China is experiencing a bull market, but Beijing doesn’t seem to like it.

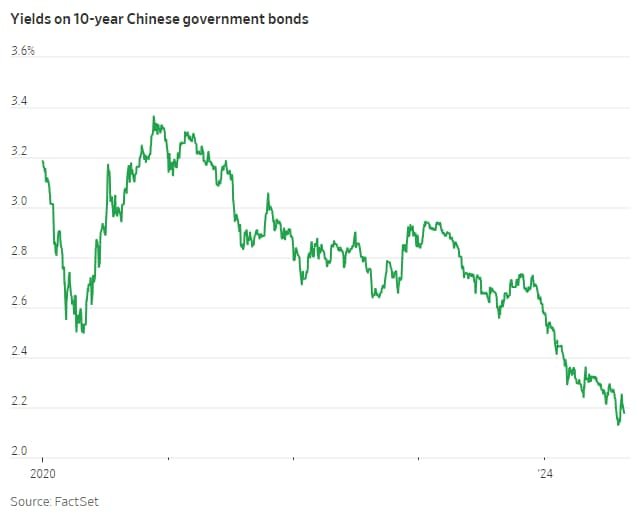

While stock and housing markets languish in China, one asset has stood out—Chinese government bonds. Yields on 10-year government bonds have dropped to around 2.18% from around 2.6% a year earlier. In most countries—especially those experiencing an alarming slowdown like China—that would be welcome. Yet the authorities have gone to extraordinary lengths to try to stem the rally in bonds they issue.

It is starting to work. China’s government bond yields have indeed picked up in the past week or so as state-backed banks appear to have turned into heavy sellers. Also helping to reverse the rally, China’s central bank said last month that it signed agreements with brokers to borrow “hundreds of billions” of yuan in government bonds. (100 billion yuan is equivalent to $14 billion). Regulators have also stepped up scrutiny on banks that have been active in the bond market.

View Full Image

While it is common for central banks around the globe to meddle in their bond markets, it is rarer for them to intervene to push yields up. China’s central bank just cut its short-term rates last month. Beijing’s heavy handed efforts to push bond yields in the opposite direction are another worrying sign about its economy.

The official explanation is that banks could end up with huge losses if the bond rally takes a sharp turn, citing Silicon Valley Bank as an example. That bank faced a devastating run last year as depositors were spooked by unrealized losses it had on its balance sheet from U.S. Treasury bonds bought before the Federal Reserve began raising interest rates.

There were indeed signs of a speculative frenzy in Chinese government bonds. Trading volume had surged and some price action was getting irrational: One 30-year government bond issued in May traded up 25% on the first day—not a swing one would expect to see in a boring government bond market.

But there also are very strong fundamental reasons why investors are flocking to the low-yielding but basically risk-free assets. First, China’s economy remains mired in weakness, being dragged down by the implosion of its housing market. Instead of worrying about inflation, an issue in the U.S. and Western Europe, downward pressure in prices is the problem instead. China’s core consumer-price index, which excludes food and energy, rose only 0.4% year on year in July, down from 0.6% in June.

And there is a lack of promising investment options. China’s CSI 300 index, which tracks the biggest stocks listed in Shanghai and Shenzhen, is down 3% this year after three consecutive years of losses. The property market, which used to be the most popular form of investment for Chinese households, remains in doldrums. New home prices in 70 major cities dropped 5.3% in July from a year earlier.

What Beijing might be most worried about isn’t low bond yields but what they say about China’s economy—that instead of lending money out, banks are happier to let it sit in government bonds with ever-lower yields. In a country that can stamp out unpleasant news such as economic pessimism in the news media and the internet, bond yields are a sign of trouble that can’t be censored.

Nudging from the government could indeed work, at least in the short term, in a financial system that is tightly-controlled by the government. But for bond yields to go sustainably higher, Beijing needs to go beyond treating the symptoms and deal with what is clouding the economy—fixing the housing market, boosting consumption and restoring investment confidence.

That will be a lot harder.

Write to Jacky Wong at jacky.wong@wsj.com