AMFI urges government to reinstate indexation for debt funds, offer pension schemes with tax benefits in Budget 2026-27.

The Union Budget will be presented by Finance Minister Nirmala Sitharaman in the Lok Sabha on February 1.

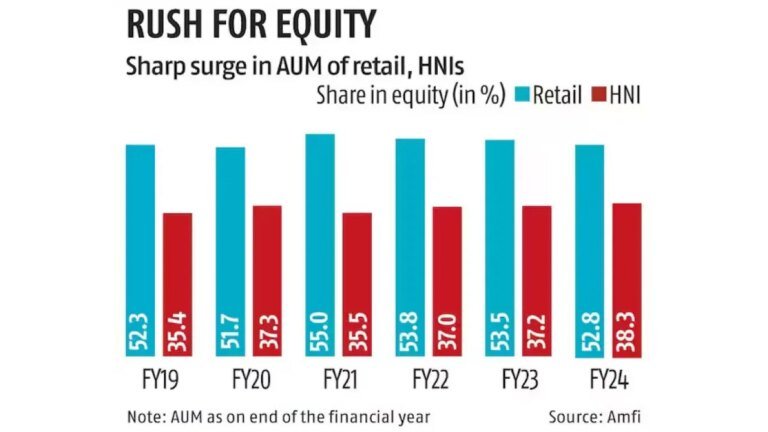

The AMFI also demanded enhancement of the tax-free exemption limit on long-term capital gains (LTCG) from equity investments to provide greater relief to retail and long-term investors.

In its recommendations for Union Budget for FY 2026-27, the industry body has urged the government to raise the tax-free exemption limit for equity LTCG from Rs 1.25 lakh to Rs 2 lakh.

“In order to encourage stable long-term capital in the mutual fund industry, exemption from long-term capital gains on units held for more than 5 years is recommended. This would ensure investors remain invested for longer periods,” AMFI said.

Also, it has requested restoration of long-term indexation benefit for debt schemes of mutual funds which was withdrawn in Budget 2024.

“This would incentivize long-horizon fixed income savings; restores parity with other long-term assets; channels household savings to the corporate bond market,” the industry body suggested.

To promote retail investment in debt instruments, AMFI has proposed introducing ‘Debt Linked Savings Scheme’ on the lines of Equity Linked Savings Scheme (ELSS).

AMFI suggested amending the definition of equity-oriented funds to include “Fund of Funds” (FoF) that invest in other equity funds, specifically those investing in overseas funds.

Earlier, other market participants also urged the government to ease capital market taxation, including a higher exemption limit on long-term capital gains. They also cautioned against any further increase in transaction-related taxes.