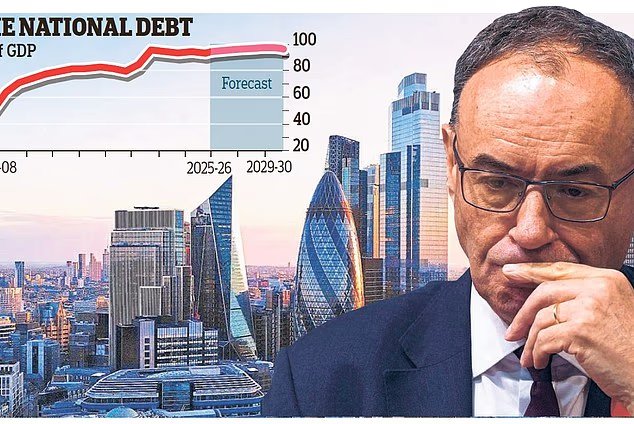

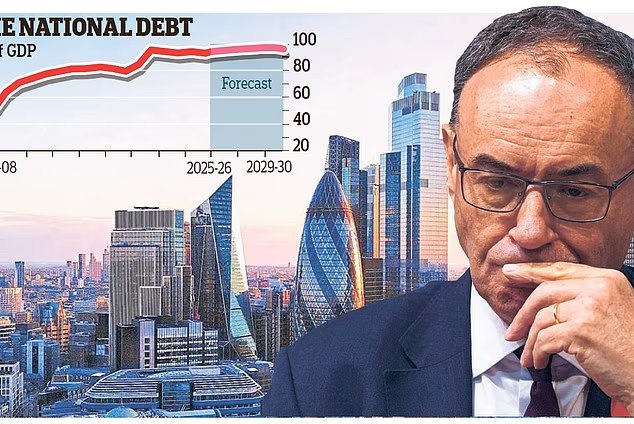

The Bank of England has sounded the alarm over the increasingly important role a small number of mainly foreign hedge funds hold in financing government borrowing.

It warned the growing involvement of the firms in buying up UK bonds, known as gilts, raised the risk of markets becoming ‘disorderly’ and seizing up.

The Bank’s alert comes after hedge funds borrowed nearly £100billion against gilts last month – a record.

And it will add to growing concerns about the reliance of the UK on what has been described as ‘the kindness of strangers’ – or overseas investors – to finance the Government.

The concern centres on the ‘gilt repo’ market in which gilts are sold and repurchased for brief periods, often overnight.

The market serves an important function keeping cash and gilts moving through the financial system.

Debt burden: The Bank of England warned the growing involvement of the firms in buying up UK bonds raised the risk of markets becoming ‘disorderly’ and seizing up

The Bank flagged its concerns in its Financial Stability Report, citing previous shocks such as the 2022 meltdown in liability driven investments (LDIs) that hit pension funds.

Hedge funds are heavily involved in trades that involve bets on small discrepancies between current and future gilt prices as they seek returns.

The Bank said activity is ‘heavily concentrated’, with a few hedge funds accounting for more than 90 per cent of all net gilt repo borrowing.

It warned: ‘Relatively high use of leverage by a small number of firms taking crowded positions increases vulnerabilities and the risk of a disorderly unwind as well as a jump to illiquidity in core UK markets.’

Amid a ‘highly uncertain global environment’, a key concern is that funds might need to stage a fire sale of gilts in response to a shock. Forced selling could trigger a ‘feedback loop’, prompting even more selling.

The Bank said: ‘Funds could need to de-leverage simultaneously in response to a shock if funding conditions tightened to the extent that refinancing became unavailable or prohibitively expensive.’

The dominance of foreign funds in the market adds to the worries. Hedge funds managed outside the UK account for about 60 per cent of gilt repo borrowing, making them harder for British regulators to monitor.

Hedge funds have become increasingly important players as insurers and pension funds – traditionally the main buyers of gilts – retreat.

Separately, the Bank stepped up monitoring of private markets, which now play a key role in global finance.

It plans its first stress-test on risks posed by private markets – scrutiny previously reserved for banks.

AI boom is ‘like dotcom bubble’

Artificial intelligence (AI)stocks could be in a bubble even if the technology transforms the world, the Bank of England’s governor has warned.

Andrew Bailey said it was ‘not inconsistent’ that even if the tech reshapes society, the frenzy for related shares could be overdone.

Bailey made the warning as the Bank said stock market valuations in the US are ‘close to levels not seen since the dotcom bubble’ 25 years ago – and in the UK since the global financial crisis of 2008.

‘This heightens the risk of a sharp correction,’ the Bank said in its Financial Stability Report.

Similar concerns about an AI bubble have also been expressed by the International Monetary Fund and the European Central Bank.

The anxiety stems from stellar share price gains at firms such as Nvidia as investors bet on the AI revolution. The mania for these shares has helped drive stock markets to record highs.

Bailey drew a distinction between the current situation and the dotcom bubble as new tech giants do generate cash – and were ‘not created on hope’ as some were in the 1990s.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Freetrade

Freetrade

Investing Isa now free on basic plan

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.