Equity investing at its root is quite simple. You make money by buying great businesses below their actual value and sharing in their profits as they compound.

But the investment industry doesn’t like to keep things simple, because then it becomes hard to pitch new products to you. Therefore, it thinks up ‘innovations’ that sound terribly intelligent but make life difficult for investors. Factor funds, also known by the moniker smart beta funds, fall into this category.

Factor funds made their debut in India playing on common factors such as Value, Low Volatility, Quality, Momentum and Alpha. Today, there are factor funds combining multiple factors and market caps into potent-sounding cocktails such as Nifty Smallcap250 Momentum Quality 100 or Nifty Midsmallcap 400 Momentum Quality 100.

Assessing factor funds

Factor investing goes by the premise that fund managers, who follow a specific style of investing, select stocks through a few standard filters. These can be distilled into three or four quantitative metrics. An index is constructed by applying these metrics to a universe of stocks and rebalanced regularly. This way, investors get to enjoy the high returns that come from active stock-picking along with the low costs of index investing.

Factor funds in India mainly play on the following:

Value: Stocks that have the lowest PE (Price-Earnings), P/BV (Price to Book Value), Dividend Yield along with high ROCE (Return on Capital Employed).

Quality: Stocks with high ROE (Return on Equity), low debt-equity ratio and low earnings growth variations in the last five years.

Momentum: Stocks that rank high on six-month and 12-month momentum ratios. Momentum ratios are stock price gains divided by their volatility (Standard Deviation).

Low Volatility: Stocks with the least volatility within an index are selected, using the inverse of the standard deviation of returns.

Alpha: Stocks that rank high on excess returns over markets in the last one year. Excess returns are assessed using the Capital Asset Pricing Model. Once you understand these basics, it becomes easier to figure out what any factor fund is doing.

There are three elements to gauging any factor fund’s strategy.

* Underlying index: This decides the universe from which a factor fund selects stocks. On the NSE, the indices are usually the Nifty 50, Nifty 100, Nifty 200, Nifty 500 and Nifty Total Market index. So, a Nifty500 Low Volatility 50 fund will select 50 stocks with the lowest volatility from the Nifty 500 universe.

* Single or multi-factor: Two or more factors can be combined in a single fund (Alpha – Low Volatility, Quality – Momentum etc). The Nifty Alpha Low Volatility 30 will apply both the Alpha and Low Volatility filters to Nifty50 stocks.

* Market-cap focus: Factor investing can be combined with market-cap based segmentation too. A Nifty Smallcap250 Momentum Quality 100 index fund will apply both the Momentum and Quality filters to the stocks in the Smallcap 250 index.

The idea that factor funds can give you the best of both active and passive investing is alluring. However, before taking the plunge, you should be wary of the following issues with them.

Need timing

On paper, it sounds good that you can own a low-cost fund that buys only quality stocks or value stocks or momentum stocks. You may even be tempted to own all three! But in the real world, the various styles of investing do not deliver returns at the same time. In any given year, in fact, there is wide divergence between factor fund returns.

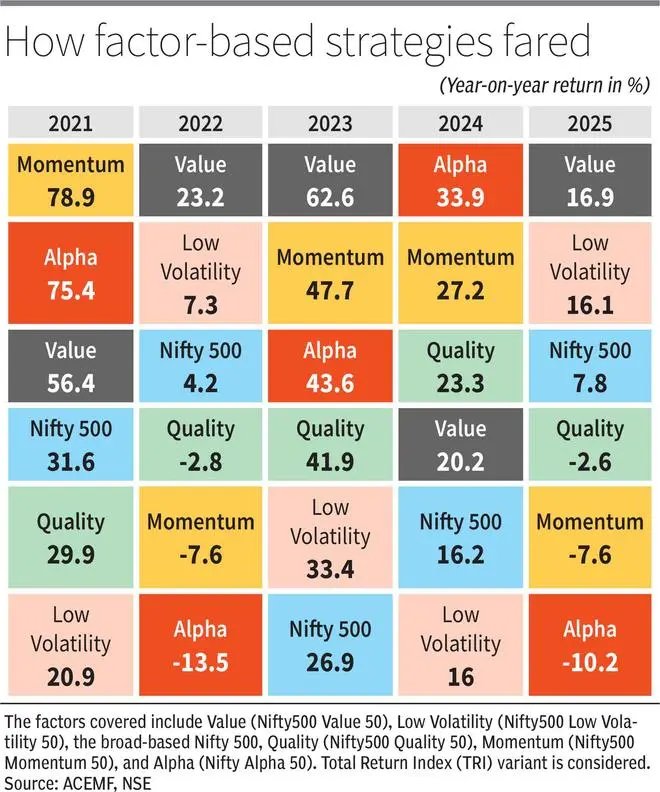

In 2025, investors in Nifty500 Value 50 made gains of about 16.9 per cent; but those who put faith in Nifty Alpha 50 lost over 10 per cent. The Nifty500 Low Volatility 50 index gave about a 16 per cent return, while the Nifty500 Momentum 50 lost about 7.6 per cent. Rewind to 2024, and Alpha funds were chart-toppers with 33.9 per cent gains, followed by momentum funds with 27.2 per cent. Low Volatility, Value and Quality funds were laggards delivering 16-23 per cent. In fact, a look at the ‘quilt’ of factor fund returns over the last decade shows that Value topped about four times, but was also at the bottom for four years. Alpha spent four years at the top and two years at the bottom. Quality and Low Volatility were usually middling performers. In any given year, half the factor funds underperformed the plain-vanilla Nifty500 index.

This goes to show that to really beat the markets with factor funds, you need to time your entry and exit well. Typically, Value and Low Volatility funds do well in falling markets or early recovery from a fall. Quality does well in a bull market. Momentum and Alpha do well in late-stage bull markets. But as it is extremely difficult for a lay investor to know the stage of a market cycle she is in, making these timing calls is very tough.

If getting the timing right for even single-factor funds is challenging, managing it for multi-factor funds can be close to impossible for lay investors.

Missing qualitative factors

What makes factor funds low-cost is the belief that you can replace human judgment with quantitative metrics to select stocks. In the real world though, an investor can seldom ace the markets just by applying three or four quantitative metrics in her stock selection process.

When assessing whether a stock is a value buy, it is necessary to gauge management quality and governance. Failing to apply these qualitative judgments can saddle you with value traps. When buying quality stocks, one needs to assess if their valuations already price in a steep premium for their superior metrics. The momentum or alpha styles can backfire if one goes entirely by price trends and ignores business or regulatory risks that can disrupt the trend. Good active fund managers will apply these extra qualitative judgments to stocks they buy, which factor funds will tend to miss.

Narrow universe

When active managers apply style filters to stocks, they have the entire listed universe to work with. But factor funds typically apply their filters to a rather narrow universe of stocks making up an index. Because the index may only own the stocks with the highest market-cap, this ends up restricting the investor’s choices. It also contributes to high sector concentration in factor fund portfolios.

For instance, if asked to pick quality stocks today, a good fund manager may not go overboard with FMCG stocks and own a 26 per cent weight in this one sector. But the Nifty100 Quality 30 index has a 26 per cent weight in FMCG stocks. Similarly, if looking for value, a good manager may not go all in on banks. But the Nifty 50 Value 20 index has a 39 per cent weight in financials alone, with bank stocks hogging exposures.

For an investor to really gain from a diversified portfolio while following a style, it makes sense to either stock pick from the entire listed universe or broad market indices like the Nifty500, BSE 500 or Total Market Index.

Unreliable back-testing

When new factor funds are launched, the pitch is often accompanied by back-tested data showing how well the fund would have performed in the last one, three or five years, using the same filters. However, this can give an unrealistically rosy view of the factor. Fund houses usually choose to launch a factor fund when a particular factor is flying high and is the toast of the market. Therefore, past returns on such funds are bound to look good. There’s no guarantee that a factor that is on a purple patch over the last three or five years will continue to be the topper for the next three or five years.

Published on January 10, 2026