Chunumunu

Co-authored with Hidden Opportunities.

If you’re a coffee fanatic, you can instantly tell the difference between a well-brewed, artisan coffee and that bland, overcooked stuff from a gas station. The artisan coffee is rich and full of flavor, while the gas station coffee often tastes flat and watery. It’s all about the choice of beans and the diligence in the brewing process. Similarly, while many places offer good meals, the best restaurants consistently deliver a superior experience, earning top reviews and loyal customers.

This principle extends beyond consumables. When you’re in the market for household accessories like doors and windows or a new car, you have many options. For the best bang for your buck, it’s important to choose goods that offer good durability and performance for their cost. Investing in well-designed products often means better customer service, and fewer replacements and repairs over time, and while these may come at a higher price, they typically reflect higher quality. Ultimately, it comes down to the quality of the goods you buy.

What is Quality in Investments?

In the world of investments, we keep hearing the mention of “high quality business.” What does this mean? Several key factors that make a security or investment particularly robust and reliable are:

-

Financial Health: Quality investments usually come from companies with strong financial metrics, such as a strong balance sheet, stable revenue and earnings, strong cash flow, and manageable levels of debt. These companies are often less vulnerable to economic downturns.

-

Business Model: High-quality investments are often in companies with a sustainable and competitive business model. These companies typically maintain a strong market position, unique products or services, high profit margins, clear growth strategy, and strong pricing power.

-

Management: Quality also reflects the competence, integrity, and qualification of the company’s management team. Effective leaders make strategic decisions to navigate various situations, and these contribute to a company’s long-term success.

-

Predictable Revenues & Profitability: Companies with consistent profitability are considered higher quality, as they demonstrate the ability to generate earnings through challenging economic conditions.

-

Dividends: When it comes to dividend-paying companies, high quality is indicative of a history of stable and growing dividends.

However, the above factors are often subjective, and their interpretations often vary from one person to another. A more standardized reference to quality in investments comes to the discussion of credit rating. A company’s financial health and balance sheet are often subject to period reviews by credit agencies like Moody’s, S&P, or Fitch, and ratings are assigned to various tiers of its debt. Investment grade instruments are typically referred to as high-quality securities and carry higher credit ratings such as AAA, AA, or A. This indicates a lower risk of default or failure to satisfy the commitments. Lower-quality bonds, often referred to as junk bonds, have lower ratings (such as BB or below) and carry higher risk.

It is imperative not to pick and choose from the listed factors to deem an investment to be high quality. Ideally, an investment must stand tall in all the above factors to be elevated to such a status.

Risks With Fixed Income Investments

Fixed-income investments are typically governed by two risk factors, which are closely tied to their duration and financial profile.

-

Credit Risk for a debt instrument is the chance that a portion of the principal and interest will not be paid back to investors. Individual securities with high credit risk do well when their issuer gets financially stronger, but they will weaken if the issuer begins to struggle. High-quality bonds are associated with lower credit risk as they are less likely to default on their debt obligations. As such, these securities make more stable and reliable investments.

-

Interest Rate Risk refers to the sensitivity of a bond’s price to changes in prevailing interest rates. The market prices of bonds with higher duration rise with declining rates and drop with rising rates, presenting an opportunity for investors. It is always due to the comparison of its yield with that of a risk-free alternate, which is often the U.S. Treasuries. Lower-duration bonds exhibit better immunity to interest rate risk.

Rate Cuts are in the Air

It has been a year since the Federal Reserve made its last interest rate hike, bringing the Fed Funds Rate between 5.25% and 5.50%, the highest in twenty years. And inflation, the primary factor behind the hawkish Fed, has progressively cooled off, bringing up widespread speculation of upcoming rate cuts.

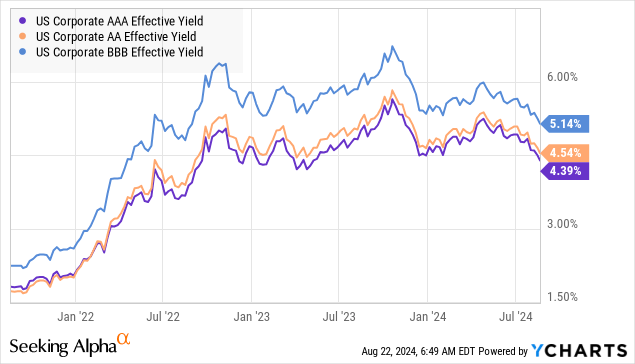

Despite price volatility, the bond market has accepted the speculation as a near-term possibility, and the yields of investment-grade instruments have declined from the peak.

Their credit ratings signify that they have little credit risk, but are still bound to interest rate risk. So when rates drop, this asset class will be a significant beneficiary, and you can get paid generously to hold until the time comes, or until maturity. That would be your choice to make.

We will now discuss a few investment-grade securities offering +6% yields. We believe that these carry very low credit risk, and their market prices are purely governed by interest rate risk. As such, their generous yields are an opportunity to lock into for the foreseeable future. Let’s dive in!

Investment-Grade Baby Bonds

1) AFG Baby Bonds – Yields of up to 5.9%

American Financial Group, Inc. (AFG) is a leader in the specialty Property and Casualty insurance market. The 152-year-old insurance company focuses on specialized commercial products that tackle unique financial risks and exposures for businesses across industry types.

AFG has four baby bonds, with varying current yields and capital upside. From a total return perspective, we like AFGE for its ~22% upside to par. At a low coupon of 4.50%, we don’t expect this security to be called anytime soon.

-

5.875% Subordinated Debentures due March 30, 2059 (AFGB) – Yield 5.9%

-

5.125% Subordinated Debentures due December 15, 2059 (AFGC) – Yield 5.8%

-

5.625% Subordinated Debentures due June 1, 2060 (AFGD) – Yield 5.8%

-

4.50% Subordinated Debentures due September 15, 2060 (AFGE) – Yield 5.5%.

AFG ended 1H 2024 with $1.1 billion in cash and cash equivalents. During 1H 2024, the insurance company reported $515 million in net earnings after factoring in $38 million for interest expenses.

With a history of growing regular dividends, special dividends, and substantial share buybacks, AFG is a shareholder-friendly company with attractively priced baby bonds.

2) Carlyle Group Baby Bond – Yield 6.0%

The Carlyle Group Inc. (CG) is a global investment management firm with over $425 billion in assets, spanning three business segments (Global Private Equity (GPE), Global Credit, and Global Investment Solutions) and 595 investment vehicles. At the end of Q1, CG reported $307 billion in FEAUM (Fee Earning Assets Under Management). CGABL is CG’s only public baby bond, offering a current yield of 6.0% and 30% upside to par.

-

4.625% Subordinated Notes due 05/15/2061 (CGABL) – Yield 6.0%.

CG generated $153.6 million in net income during 1H 2024, after spending $11.8 million on interest expenses towards the subordinated notes. At the end of the first quarter, the company reported $914.8 million in cash and cash equivalents on its balance sheet. Overall, the baby bond’s interest expense is adequately covered by the firm’s operations, making it an excellent source of reliable income for the years ahead.

3) KKR & Co Baby Bond – Yield 5.7%

KKR & Co Inc. (KKR) also known as Kohlberg Kravis Roberts & Co, is a leading global investment firm that offers alternative asset management as well as capital markets and insurance solutions to corporations. Since its inception in 1976, KKR has consistently been a leader in the private equity industry and has completed more than 730 private equity investments in portfolio companies with a total transaction value exceeding $710 billion as of December 2023.

At the end of Q1, KKR’s credit and liquid strategies had $259.5 billion in AUM (Assets Under Management). The company also manages $137 billion of credit investments under its recently acquired Global Atlantic insurance companies, and its BDCs have ~$15.3 billion in AUM.

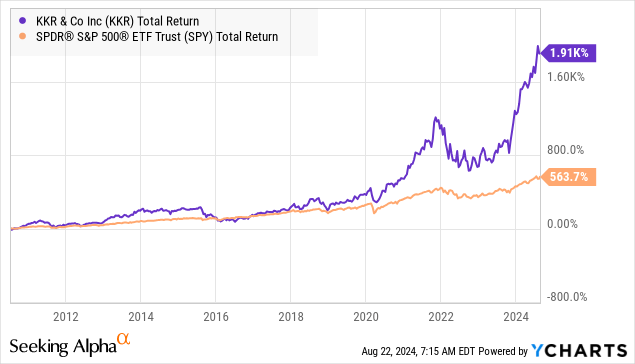

Since 2010, KKR has grown its fee-related earnings and adjusted net income by 7x and 5x, respectively. As a result of this outstanding growth, its common stock has massively outperformed the S&P 500.

Insiders own 39.3% of the common stock, indicating a strong alignment of the strategy with shareholders’ interests.

Among a series of debentures, KKRS is KKR’s only public baby bond. This security is callable after April 2026 and currently offers a 5.7% yield and ~24% upside to par.

-

4.625% Subordinated Notes due 4/1/2061 (KKRS) – Yield 5.7%.

KKR spends $23 million annually towards the interest expenses on this public baby bond, a tiny fraction of its $1.3 billion net income for 1H 2024. The bond interest payments enjoy substantial safety, making KKRS an excellent buy to lock a steady yield for the foreseeable future.

4) APO Rate-Reset Baby Bond – Yield 7.1%

Apollo Global Management, Inc. (APO) is a leading provider of alternative asset management and retirement solutions. The company manages over $670 billion AUM and proudly claims that the financial crises and de-banking from the collapse of Lehman Brothers and the establishment of Basel III and Dodd-Frank regulations were tailwinds for the alternative asset management business.

In August 2023, APO issued the 7.625% junior subordinated debt (APOS) with a rate-reset clause. Considering the high coupon issue, this security never traded at a discount to par. APOS coupon resets to the 5-Yr Treasury Rate + 3.226%, indicating that the security’s coupon will be lower after July 2028.

Reset Rate Junior Subordinated Notes due 09/15/2053 (APOS) – Yield 7.1%

APOS’ current 7.1% yield presents a compelling opportunity due to the limited credit risk and income safety presented by the security.

Investment-Grade Preferreds

1) Corteva Preferreds – Yield 6.3%

Corteva, Inc. (CTVA) was formed in 2018 after the agricultural unit of DowDupont was spun off as an independent public company. CTVA is a major American agricultural chemical seed company with $17.2 billion in net revenues and $3.4 billion adj EBITDA.

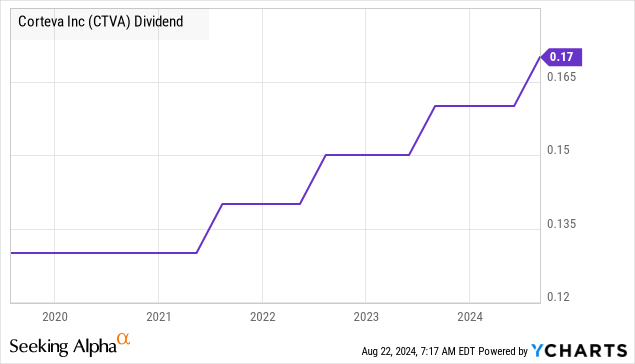

CTVA has delivered growing dividends to shareholders since its spin-off from DowDupont.

CTVA’s two BBB-rated cumulative perpetual preferreds have come under CTVA, presenting a lucrative opportunity for those seeking steady and well-covered income.

-

$3.50 Series Cumulative Perpetual Preferred Stock (CTA.PR.A) – Yield 6.2%

-

$4.50 Series Cumulative Perpetual Preferred Stock (CTA.PR.B) – Yield 6.3%.

CTA-B costs the issuer $7.5 million in annual dividend expenses. This security is callable anytime at $120/share. At current prices, CTA-B offers a 6.3% yield and 68% upside to par.

CTA-A has 700,000 shares outstanding and costs the issuer $2.5 million in annual dividend expenses. This security is callable anytime at $102/share. At current prices, CTA-A offers a 6.2% yield and 80% upside to par.

CTVA ended Q1 with $1.8 billion in cash and cash equivalents. The preferreds dividends cost a fraction of the company’s $1.4 billion net income for 1H 2024 while CTVA spends +$400 million on annual common stock dividends, making the cumulative preferreds an adequately covered security for consistent income.

Considering the low coupon and high cost of redemption, we expect both preferreds to remain outstanding for the foreseeable future, presenting a solid opportunity for perpetual qualified dividend income generation.

2) SCHW Preferreds – Yields of up to 5.9%

The Charles Schwab Corporation (SCHW) is the largest American investment services firm, with $9.41 trillion in client assets, 36.5 million active brokerage accounts, and +3.7 million daily average trades. The company’s record Q2 accelerated its lead over Vanguard, as core net new assets rose 17% to $61.2 billion.

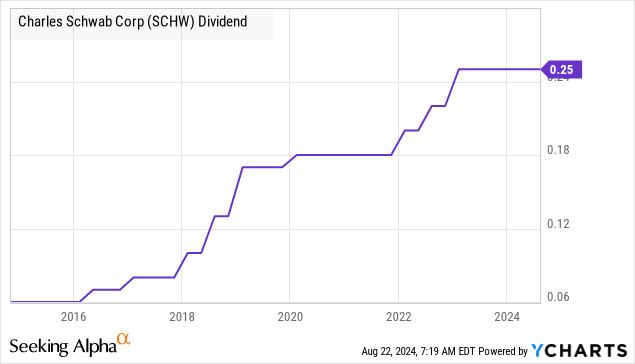

The bank spent $919 million on its 1H 2024 quarterly common dividend, which it has progressively raised over the past decade.

The preferred dividend cost $232 million during 1H 2024, a figure that was 11.2x covered by the bank’s net income for the quarter.

-

5.95% Depository Shares Non-Cumulative Perpetual Preferred Stock Series D (SCHW.PR.D) – Yield 5.9%

-

4.45% Depository Shares Non-Cumulative Perpetual Preferred Stock Series J (SCHW.PR.J) – Yield 5.3%.

Among the two preferreds, SCHW-J offers a 5.3% yield and 18% upside to par, making it an attractive source of qualified dividends. However, considering its relatively low coupon, the company is less likely to redeem it in the foreseeable future.

Conclusion

When you go for a buffet lunch at a familiar place, you will most likely save portions of your appetite for the items that you know are good. You want to make sure you get the most out of your favorite dishes while still leaving room for a few surprises. Similarly, fixed income offers a buffet of choices for an income seeker’s insatiable need, allowing you to savor both reliable staples and discover new opportunities for steady returns.

At High Dividend Opportunities, we maintain a carefully curated portfolio of over 50 individual preferreds and +20 baby bonds. Notably, we have been on a buying spree all year round, loading up on recently issued, investment-grade, high-coupon baby bonds with staggered maturities over the next six years. In a market dominated by a few dominant Titans with lofty valuations, our fixed-income portfolio serves as a beacon of stability. With our substantial allocation to fixed income, we are well-positioned to sustain strong income through economic fluctuations. This income stability is a necessity for a stress-free retirement.