El Salvador has pushed forward with its bold experiment in cryptocurrency, launching Bitcoin-backed bonds that tie the nation’s finances directly to the volatile world of digital assets. Known as Volcano Bonds, these securities mark a first for any country, blending traditional debt instruments with Bitcoin’s potential for high returns. President Nayib Bukele’s government issued the bonds earlier this year, aiming to fund infrastructure projects and pay down existing debt while capitalizing on Bitcoin’s rising value.

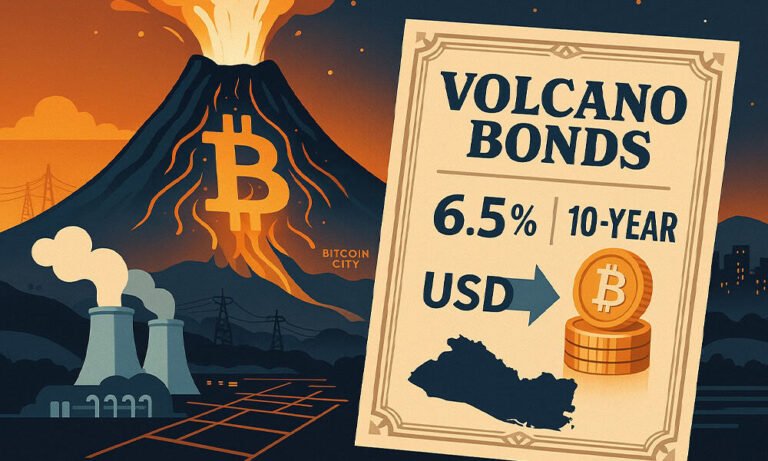

The bonds work like this: Investors buy in with U.S. dollars and get a 6.5% annual yield over a 10-year term, but they commit to a five-year hold period. Half the proceeds go toward buying more Bitcoin, and the other half supports energy and mining initiatives powered by the country’s geothermal resources from volcanoes—hence the name. This setup lets bondholders share in any Bitcoin price gains beyond the fixed interest, turning a standard bond into a hybrid investment.

The timing couldn’t have been better for El Salvador. Bitcoin hit new highs above $124,000 in recent months, driven by institutional buying and global adoption trends. This surge has lifted the value of the country’s Bitcoin holdings to around $775 million, generating unrealized profits of over $475 million from an initial outlay of about $300 million. Those gains have spilled over to the bonds, making them attractive to investors seeking exposure to crypto without direct market risks.

Demand has been strong. Reports show the Volcano Bonds were oversubscribed three times over, pulling in more than expected from both local and international buyers. This success comes as El Salvador continues to stack Bitcoin, recently adding 21 more coins to celebrate Bitcoin Day, bringing its total to over 6,000 BTC. The strategy has paid off so far, with the nation’s dollar-denominated bonds rallying in emerging markets after lawmakers tweaked the Bitcoin law to ease some restrictions on digital asset use.

But it’s not all smooth sailing. The International Monetary Fund stepped in with a $1.4 billion bailout package earlier this year, which includes conditions to temper Bukele’s crypto ambitions. The deal limits further Bitcoin accumulation and delays some bond-related plans, reflecting broader concerns about financial stability in a small economy betting big on a single asset.

Critics point out that Bitcoin’s price swings could expose the country to losses if the market turns, and not everyone in El Salvador has embraced the shift—adoption remains uneven, with many still preferring dollars for daily transactions.

From a regional perspective, El Salvador’s move stands out in Central America. While neighbors like Costa Rica explore renewable energy and tech investments, none have gone as far as making Bitcoin legal tender or issuing crypto-backed debt. This could inspire similar experiments if the bonds deliver, but it also highlights risks in a region already dealing with debt burdens and economic inequality.

El Salvador’s government sees this as a path to sovereignty, using Bitcoin to attract foreign capital and build projects like Bitcoin City, a planned hub for crypto innovation. So far, the bonds have helped repurchase some national debt, taking advantage of Bitcoin’s rally to strengthen the balance sheet. With Bitcoin’s dominance at 58% of the crypto market and ETF inflows hitting $10 billion monthly, the momentum supports Bukele’s vision.

Yet questions linger. Will the bonds hold up if Bitcoin corrects? And how will the IMF’s oversight shape future issuances?