Growth stock ETFs offer a catch-all way to buy the dip in top stocks.

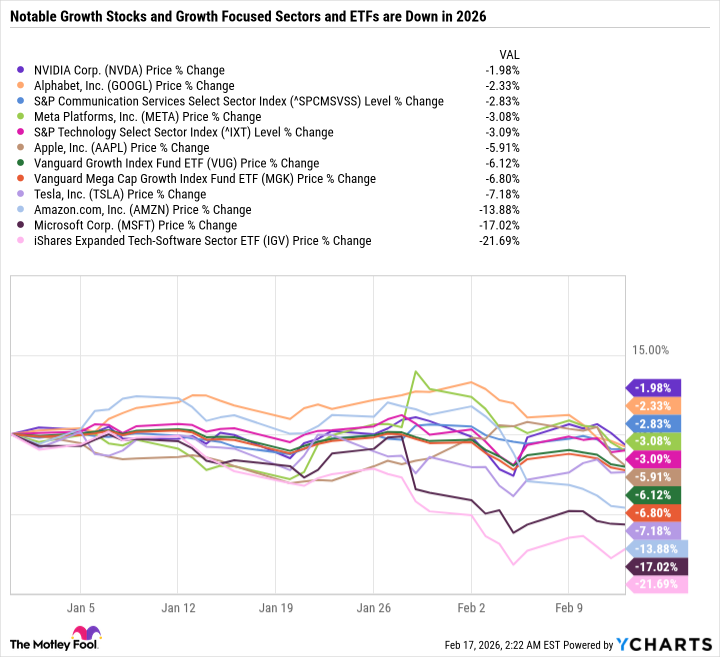

From 2023 to the end of 2025, portfolios that were heavily invested in growth stocks, especially megacap, tech, and artificial intelligence (AI)-focused growth stocks, probably outperformed the major indexes like the S&P 500 (^GSPC +0.69%). But 2026 is different.

Tech-heavy sectors, like tech and communications, have lost value year to date. And every “Magnificent Seven” stock is down — from Nvidia to Alphabet, Apple, Microsoft, Amazon, Meta Platforms, and Tesla.

So it’s unsurprising that growth-heavy exchange-traded funds (ETFs) are also under pressure.

Here are three ETFs that stand out as top buys for long-term-focused investors.

Image source: Getty Images.

1. Vanguard Growth ETF

The Vanguard Growth ETF (VUG +0.79%) has “foundational holding” written all over it. Its ultra-low-cost 0.04% expense ratio is a passive investor’s dream come true.

The fund has historically performed similar to the Nasdaq-100, but it has a few key differences. The Nasdaq-100 invests in the largest non-financial companies listed on the Nasdaq stock exchange — meaning it won’t invest in growth stocks like Oracle that are listed on the New York Stock Exchange. However, that also means the Nasdaq-100 is going to include a lot of megacap stocks that aren’t necessarily growth stocks.

For example, Walmart is the ninth-largest Nasdaq-100 holding, Costco Wholesale is No. 12, and PepsiCo is No. 21. These are consumer staples stocks with single-digit to low-double-digit earnings growth rates — not high-octane AI growth stocks. Vanguard splits most large-cap stocks into either its growth ETF or the Vanguard Value ETF (VTV +0.30%) — electing to include Costco in the Growth ETF but putting Walmart and Pepsi in the Value ETF.

Down 6.1% year to date, the Vanguard Growth ETF is a solid buy for investors looking for a low-cost way to get exposure to a basket of 151 stocks.

Today’s Change

(0.79%) $3.66

Current Price

$464.88

Key Data Points

Day’s Range

$458.92 – $466.73

52wk Range

$316.14 – $505.38

Volume

94K

2. Vanguard Mega Cap Growth ETF

The Vanguard Mega Cap Growth ETF (MGK +0.85%) is basically a more concentrated version of the Vanguard Growth ETF. With just 60 holdings, it assigns a greater weight to the largest growth stocks by market cap.

The Mega Cap Growth ETF has a 59.4% weighting in the Magnificent Seven. Throw in Broadcom, Eli Lilly, and Visa, and that’s 68.4% of the ETF in just 10 stocks.

Since Magnificent Seven stocks have been falling more than the broader market, the Vanguard Mega Cap Growth ETF is down slightly more than the Vanguard Growth ETF year to date.

Like the Vanguard Growth ETF, the Mega Cap Growth ETF has a dirt cheap 0.05% expense ratio. It’s a great choice for investors who are specifically targeting the largest growth stocks by market cap.

3. iShares Expanded Tech Software Sector ETF

It’s rare to see the broader indexes hovering around all-time highs when such a massive portion of the market is in a steep downturn. But that’s exactly what’s happening with software, which is a core industry in the market’s largest sector — tech.

The iShares Expanded Tech Software Sector ETF (IGV 1.22%) is down a staggering 21.7% year to date as investors question AI’s disruption of the software-as-a-service business model.

Some of the fears are warranted. The industry’s traditionally high margins are largely dependent on growing user bases through higher subscription volumes and on making updates that justify price increases. But if AI tools can replace entire software workflows, and fewer overall subscriptions are needed, then that’s a serious threat to the business model.

Still, it’s a mistake to assume that the entire industry should fall just because of innovation. The sell-off in the iShares Expanded Tech Software Sector ETF is an impeccable buying opportunity for investors looking for exposure to names like Microsoft, Palantir Technologies, Oracle, and Salesforce. It can be easier to hold a basket of stocks through a turbulent period than one or two names in a theme, as stocks can also rise and fall to levels beyond your imagination.

The fund is a good buy for investors who prefer to bet on a broader industrywide recovery. However, one drawback is that it features a 0.39% expense ratio, which is significantly higher than the previously discussed Vanguard funds.

Daniel Foelber has positions in Nvidia and Oracle and has the following options: short March 2026 $240 calls on Oracle. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Costco Wholesale, Meta Platforms, Microsoft, Nvidia, Oracle, Palantir Technologies, Salesforce, Tesla, Vanguard Growth ETF, Vanguard Value ETF, Visa, and Walmart. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.