tumsasedgars

Introduction

Atlanticus Holdings Corporation (ATLC) is a niche lender that provides consumer loans to underserved communities. The company partners with corporations across many of its brands to provide credit solutions. Back in April, I covered the company’s new baby bond, Atlanticus Holdings Corporation NT 29 (NASDAQ:ATLCZ) which provided an attractive coupon of 9.25% and matured in 2029. Since then, both baby bonds offered by Atlanticus have declined in price and increased in yield to maturity. Now, I’m still favorable to both baby bonds, but I think investors should consider the 6.125% coupon baby bond, Atlanticus Holdings Corporation CAL NT 26 (NASDAQ:ATLCL) as its yield is over 10.5%.

Microsoft Excel API

Increased Margins, Decreased Profitability

Atlanticus earns its revenue through interest on its consumer loans, but it also earns income from fees and income on other assets. During the first half of 2024, consumer loan revenues grew by $43 million, or 10% compared to the same period a year ago. Interest expenses rose by $25 million in the first six months compared to the same period a year ago, but unlike a typical bank, interest expenses are not the largest expense for Atlanticus.

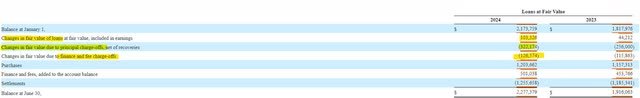

Atlanticus utilizes fair market value to estimate the value of its loans. The adjustment to the value of its loans becomes a part of the expense side of earnings. The fair value of its loans fell by $345 million during the first half of the year, which was $18 million higher than a year ago. Overall, the increases in interest expense and fair value write-down of loans were not enough to decrease the net margin, which grew by $9 million to $183 million.

Unfortunately, Atlanticus did see an increase in its operating expenses. Salaries and servicing costs were the leading drivers behind the $14 million in operating expense increases for the first half of 2024. While the company faced a lower income tax expense, net income finished $1 million lower at just under $50 million. Despite the lower performance, the company was rather profitable, and investors should be optimistic about the increased margin performance.

SEC 10-Q

Balance Sheet Growth

Atlanticus grew its balance sheet during 2024. The niche lender’s main asset is loans at fair value, although it does carry a small amount of loans at cost. By carrying loans at fair value, Atlanticus does not need an allowance for credit losses, but it does need to adjust the fair value of these loans routinely. Atlanticus is not a bank, so its loan growth must be fueled by existing capital or external borrowing. The company increased its senior notes by more than $50 million and its notes payable by $18 million. Despite not having an allowance buffer, investors should note the healthy $351 million in cash on the balance sheet.

SEC 10-Q

Cash Flow is Plenty to Deleverage

While Atlanticus increased its borrowing during the first half of 2024, that was for the purpose of growing its business (versus meeting current operational needs). The best way to exemplify this is by examining the cash flow statement. Cash flow from operations was $234 million during the first half of 2024, which was $25 million higher than the same period a year ago.

Atlanticus utilized cash flow from operations combined with proceeds in principal and net borrowing proceeds to invest in new loans. If operating cash flow is positive, Atlanticus can deleverage if loan demand drops, or if the company decides to pay down debt. This is the most important aspect of the baby bond investment thesis, and Atlanticus is demonstrating that it can make bondholders whole.

SEC 10-Q

Risks to Atlanticus Holdings

Atlanticus Holdings is a consumer lender, which is a market that is very sensitive to changes in the economy. Should the economy weaken further, and unemployment continue to rise, Atlanticus will face earnings headwinds. Additionally, Atlanticus loans are very short-lived in terms of tenure. For example, over 50% of the company’s loans were paid off in the first half of 2024. Should Atlanticus run into problems with its consumers, it could come on at a rapid pace, so investors should monitor the details in changes to loan valuation on a quarterly basis. Our position in the late stage of the business cycle and the effects on consumer lenders in a recession have me on the sidelines when it comes to the company’s common shares.

SEC 10-Q

Holders of Atlanticus baby bonds should also be aware of the bank’s revolving credit debt. The revolving credit debt is comprised of nearly $1.9 billion in loans that are secured by the company’s loan assets. While baby bonds are senior to the company’s shares, they are behind the revolving credit facilities in seniority and therefore are largely unsecured, which could create a problem if the company experiences bankruptcy.

SEC 10-Q

Conclusion

Atlanticus Holdings continues to increase the margins on its consumer loans despite the challenging interest rate environment. Despite the success, the current state of the US economy and the fickleness of its industry should persuade investors away from its common shares. However, the company’s baby bonds are very attractive and can only be impaired in the event of bankruptcy, which seems to be unlikely. The widening spread and higher yield to maturity of the short-term baby bond makes that issue more attractive for income investors.