The city issued approximately $126.4 million in general obligation, and water and sewer revenue bonds as well as certificates of obligation that will be paid back over a 10-year period, according to city documents.

- $81.9 million in general obligation bonds

- $40 million in water and sewer revenue bonds

- $4.5 million in certificates of obligation

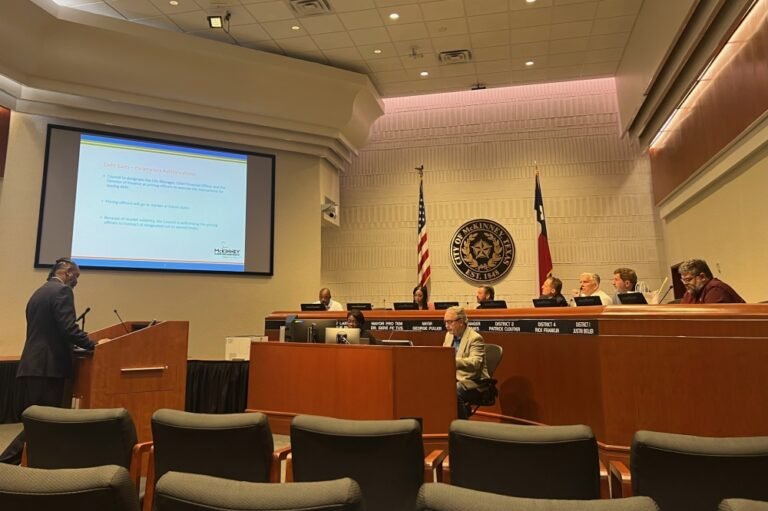

The bond sales were unanimously approved by McKinney City Council members, with council member Charlie Philips absent.

The overview

Investment and Treasury Manager Kelvin Bryant said around $82 million in revenue was generated through the sale of general obligation bonds, which was deposited into various project funds for items included in the 2019 and 2024 bond packages. He added there was savings of 10% due to issuing refunding bonds for around $6 million of general obligation bonds approved in 2014.

Combined, the roughly $126 million will be issued to cover several projects for the city’s 2024 capital improvements program, Bryant said, including:

- Street projects

- Public safety facilities

- Softball fields

- Various drainage projects

- Waterline improvements

- Wastewater projects

In addition to the bond sale, Bryant affirmed the city maintained its AAA rating for the general obligation and certificates of obligation bonds with credit rating agencies Standard and Poor’s, and Moody’s, which is the highest possible rating. The city’s water sewer revenue bond ratings with each agency were also affirmed, with Standard and Poor’s issuing a rating of AA+, and Moody’s issuing a rating of Aa1, according to the presentation.

The bond sales were conducted on July 10-11, and the sales are expected to close Aug. 6, Bryant said.