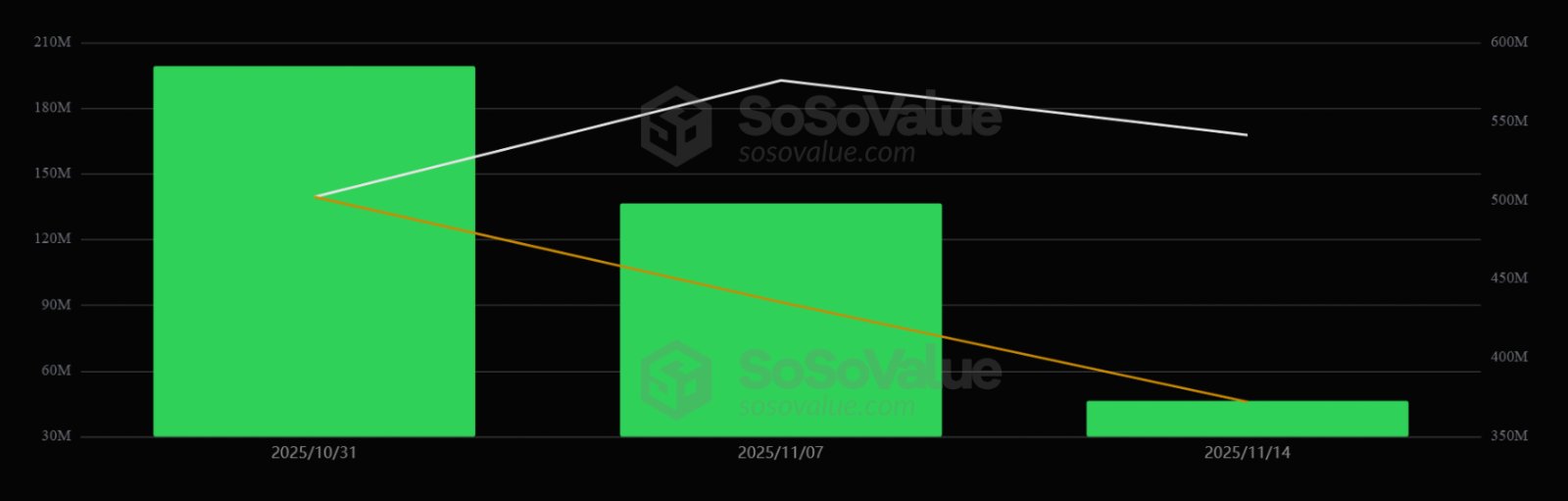

SoSo Value data shows that the Solana ETFs recorded a daily net inflow of $12 million on November 14. Specifically, Bitwise’s SOL ETF recorded a daily net inflow of $12 million while Grayscale’s saw zero net flows.

Meanwhile, these funds saw weekly net inflows of $46 million. Notably, these funds have been on a streak of daily net inflows since they launched three weeks ago and have yet to record a daily net outflow. Canary’s XRP ETF also had a good outing on November 14, which was its second day 2 of trading.

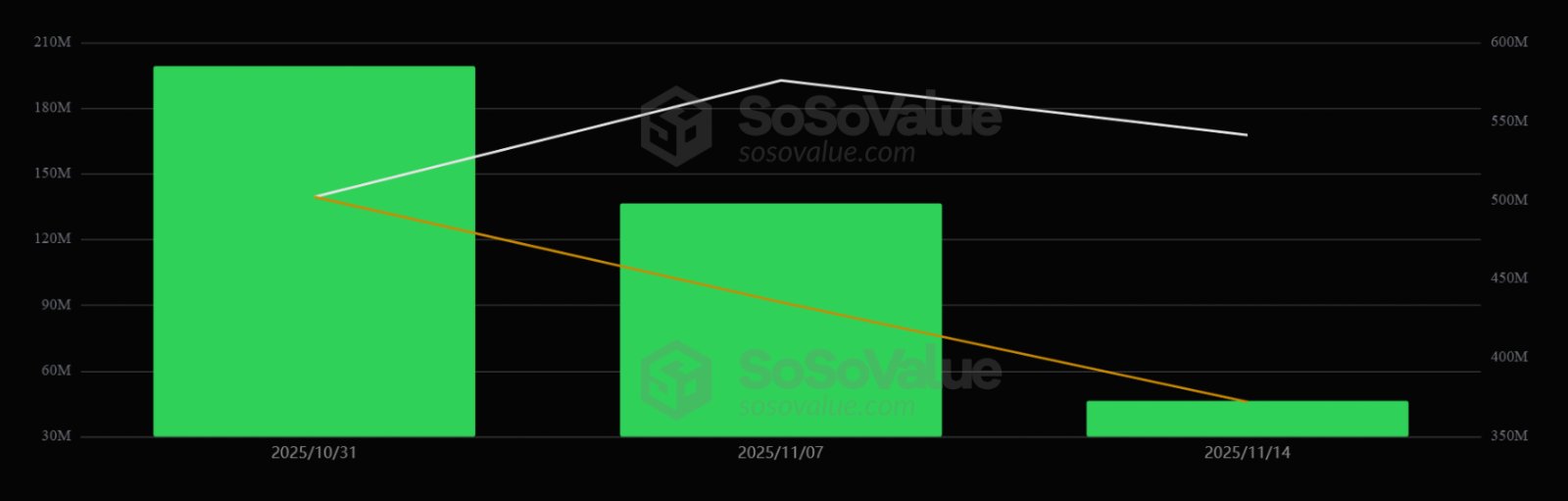

SoSo Value data shows that the XRP fund saw a daily net inflow of $243 million, just below the $245 million it took in on day one of trading. As CoinGape reported, Canary’s fund topped Bitwise’s Solana ETF with a trading volume of $58.5 million and $245 million in inflows recorded on November 13. As a result, Canary’s fund now has the best launch among all ETFs launched this year.

The XRP ETF has surpassed estimates, as Bloomberg analyst Eric Balchunas had predicted the fund would reach only about $17 million in trading volume, while his colleague James Seyffart predicted it would record around $34 million.

More XRP Funds Set To Launch Soon Enough

More XRP ETFs are set to launch as early as next week. As CoinGape reported, the SEC issued guidance clarifying that all S-1s without delaying amendments can become effective after 20 days.

Notably, Franklin Templeton, Bitwise, and 21Shares are all due to launch their XRP funds next week based on their updated S-1s, in which they removed the delaying amendment. Meanwhile, Balchunas predicted that crypto ETFs that have yet to file Form 8-A will do so as soon as possible, so their registration statements can become effective automatically after 20 days.

SEC put out some guidance where it looks like issuers can sort of speed up the effectiveness of filings in an effort to clear out some backlog. My guess is some of those crypto etfs that didn’t do the 8a thing will try and push out as soon as they can. Bitwise XRP is due next up… pic.twitter.com/vY3ja5Xk1I

— Eric Balchunas (@EricBalchunas) November 14, 2025