‘The day is not too far when the share of MFs alone will be greater than that of foreign institutional investors.’

Illustration: Dominic Xavier/Rediff

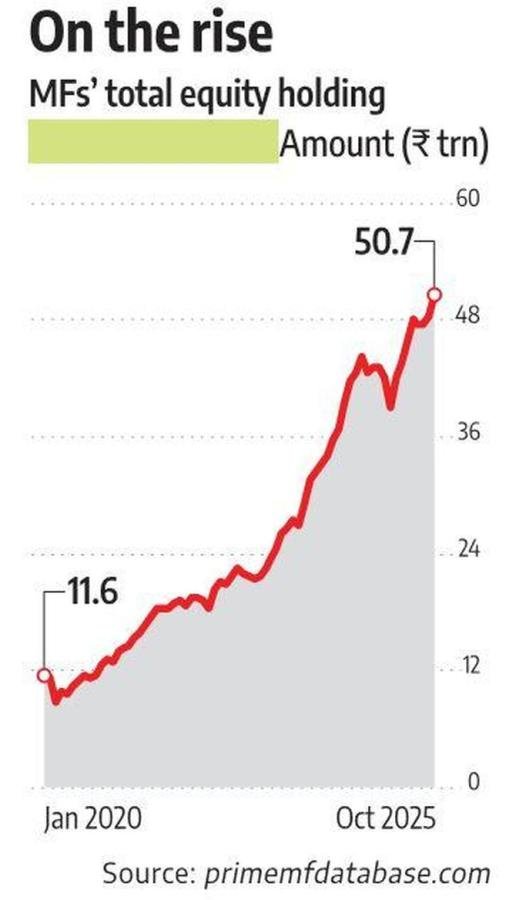

Mutual funds’ equity assets under management (AUM) have crossed the Rs 50 trillion mark for the first time, driven by steady inflows and a buoyant equity market.

At the end of October, equity assets stood at Rs 50.6 trillion, doubling in a little over two years.

The milestone underscores MFs’ standing as the most preferred route for equity market participation.

The surge in MF ownership has come on the back of a growing investor base and the reliability of SIPs (systematic investment plans).

“The milestone shows how MFs have become one of the most trusted and efficient ways for households to participate in the equity markets,” said Radhika Gupta, managing director and chief executive, Edelweiss MF.

“This rise has been made possible by decades of effort from our MF distributor community in building investor confidence, and by regulators who have ensured that MFs remain a transparent and well-governed avenue,” added Gupta.

In calendar year 2025 (up to October), active equity schemes have drawn net inflows of Rs 2.9 trillion.

In 2023, investors poured in Rs 3.9 trillion — more than twice the amount seen in 2022.

SIP inflows, which witnessed a rare decline in early 2025 during the market correction, are again scaling new summits each month. In October, SIPs brought in Rs 29,529 crore.

Despite softer inflows into equity schemes, MFs’ net equity buying is on track to touch a new peak. As of October-end, net equity purchases in 2025 stood at Rs 4 trillion, compared to Rs 4.3 trillion in 2024.

MFs now hold nearly 11 per cent of India’s total market capitalisation.

The rising clout of domestic funds has strengthened the market’s resilience, say analysts.

The growing firepower of MFs and other domestic institutions has made Indian equities less dependent on foreign flows.

“Indian markets are continuing their steadfast march towards even more atmanirbharta (self-reliance), with the day not too far when the share of MFs alone will be greater than that of foreign institutional investors,” said Pranav Haldea, MD, Prime Database.

“The gap between MF and foreign portfolio investor ownership has nearly halved to 5.78 per cent in the past two years. At its peak, the gap was 17.15 per cent on March 31, 2015, with FII share at 20.71 per cent and MF share at just 3.56 per cent,” he added.

The latest Rs 10 trillion addition to MF equity ownership came in 15 months — almost twice the time it took for holdings to rise from Rs 30 trillion to Rs 40 trillion, according to Prime Database.

The sluggish pace, experts said, reflects lower mark-to-market gains.

Changes in MF equity holdings depend on two factors: Net inflows and shifts in the value of underlying assets.

Feature Presentation: Aslam Hunani/Rediff