With rising geopolitical tensions and the Federal Reserve shifting toward rate cuts, 2024 is shaping up to be gold’s best year in over four decades, reigniting strong investor demand for the precious metal.

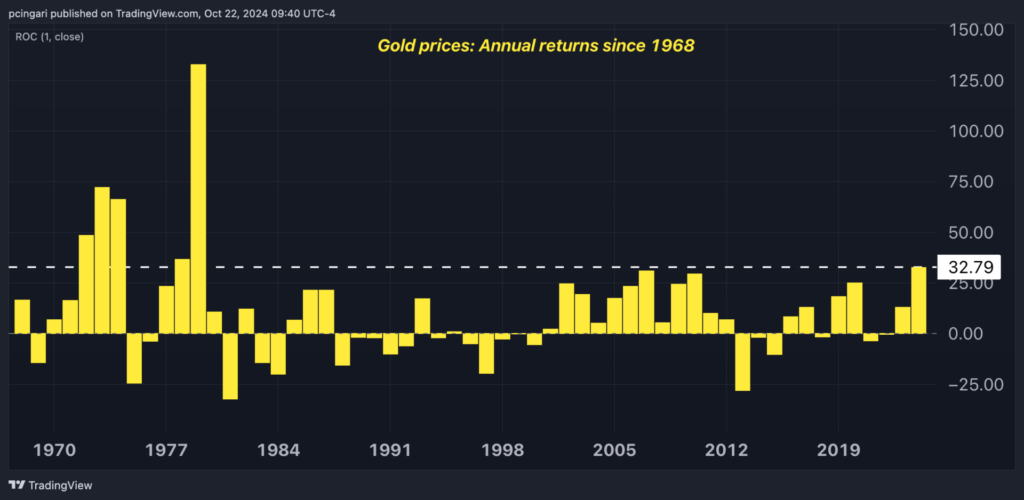

Gold, as tracked by the SPDR Gold Trust GLD, has surged 33% year-to-date as of Oct. 22, positioning it for its strongest year since 1979, when it spiked 136%.

In stark contrast, U.S. long-dated Treasury bonds are suffering. The iShares 20+ Year Treasury Bond ETF TLT is down 6.7% for 2024, marking the fourth consecutive year of losses and a steep 48% drop since its 2020 highs.

Sell Bonds, Buy Gold?

Veteran Wall Street investor Ed Yardeni, president at Yardeni Research, has been urging investors to ‘sell bonds, buy gold’ since mid-August.

“Our Aug. 19, 2024 Morning Briefing was titled, ‘Get Ready to Short Bonds?’” Yardeni said in a note on Monday, citing the Fed’s overly optimistic rate-cut expectations at the time.

“Bond investors may be expecting too many interest-rate cuts too soon,” he warned, predicting that yields would rebound sharply on stronger economic data.

Read Also: US Economy Eyes 3.4% Growth In Q3: Is Soft Landing Turning Into Reacceleration?

The expert’s view was right. The 10-year Treasury yield, which stood at 3.88% in mid-August, has surged to 4.18% on Oct. 21— a 56-basis-point jump.

In his April 7 report, Yardeni advised investors to “add to precious metals positions,” reiterating his long-standing view that gold remains a key investment hedge, especially as geopolitical risks rise.

His argument is simple: with bond markets vulnerable to rising yields and uncertainty over Fed policy, precious metals offer a safe haven for long-term investors.

Why Is Gold Rallying In 2024?

Gold has traditionally been viewed as a hedge against inflation, but its recent surge comes even as inflation has moderated. Yardeni points to rising geopolitical tensions, particularly in the wake of Russia’s invasion of Ukraine, and heightened economic uncertainty as major reasons for gold’s appeal.

With Russia’s foreign reserves still frozen and global tensions on the rise, many nations are turning to gold as a secure store of value.

This “de-dollarization” trend is likely another catalyst behind the metal’s sharp rise, as countries seek to diversify away from U.S.-denominated assets.

“Gold is now a hedge against U.S. economic sanctions,” Yardeni said, referring to moves by China and other nations to increase their gold reserves as a safeguard against potential asset freezes.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.