Stocks are in trouble if bond markets prove right on interpreting U.S. economic data

- Stock markets seem unsure what to make of data on U.S. inflation and jobless claims.

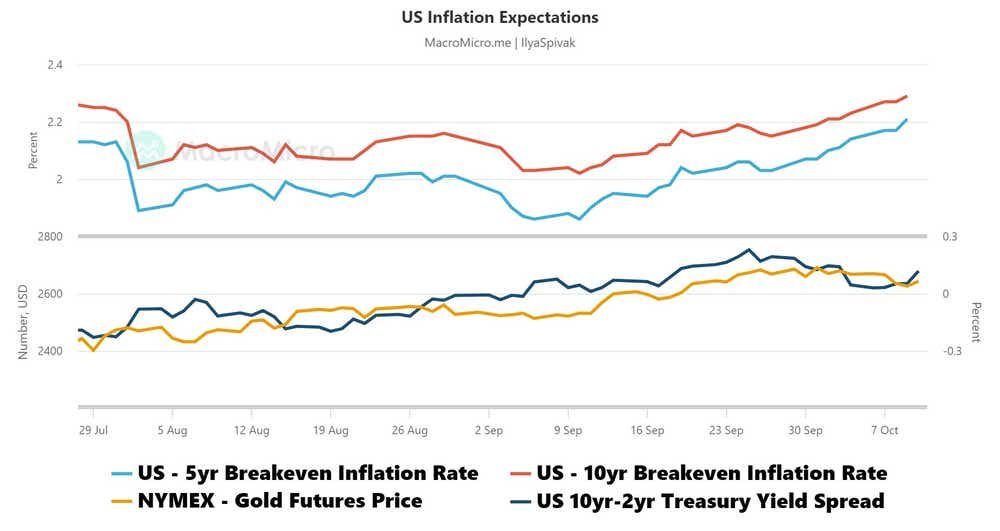

- Bond traders are more certain about reflation because of a steeper yield curve.

- U.S. consumer confidence data may clear things up, spooking Wall Street.

Stock markets struggled with what to make of the latest batch of U.S. economic data. September’s closely watched consumer price index (CPI) inflation data overshot consensus forecasts.

Unfortunately, the weekly report on jobless claims did so, too. Their conflicting signals left Wall Street rudderless.

The CPI report showed headline price growth fell less than expected, down to 2.4% year-on-year instead of the 2.3% anticipated by economists. The core rate excluding volatile food and energy prices—the focus for Federal Reserve officials—unexpectedly rose to 3.3% year-on-year. That’s the first rise since March 2023.

Meanwhile, initial jobless claims surged to an eye-watering 258,000 in the last week of September, the highest in 15 months. Continuing claims jumped to 1.86 million, the most since late July. Both outcomes topped expectations and punched above their four- and 12-week trend averages.

Stocks puzzled but bond markets make a call after clashing U.S. data

The bellwether S&P 500 stock index fell at first as these numbers came across the wires, then seesawed back to session highs, only to settle back down into indecisive sideways drift. Equities trades seemingly struggled with a clear read-through from the data to Fed interest rate cut expectations.

On one hand, hotter CPI data suggests the central bank might have to be stingier with easing if it is to ensure inflation returns to its medium-term target of 2%. On the other, the steep rise in claims for unemployment benefits clashes with last week’s chipper payrolls data, urging Fed Chair Jerome Powell and company to open the stimulus spigot.

The bond market may be offering a clearer picture. The yield curve steepened with conviction after the data crossed the wires as longer-dated Treasury bond yields rallied while those at the front end idled in place. This hints that expectations for reflation—and thereby a relatively tighter Fed stance downwind—are winning the argument for now.

U.S. consumer confidence data may resolve Wall Street confusion

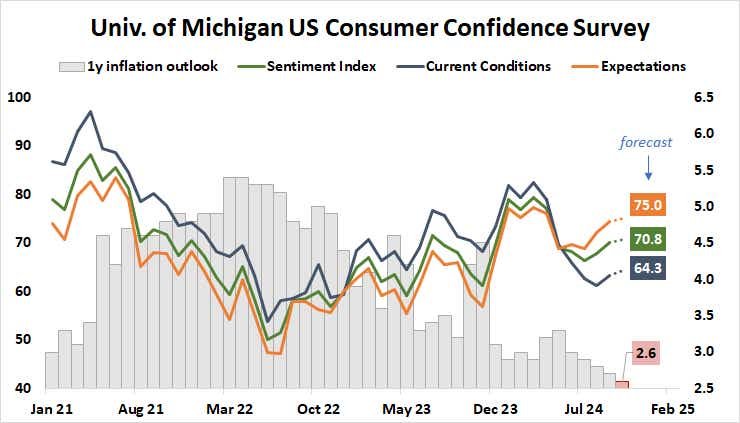

This take might get a dose of reinforcement from a University of Michigan (UofM) survey of U.S. consumer confidence. It is expected to report that survey respondents’ mood brightened for a third consecutive month as one-year inflation expectations fall to 2.6%, the lowest since December 2020.

If sentiment improves and perhaps even overshoots forecasts—extending a string of upside surprises on U.S. news flow—then brisk hiring and wage growth will look dominant. If it sours, especially alongside a rise in the one-year inflation outlook, then labor market turnover and worsening affordability may spook traders.

Household consumption is the top growth engine for the U.S. economy, accounting for close to 70% of output expansion. This makes the mood here vital for how the central bank will proceed. Signs of an upbeat disposition may be taken to mean that fewer rate cuts are plausible in 2025 than currently expected. Stocks probably won’t like that.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.