Investors relied for years on a specific crypto market rhythm: profits cycled from Bitcoin to Ethereum and then cascaded down to smaller tokens. That profit rotation has become less consistent than in prior cycles.

Wintermute’s 2025 Digital Asset OTC Markets Report indicates the liquidity pipeline fractured rather than trickled down last year. The report identifies a collapse in market breadth. The median altcoin rally did not last two months as it did the prior year; instead, it shrank to just 19 days.

Instead of trickling down to smaller caps, liquidity has remained concentrated at the top of the market. Wintermute’s analysis suggests that capital no longer rotates efficiently. It enters specific, high-cap assets and stays there. This structural shift indicates that the era of broad-based, speculative cycles may be ending, replaced by a mature market environment where liquidity is deep but highly selective.

ETFs and Treasuries Drove Capital to BTC and ETH

The specific vehicles through which institutional capital is now entering the crypto market served as the major catalyst for last year’s concentration of liquidity. Unlike retail traders of previous cycles who used OTC exchanges to rotate funds rapidly between tokens, institutional entrants in 2025 utilized regulated walled gardens—specifically ETFs and corporate treasuries. These structures are designed for accumulation and long-term holding, not for speculative rotation into lower-cap assets.

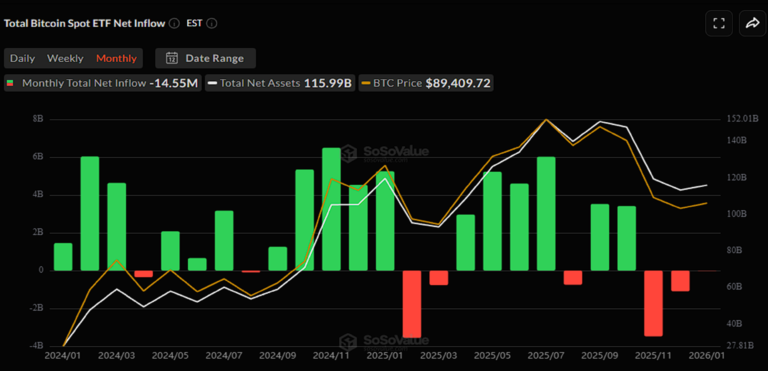

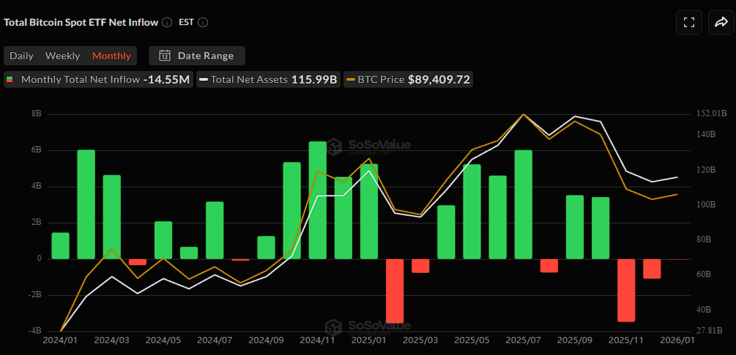

Capital flows in 2025 heavily favored the top two crypto assets. US spot Bitcoin ETFs accumulated $16.11 billion in cumulative net inflows, while Ethereum ETFs took in $9.57 billion. Newer funds for XRP ($1.16 billion) and SOL ($766.2 million) saw activity, but the bulk of liquidity stayed with the majors.

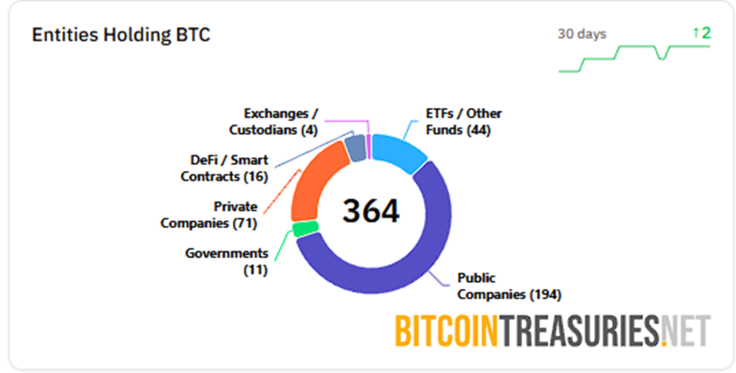

Corporate treasuries further tightened supply. Data from BitcoinTreasuries on January 23, 2026, shows that public and private entities, along with governments, now hold 4.09 million BTC. That figure accounts for nearly 19.5% of the total supply removed from active circulation. Ethereum Treasuries show a similar pattern, with public companies and organizationsholding 3.62 million ETH.

Trading patterns reflect this institutional shift. The Binance 2025 Year in Review report shows institutional volume on the platform grew 21% year-over-year. Notably, OTC fiat trading volume jumped 210%, indicating large buyers avoided public order books to execute trades without moving the price. Catherine Chen, Head of Binance VIP & Institutional, pointed to this as evidence of a maturing market: “Institutional interest in crypto has decisively shifted from exploration to large-scale adoption. In 2025 alone, institutional trading volume on Binance grew 21% year-on-year, while OTC fiat trading surged 210%, reflecting growing demand from asset managers, corporates, and wealth intermediaries.”

This transition from testing the waters to full commitment helps explain why liquidity has become so sticky. When capital enters via a corporate treasury or a pension fund allocation, it is generally governed by strict mandates that prevent it from flowing into speculative, long-tail tokens.

Chen added that “for institutions, crypto is no longer a niche exposure, but it is becoming a strategic component of modern portfolios.”

Consequently, the liquidity that entered the market in 2025 did not behave like the mercenary capital of the past. It deepened the order books for Bitcoin and Ethereum but left the broader altcoin market starved of the trickle-down effects that previously sustained prolonged rallies.

Regulatory Policies Also Served as a Catalyst

While structured products like ETFs provided the mechanism for this shift, regulatory policy provided the confidence. The legislative environment in 2025 moved from ambiguity to clarity, encouraging major global asset managers and large custodial institutions to step in with conviction.

In the United States, the policy stance shifted significantly from enforcement actions to the establishment of clear operational frameworks. One of them was the GENIUS Act, which was signed in July 2025 and established a federal regulatory framework for stablecoins.

US policy also shifted with the Strategic Bitcoin Reserve executive order in March 2025 and the House passing the Clarity Act in July. These moves indicated to financial firms that digital assets were established economic fixtures. In Europe, the full implementation of MiCA offered similar regulatory clarity. Exchanges adjusted operations to meet these new standards.

In late 2025, Binance became the first global exchange to receive full authorization under the Abu Dhabi Global Market framework. The significance of such licensing goes beyond the platform itself. It signals a broader industry migration toward regulated trading environments that can satisfy the compliance requirements of traditional capital allocators.

When the largest liquidity venues align with the rigorous standards of international financial centers, it clears the path for institutions to deploy capital at scale. However, because these institutions operate under strict risk parameters, their capital flows almost exclusively into assets and venues that meet these elevated regulatory standards, further reinforcing the concentration of liquidity in the market’s upper tier.

A New Era of Structured Liquidity

The collapse of the 61-day rally cycle into a 19-day window is not merely a statistical anomaly; it is evidence of a mature market structure. The Wintermute data suggests that the days of easy, broad-based speculative frenzies are likely over. In their place is a market defined by structured inflows and strategic accumulation.

With nearly 20% of the Bitcoin supply locked in treasuries and regulated ETFs absorbing billions in sticky capital, the crypto market has structurally aligned itself with traditional finance. The result is a two-tiered liquidity environment: deep, resilient markets for the sector’s largest, regulated assets, and a fragmented, highly volatile environment for everything else. This shift marks the end of the rising tide that lifts all boats, ushering in an era where liquidity must be earned by utility, compliance, and institutional grade.