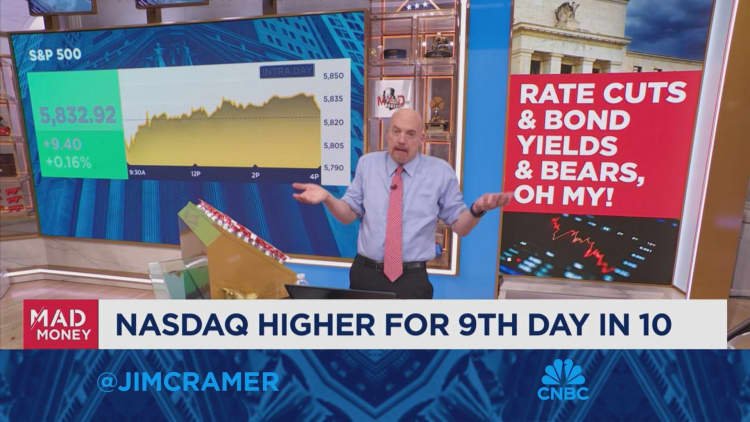

CNBC’s Jim Cramer on Tuesday lamented rising bond yields’ effect on the market, saying this action could narrow the rally to tech and diminish broader sector gains.

“If the bond market doesn’t start behaving, or at least calming down, if longer-term interest rates don’t stop going up, we’re going to start losing the groups that have led us higher for months now,” he said.

Some on Wall Street were expecting bond yields to decline after the Federal Reserve issued a hefty 50-basis-point cut and indicated there would be more to come over the next several months. The bond market and the stock market usually show a negative correlation, with investors flocking to the latter when rates are low and the economy is roaring while piling into the former when rates are high and bonds seem safer than equities.

The 10-year Treasury yield on Tuesday rose to its highest level since July. And while the Dow Jones Industrial Average underperformed, the Nasdaq Composite hit a new record high as investors awaited earnings from megacap tech companies.

Cramer said investors are drawn back to tech stocks as higher rates complicate the growth narratives for economically sensitive corners of the market. In recent months, investors were hoping that lower borrowing costs would help companies — such as those in the industrial sector and other housing-related areas — see an increase in business and, by extension, their stock prices. But the tech stocks du jour stand to benefit regardless of lower rates because they center around secular themes like artificial intelligence as the generative AI boom continues.

“If [the bond market] doesn’t stop its retreat, then we’re going to start questioning the idea that the Fed will keep cutting rates, ushering in a fabulous economy for 2025,” Cramer said.