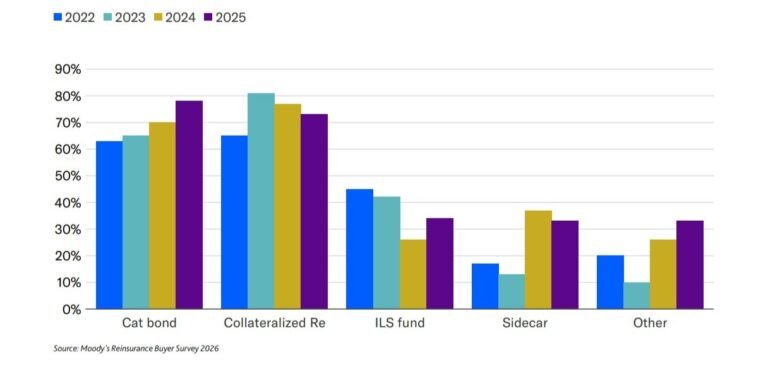

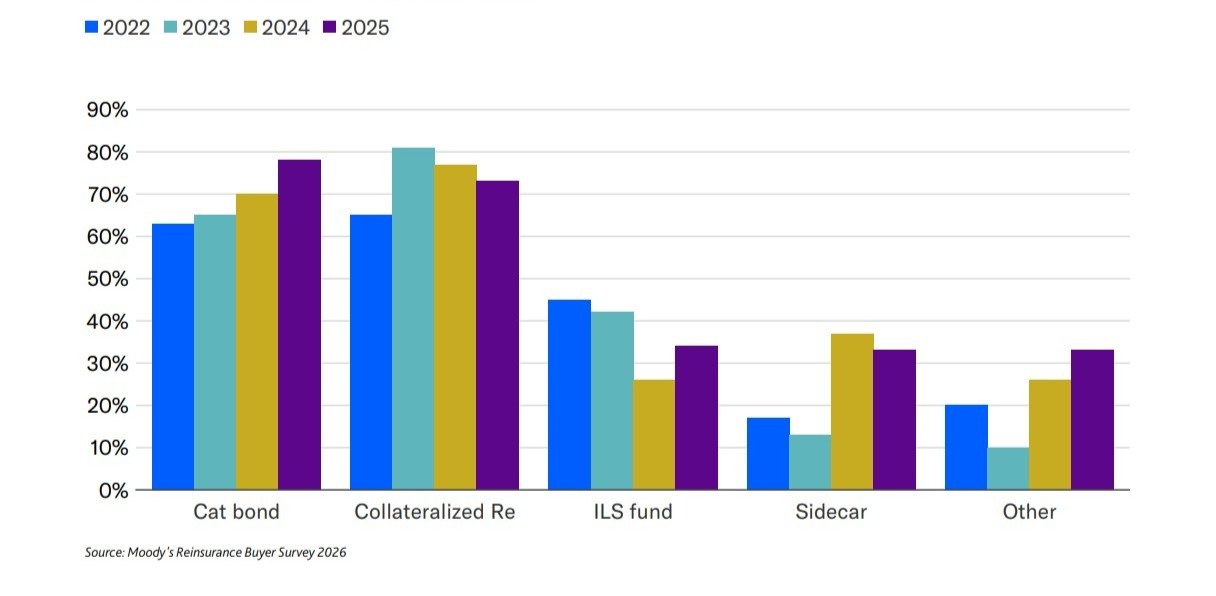

As per a survey by Moody’s Ratings, over the next year, reinsurance buyers have indicated a strong preference for catastrophe bonds when it comes to utilising alternative capital, while insurance-linked securities (ILS) funds are expected to see increased demand too.

Each year in advance of the annual Monte Carlo Rendez-Vous event, Moody’s Ratings surveys reinsurance buyers to identify their outlook for the forthcoming year and their preferences for risk transfer structures and sources.

According to the survey results, catastrophe bonds and collateralized reinsurance appear to be the most attractive forms of alternative capital heading into 2026.

“Interest in catastrophe bonds as an alternative form of capital has continued to increase among our survey participants, with a significant proportion of respondents (78%) saying they would be somewhat likely or very likely to consider the issuance of a catastrophe bond,” the rating agency explained.

“This aligns with high levels of catastrophe bond issuance over the past year.”

As we’ve been reporting throughout 2025 and highlighted in our latest Q3 2025 cat bond and related ILS market report, alternative capital growth has been driven by the catastrophe bond market, with year-to-date 2025 issuance already surpassing the previous record set in 2024.

Moody’s continued: “Collateralized reinsurance was the second type of alternative capital in which participants expressed the most interest after catastrophe bonds, with 73% saying they would be somewhat likely or very likely to consider a collateralized reinsurance transaction.”

Perhaps surprisingly, given the increased activity that’s been seen throughout the market this year, the reinsurance sidecar structure is expected to see slightly less demand from protection buyers over the next year.

While, as the graphic above shows, Moody’s survey of reinsurance buyers expressed a higher preference for ILS funds and other forms of alternative capital, compared to last year.

It’s worth noting that while it looks like reinsurance buyers appetite to transact with collateralized reinsurance sources may decline slightly, given the ILS fund bucket has risen and most of those arrangements will effectively be in collateralized reinsurance formats, the overall may still remain stable or even grow.

With returns strong across ILS instruments and alternative reinsurance capital structures in 2025 so far, there is likely to be ample capital to meet the demands of reinsurance buyers, across all of these insurance-linked securities formats.

While buyers are expected to look to transact via cat bond structures and with ILS funds, on the investor side demand remains more varied, with a wide range of structures expected to be allocated to over the coming months.